Lease accounting compliance in native NetSuite for ASC 842 & IFRS 16

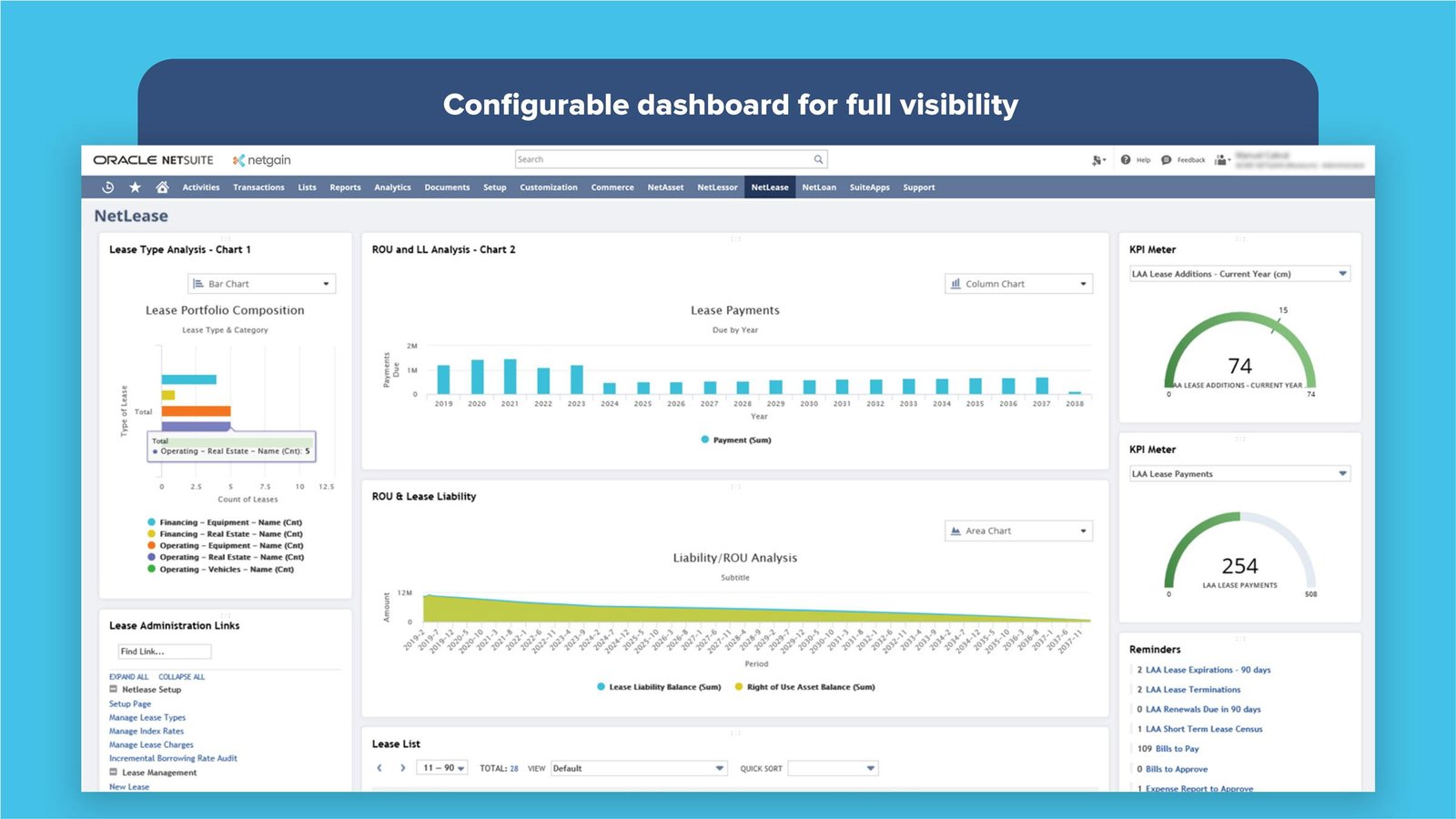

Leave your complex lease spreadsheets behind and automate your lease accounting processes. NetLease for Netsuite is the application of choice for thousands of accountants, controllers and CFOs using NetSuite.

