International Payroll Including Leave Management

Infinet Cloud Payroll allows you to manage your Australian, New Zealand, Canadian and United Kingdom payroll entirely within your NetSuite account. Compliant with ATO,IRD CRA and HMRC, all legislative and functional improvements are seamlessly updated as and when required. Globally over 650 NetSuite customers use Infinet Cloud Payroll to pay their employees, manage their leave and benefits, account for their payroll expense and submit all that information to the tax office in a linear and straight forward manner. Our One World customers use Infinet Cloud Payroll to easily manage payroll in multiple jurisdictions and subsidiaries, removing the need for separate systems for each entity, all your NetSuite data including payroll is available with one easy click.

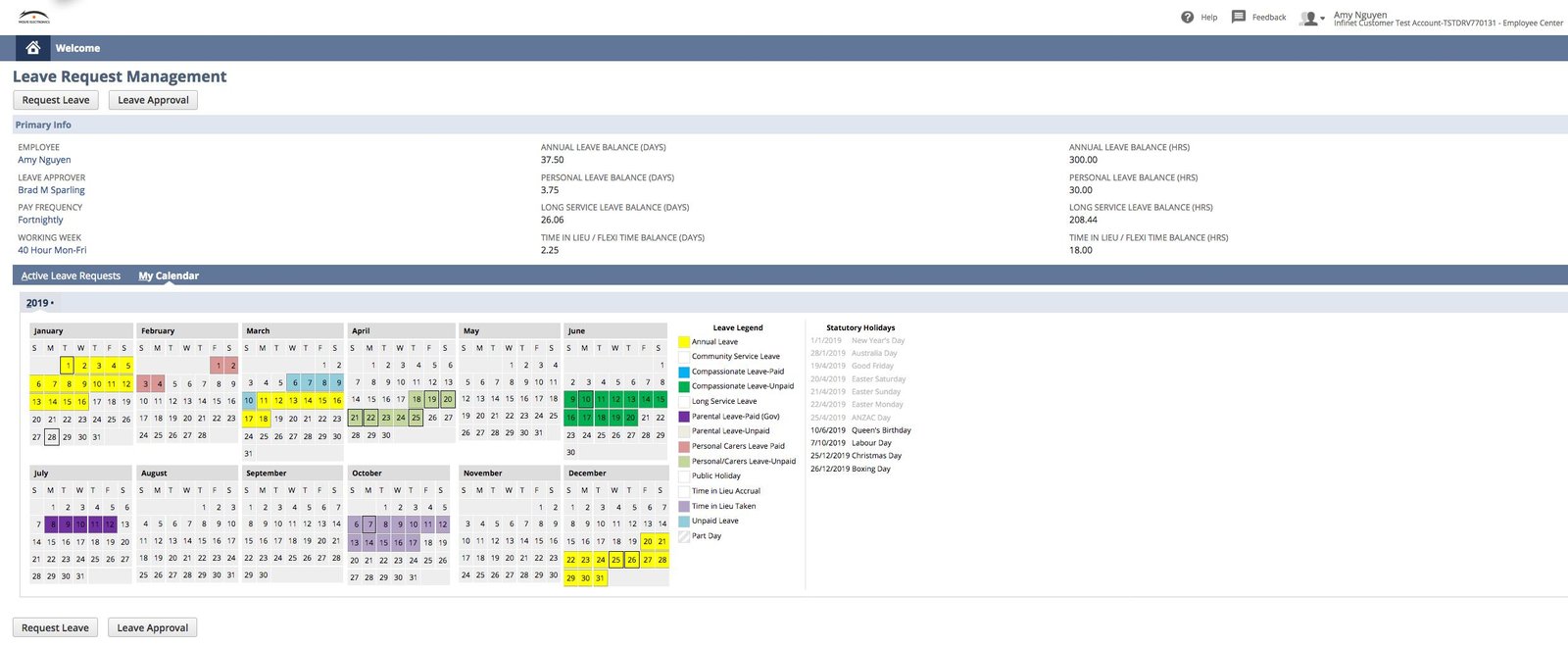

Coupled with Leave Management functionality that manages even the most complex accrual and leave entitlement rules, the Infinet Cloud Payroll Suiteapp is the go to solution for your inhouse, on platform payroll management needs.

