A Single Tax Compliance Solution for Latin America

Does your business use NetSuite and operate subsidiaries in Latin America? Many international companies find it extremely challenging to manage the complex and frequently changing local tax regulations in the Latin American region.

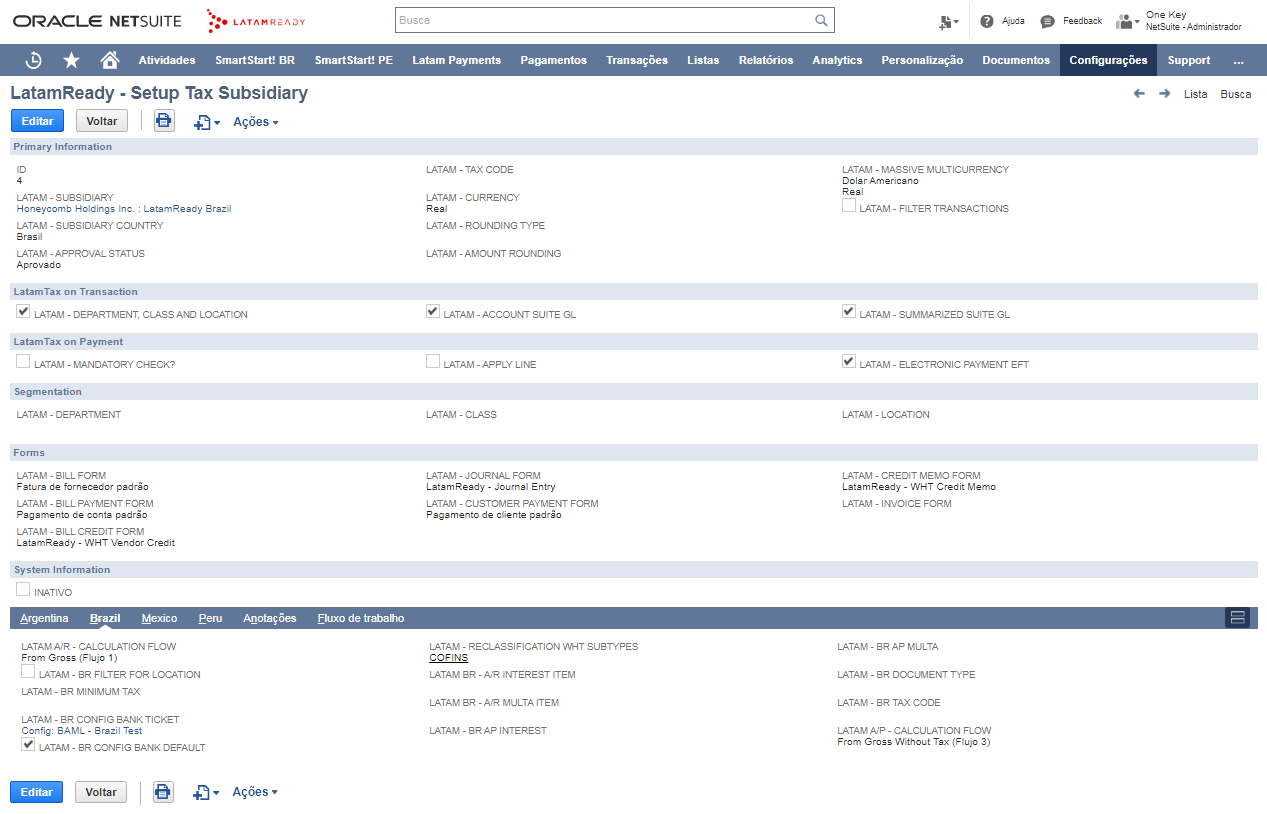

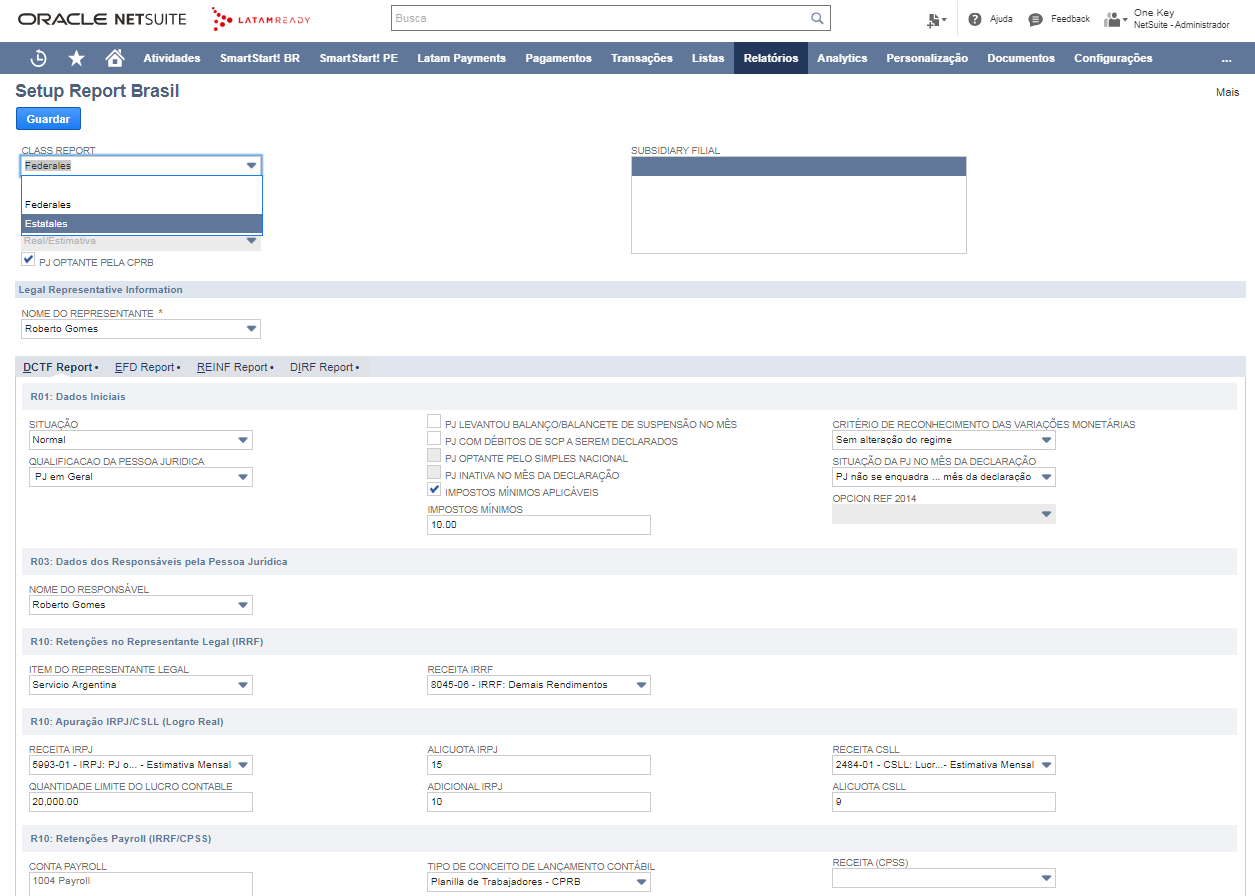

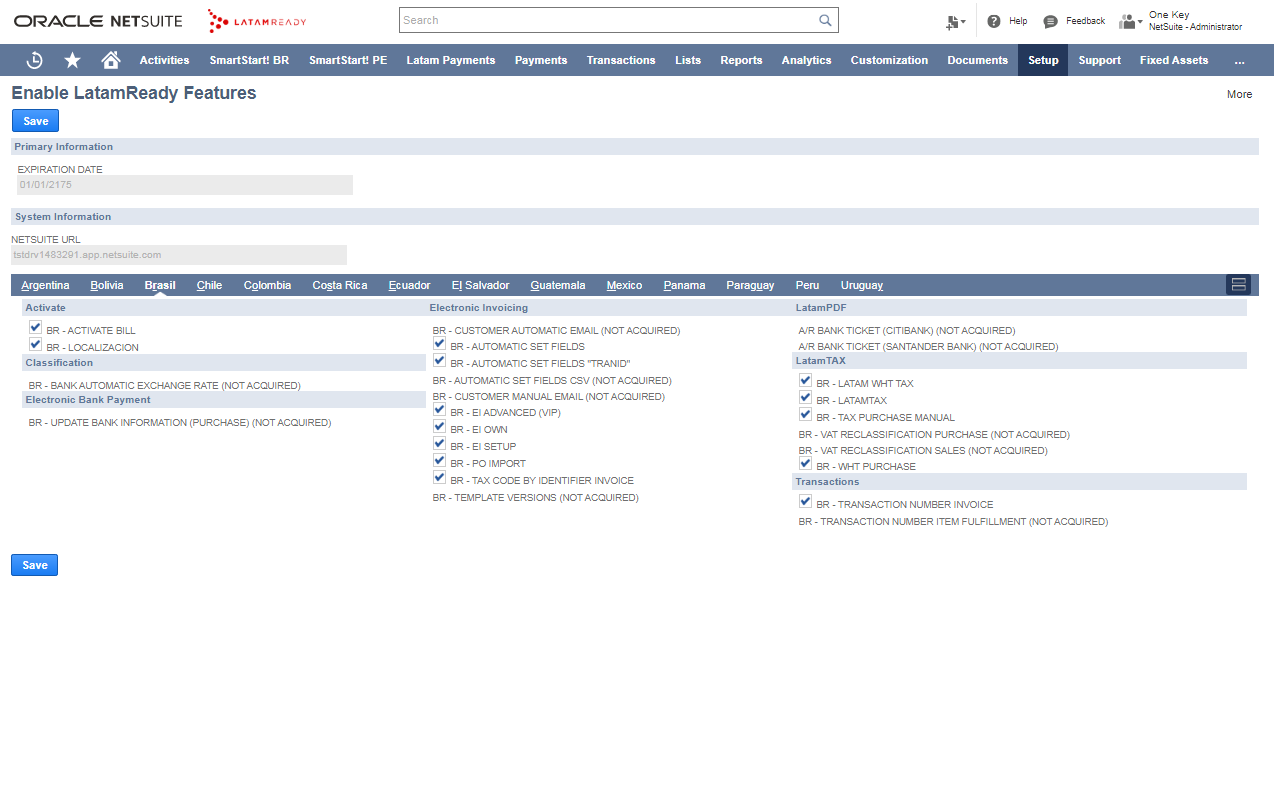

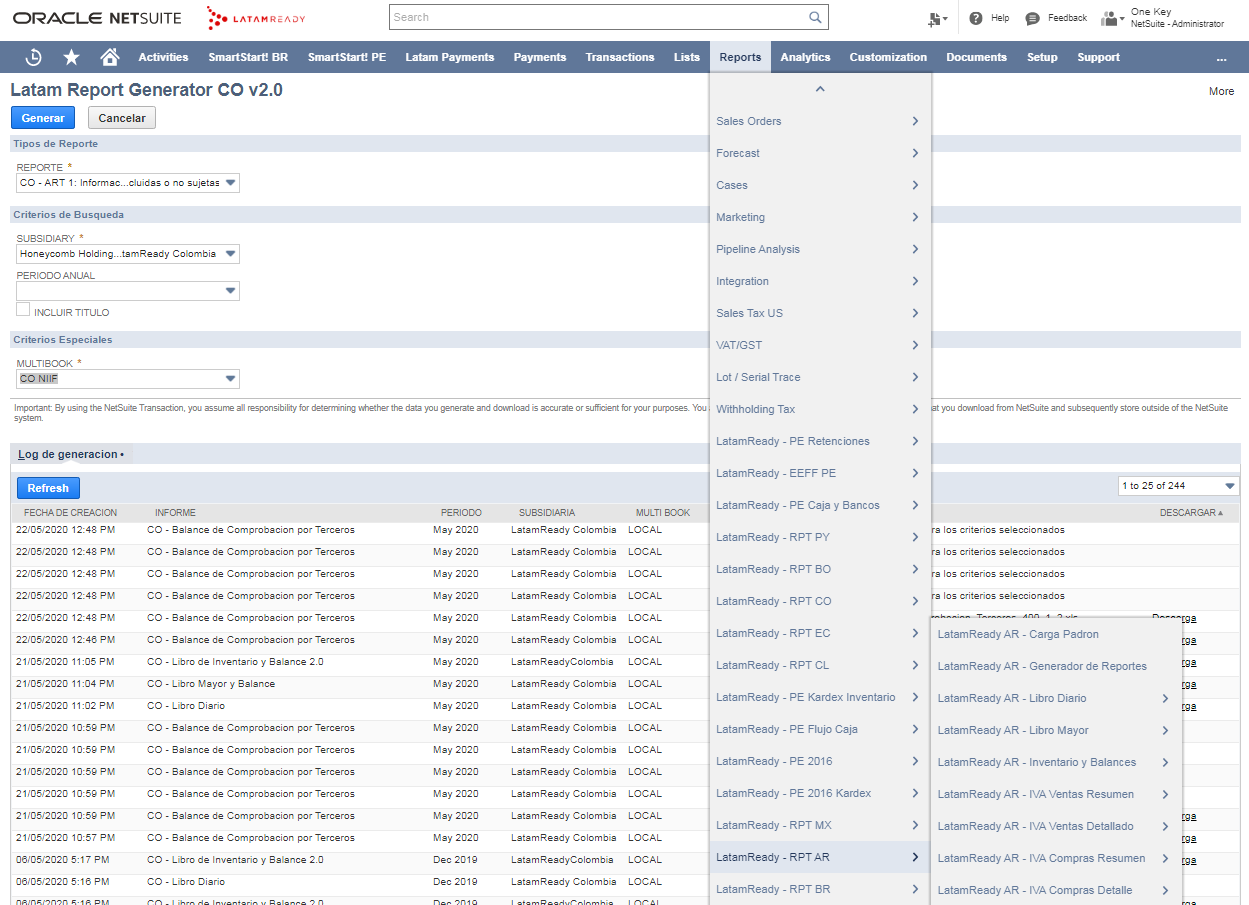

That is why LatamReady, the #1 ERP and Tax Compliance experts in the Latin American space, developed the LatamReady SuiteApp, a robust Built-for-NetSuite solution that helps large international corporations achieve full tax compliance in 18+ Latin American countries.

Key Benefits

With the LatamReady SuiteApp, you can finally let go of the patchwork of different accounting software and temporary solutions and reclaim hours of valuable time for your accounting and compliance teams.

LatamReady’s single solution, accessible on the Cloud from anywhere in the world, can solve all your tax compliance challenges in Latin America from within Oracle NetSuite.

Leave your tax troubles in Latin America behind as you receive full support for all your subsidiaries in the region, monthly SuiteApp updates to ensure continued accuracy, as well as dedicated technical support from LatamReady’s experienced team.

Benefits of a Single Native SuiteApp

- One point of contact to support tax compliance in Brazil, Mexico, Chile, Colombia, Argentina, Peru, and +18 countries across the Latin American region.

- Native SuiteApp that functions 100% inside of NetSuite

- Complete tax compliance, tax & legal reporting, and electronic invoicing solution

- Monthly SuiteApp updates to conform to the latest local tax and accounting requirements

- Multilingual customer care in English, Spanish, and Portuguese