Key Benefits

- 100% built for NetSuite and NetSuite native, requires no integrations or reconciliations with outside systems

- Confidently transition to ASC 842 with help from our team of 45+ ex-big 4 CPAs

- Be audit-ready and compliant with the new lease accounting standard in record time

- Save time every month by efficiently managing your lease accounting in native NetSuite

- Fits your budget with two versions of NetLease for NetSuite:

NetLease Go – partially automated non-GL impacting

NetLease Max – fully automated GL impacting

Choose self-service, group or individual implementation

Capabilities

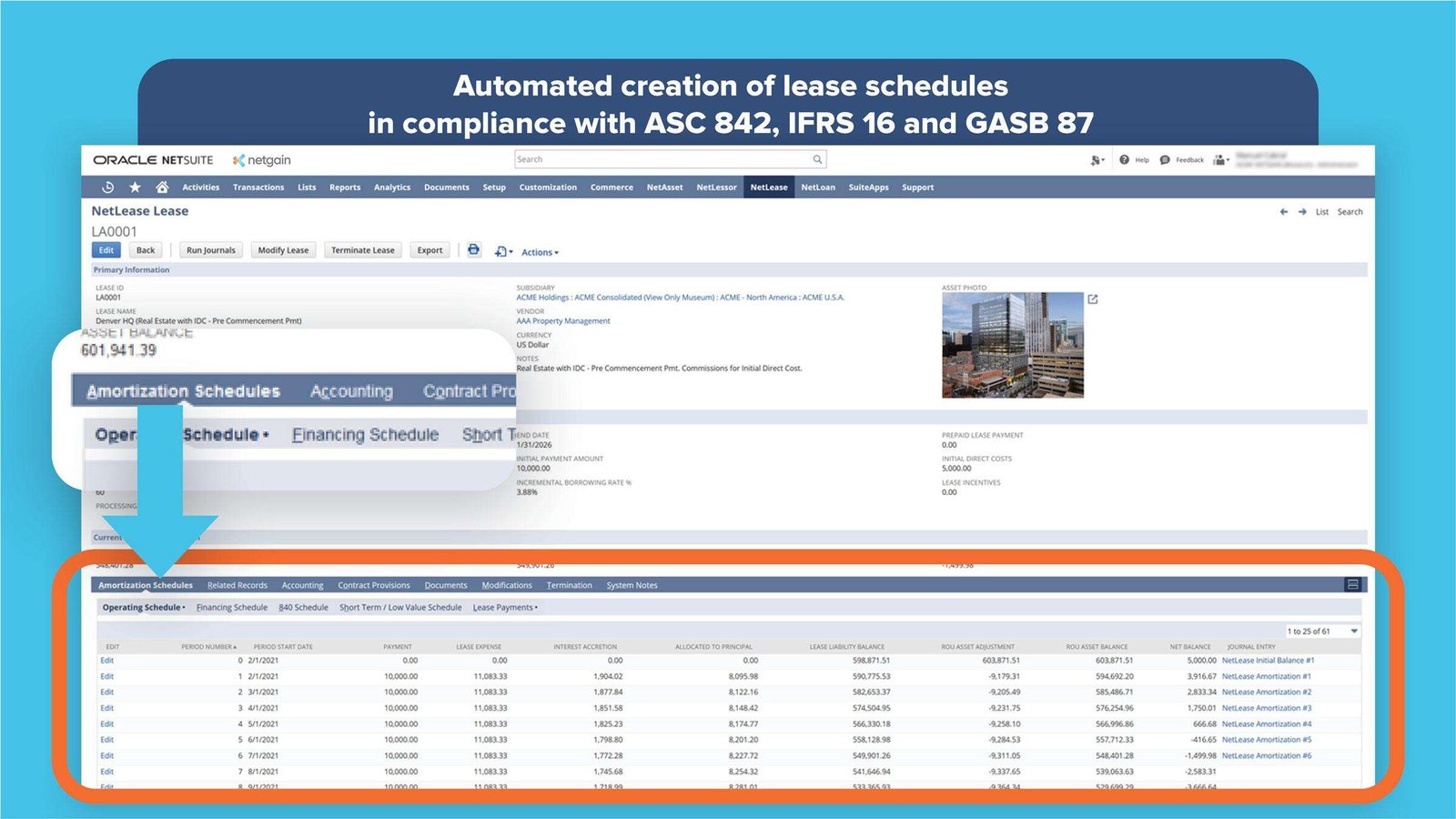

Calculates schedules including lease payments, lease liability amortization and right-of-use asset amortization