Key Benefits

Gain Complete control over your Payroll Process & data

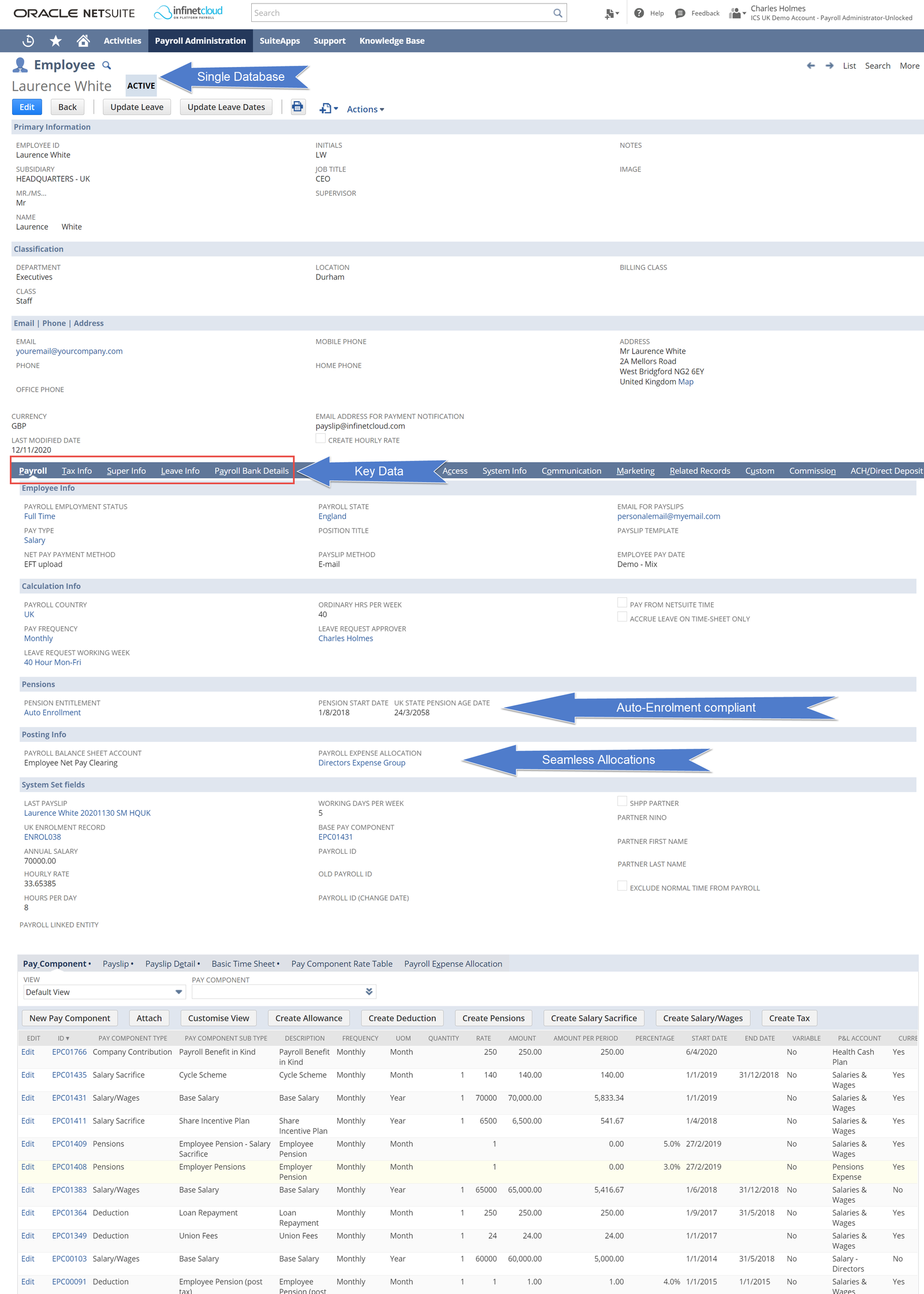

- Infinet Cloud Payroll is a native application that leverages default functionality and record structures, including: Time Tracking, Employees, Vendors, Journals, and General Ledger. Built using Custom Fields & Records as well as SuiteScript and SuiteFlow to deliver a seamless experience.

- Powerful financial reporting and general ledger capabilities provide real-time insights into one of your largest and most complex expenses.

- Transactions are posted directly, and with a very high degree of flexibility, to the NetSuite general ledger, eliminating the need to manage and reconcile external or disparate systems for payroll.

- Full Rollback and re-posting capability, making payroll adjustments easy in a process where accuracy is a priority.

