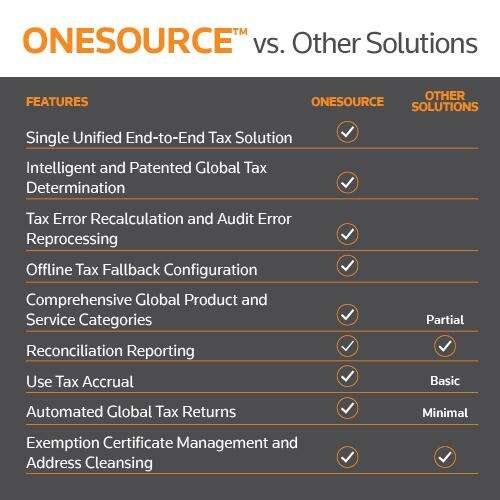

Industry standard for sales tax, use tax, VAT and GST

Even the most powerful ERP systems can’t handle the complexity of global transaction sales tax and use tax compliance — which leaves your staff to fill in the gaps. That’s why we’ve integrated Thomson Reuters ONESOURCE Determination with Oracle® NetSuite so your teams can get taxes right, the first time, every time.

Key Benefits

ONESOURCE Determination integration for NetSuite makes it easy to stay on top of constantly changing indirect tax rates and determine your company’s liability for sales tax, use tax, GST, VAT, excise tax, and other country-specific taxes regardless of your corporation’s size or geographic reach. Better manage tax liability through our seamless integration with your existing sales and purchase process.

- Seamless pre-built integration with NetSuite to support end-to-end tax determination & compliance.

- Central repository for global tax rates and rules covering 205 countries and territories in 56k jurisdictions across the globe.

- Native cloud capabilities that automate new tax rate and rules with no down-time updates; achieve up to 95% reduction in coding requirements due to tax changes.

- Easily apply your tax policy consistently across your business & collaborate across regions with our cloud-native solution.

- Reduces time for manual and redundant indirect tax and compliance processes by 50%.

- Substantial reduction in manual effort and errors with a sharp increase in efficiency amounting to Indirect tax automation of 90 to 95%.

- Trusted reporting you need to reduce risk & ensure that your sales tax calculations are accurate.

- Better Manage Tax Liability

Better Manage Tax Liability

ONESOURCE handles everything from tax calculation and certificate management to reporting and filing returns. From reverse charges and tax only credit memos to recoverability and partial recoverability, ONESOURCE Determination Integration for NetSuite delivers real-time tax decisions at the point of transaction, directly to your existing NetSuite platform.