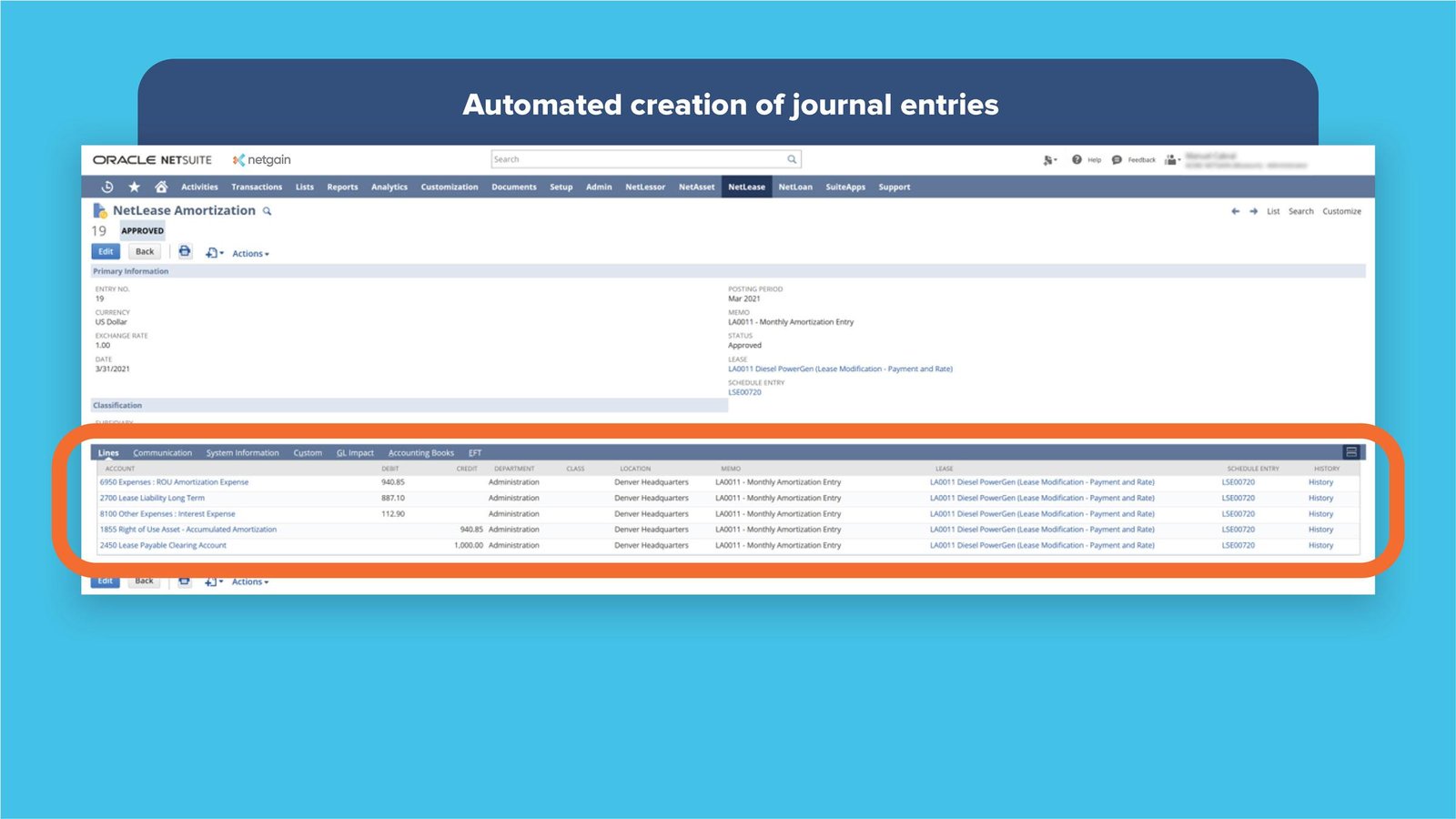

Generates journal entries for the lease liability and right-of-use asset

Automates the classification of leases as operating or finance, low-value or short-term, and account for each accurately