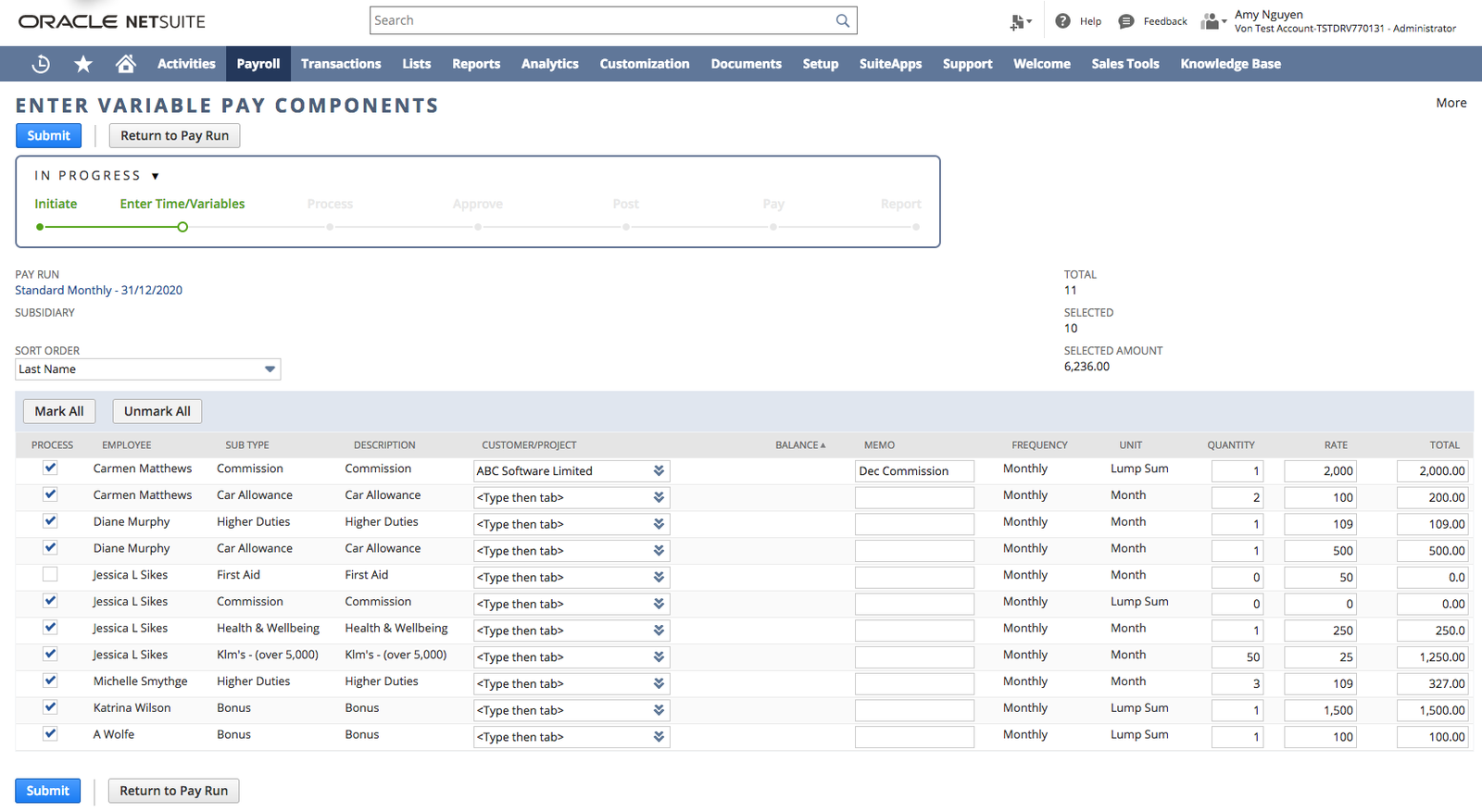

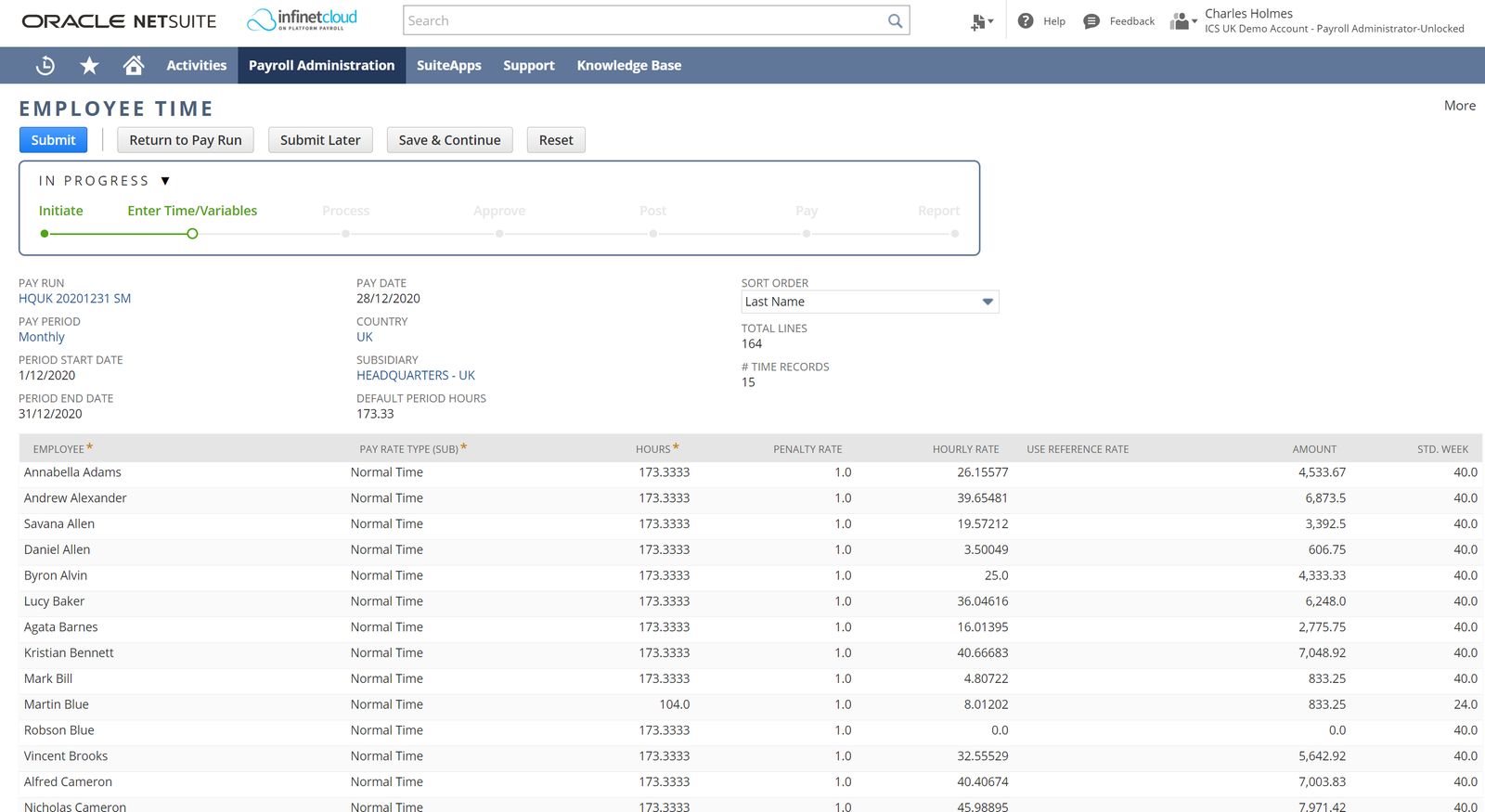

- Reduce the time it takes to pay employees with Infinet Cloud Payroll’s easy to use step by step payroll process which makes calculating employee pay simple and hassle free.

- Calculations of tax and superannuation pension liability are automated as part of the payroll process and are compliant with the ATO, IRD, CRA, HMRC and Fair Work Australia guidelines.

- OpenAir Customers using NetSuite also benefit from seamless calculation of wages and employee leave accrual.

- Remove the need to use an outsourced payroll bureau to pay employees, and replace it with a simple and cost effective inhouse process

- Run Payroll from start to finish in as few as four stages

- Generate an EFT file for direct upload to your banks portal

- Automatically distribute highly customisable Payslips to your employees, either by email, print or through NetSuites Employee Centre or Infinet Cloud MyPay Suiteapp

- All data is secure within your NetSuite account, you control what happens, when and by whom.

- Popular Rostering and Time and Attendance systems already integrate with Infinet Cloud Payroll, offering a turnkey solution for businesses with more complex time entry requirements.