Seamlessly integrates with your company’s chart of accounts, currencies, vendors, departments, classes and locations

Practical expedient application simplifies the transition to ASC 842 and IFRS 16

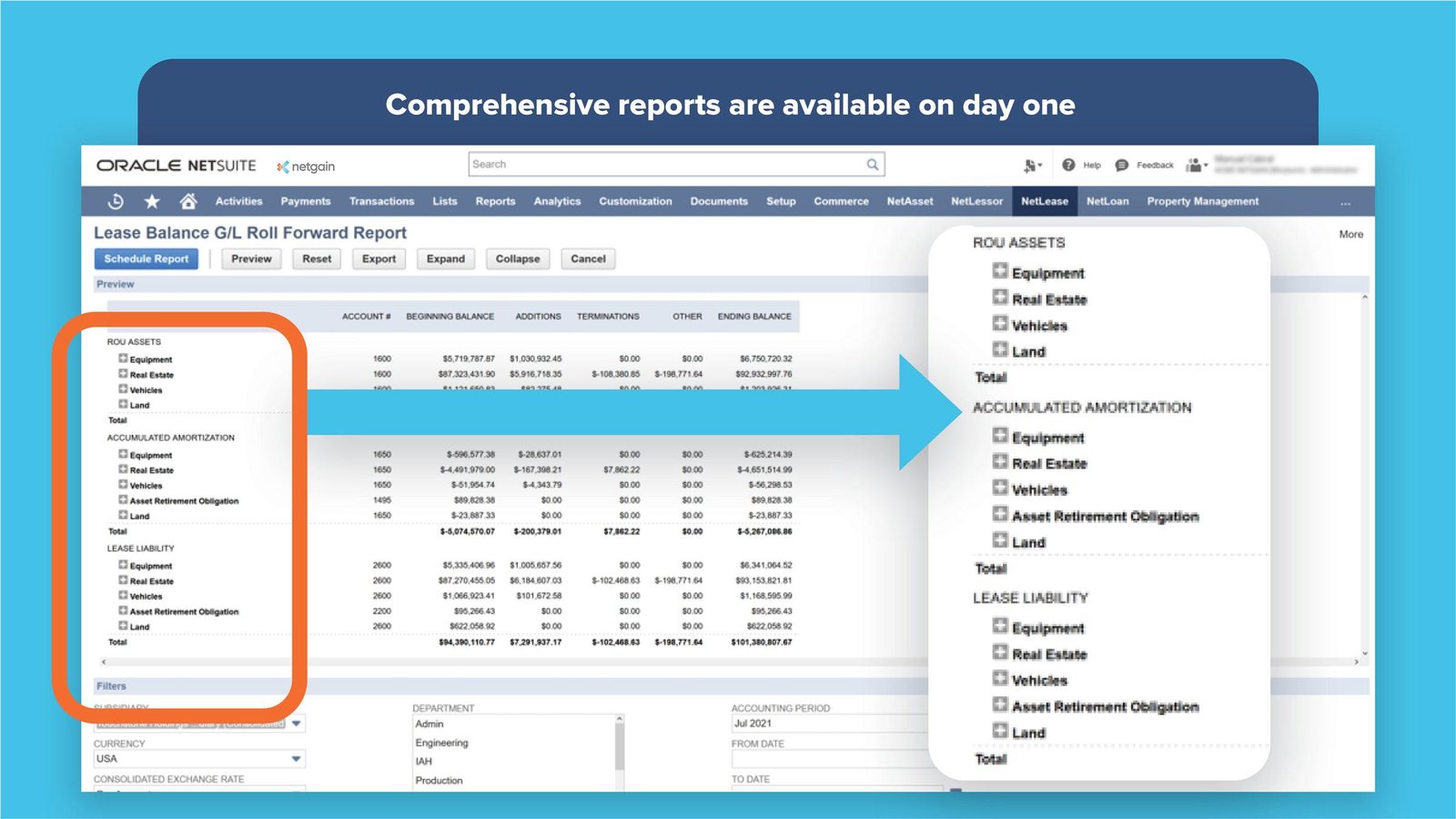

Generate audit-ready reports with one click including disclosure footnotes, lease balance roll-forward report and waterfall report

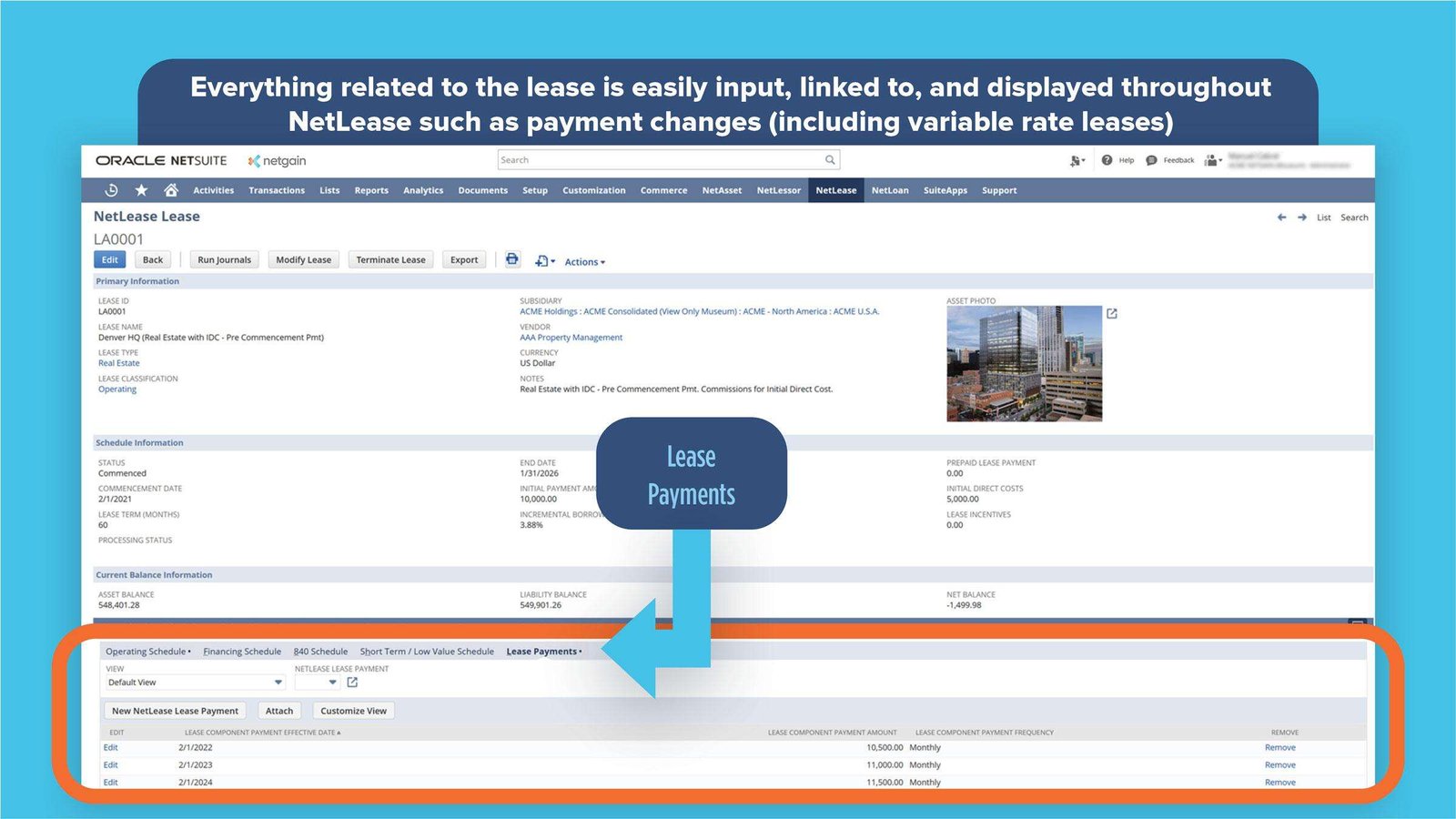

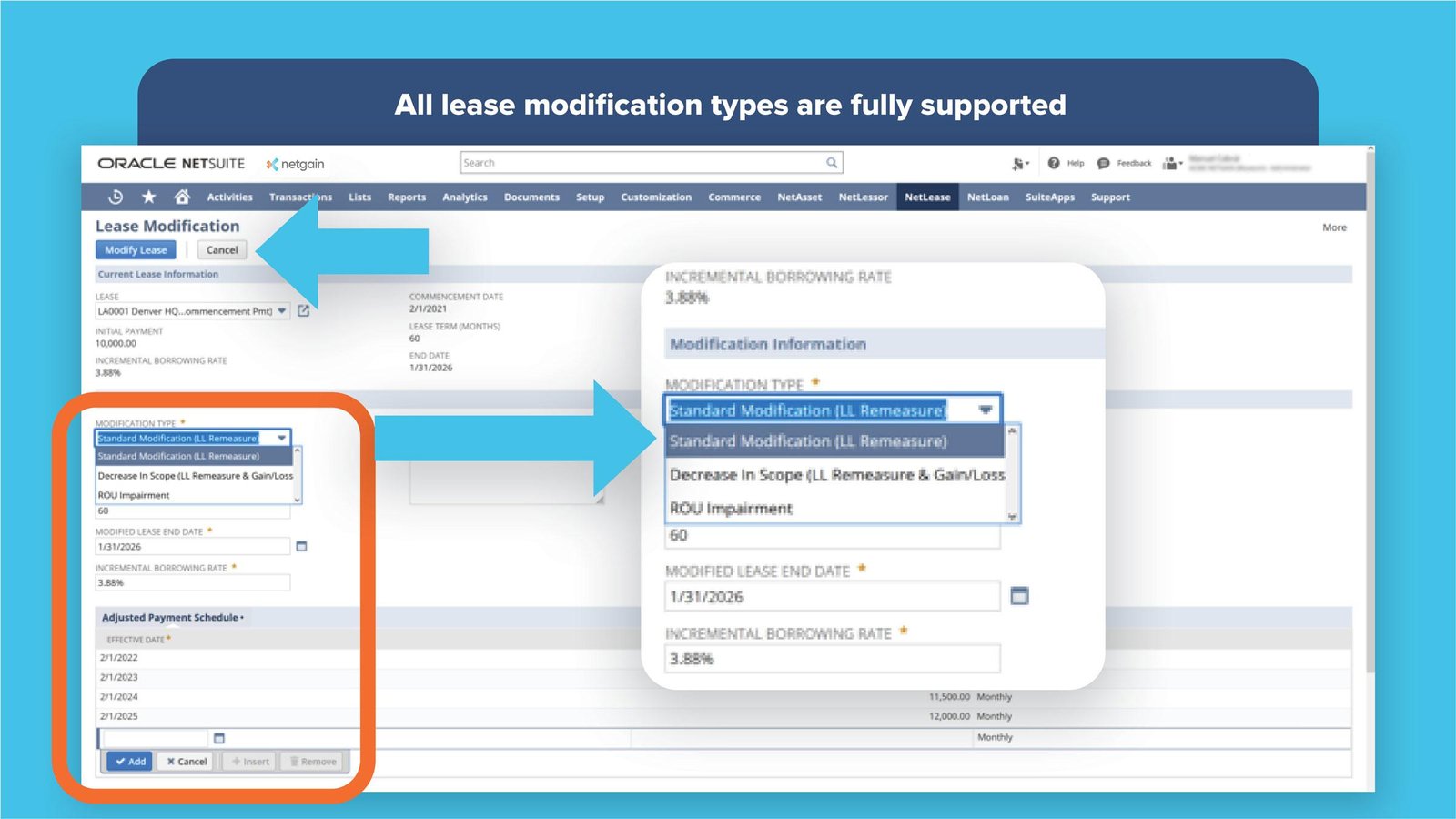

All modification types are fully supported including standard modification, decrease in scope and ROU impairment, and automatically produce the updated journal entry and schedules