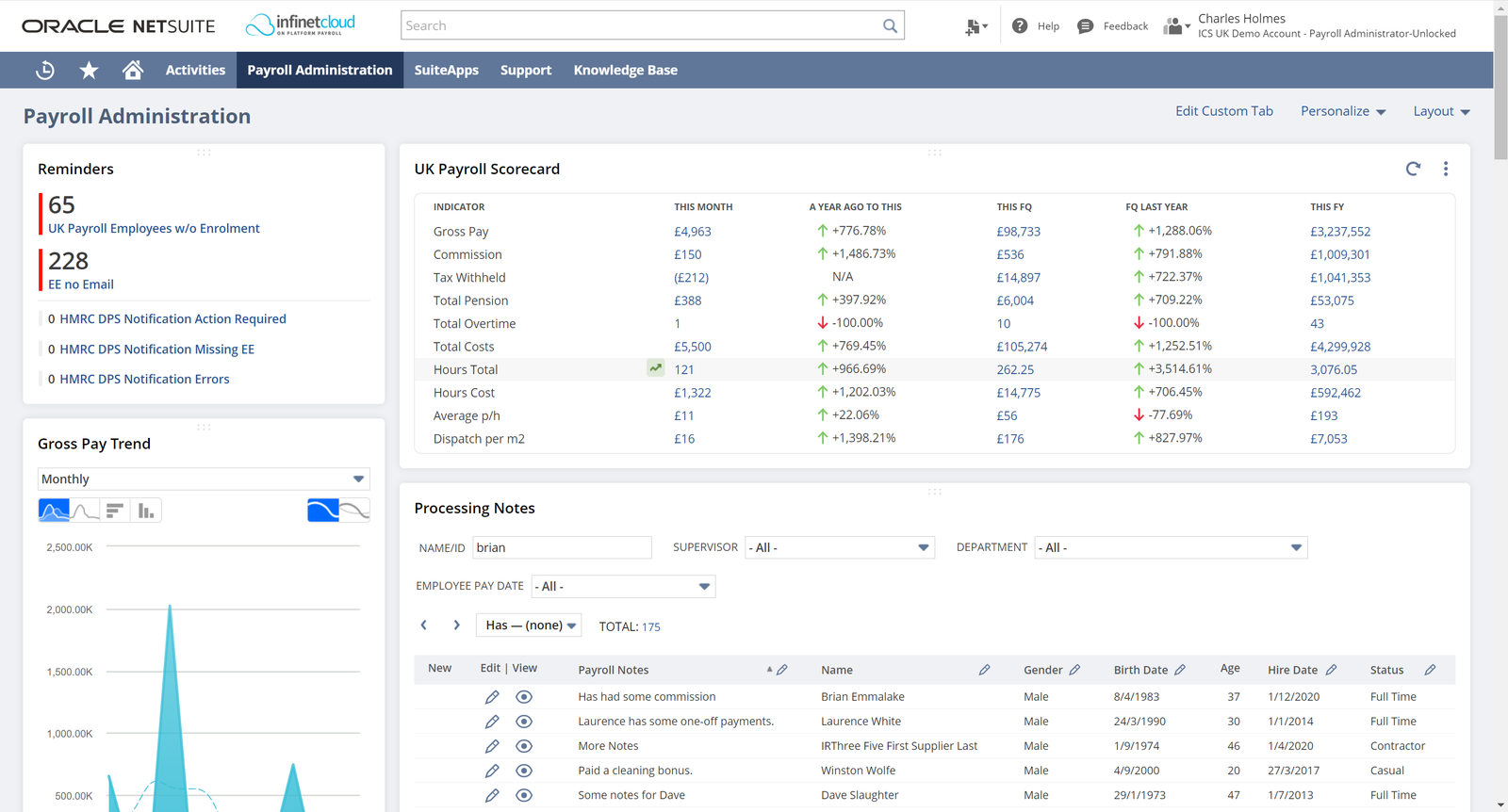

One Click Reporting Removes the Headache from Obtaining Payroll Management Information

With a full Suite of over 50 customisable and out of the box reports, you can leverage the power of NetSuite to create, manage and run your own reporting requirements to get the finest detail from your Payroll expenses, in real time, including easy export via Excel/CSV/PDF and drag and drop pivot reporting.

- Want to allocate your admin department costs across the business, including all associated employer costs?

- Need to incorporate Payroll costs into Project profitability for your service business?

- Bring wage expenses to your manufacturing job costing?

All of this is possible, and more with Infinet Cloud Payroll for NetSuite.