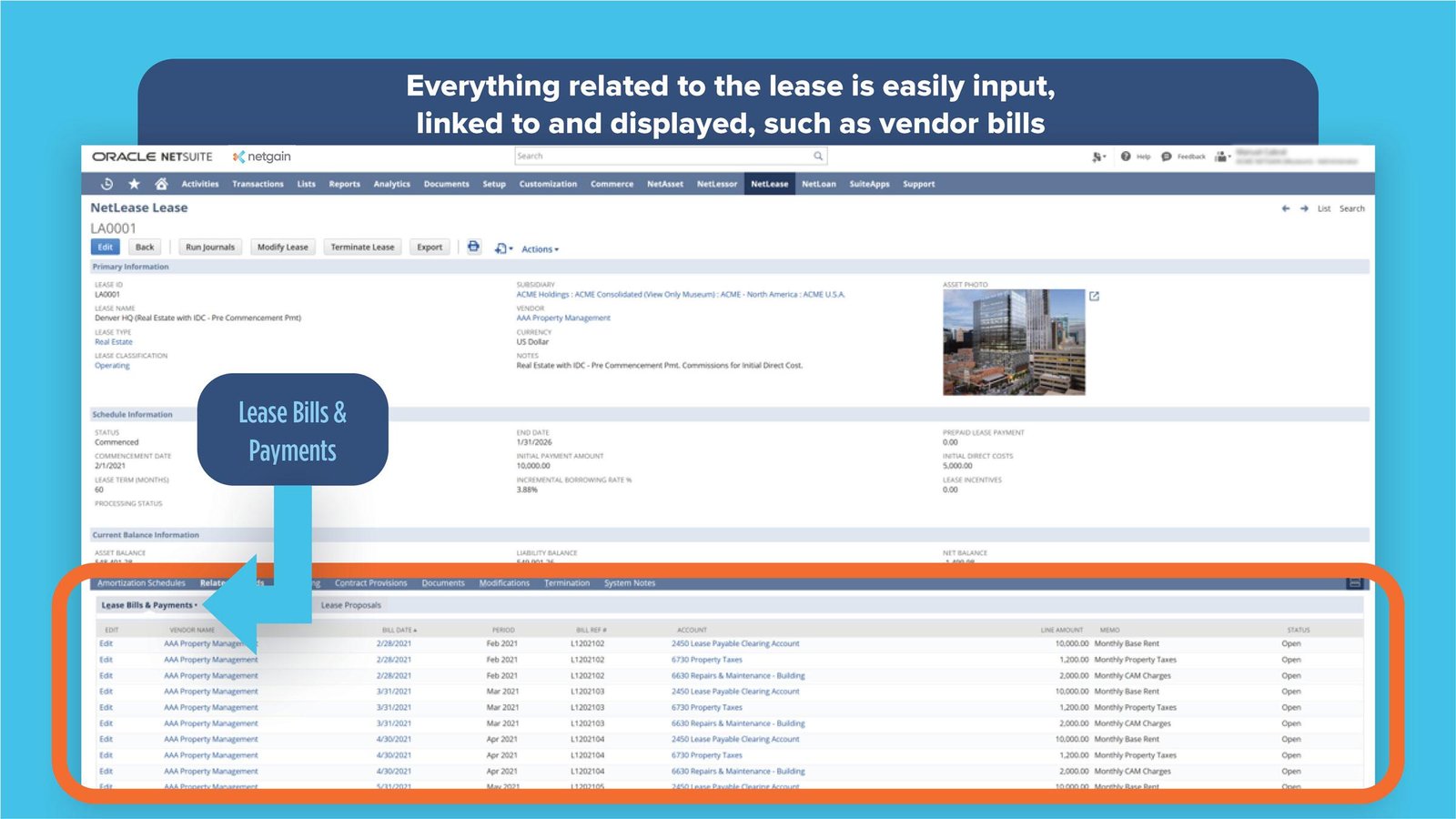

Integrated with NetSuite’s AP process removing the disconnect between lease payments and lease journal entries

Store and access key lease details such as commencement date, renewal options, vendor and other key contract details

Robust audit trail provides detailed change tracking for strong internal controls

CPA-approved calculations have been audited by the big four since 2018 and are trusted by thousands of accountants worldwide