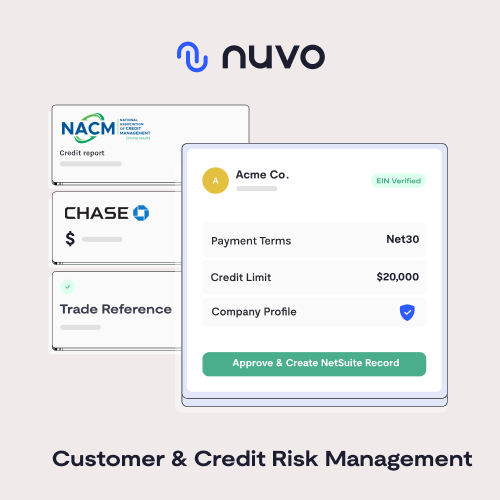

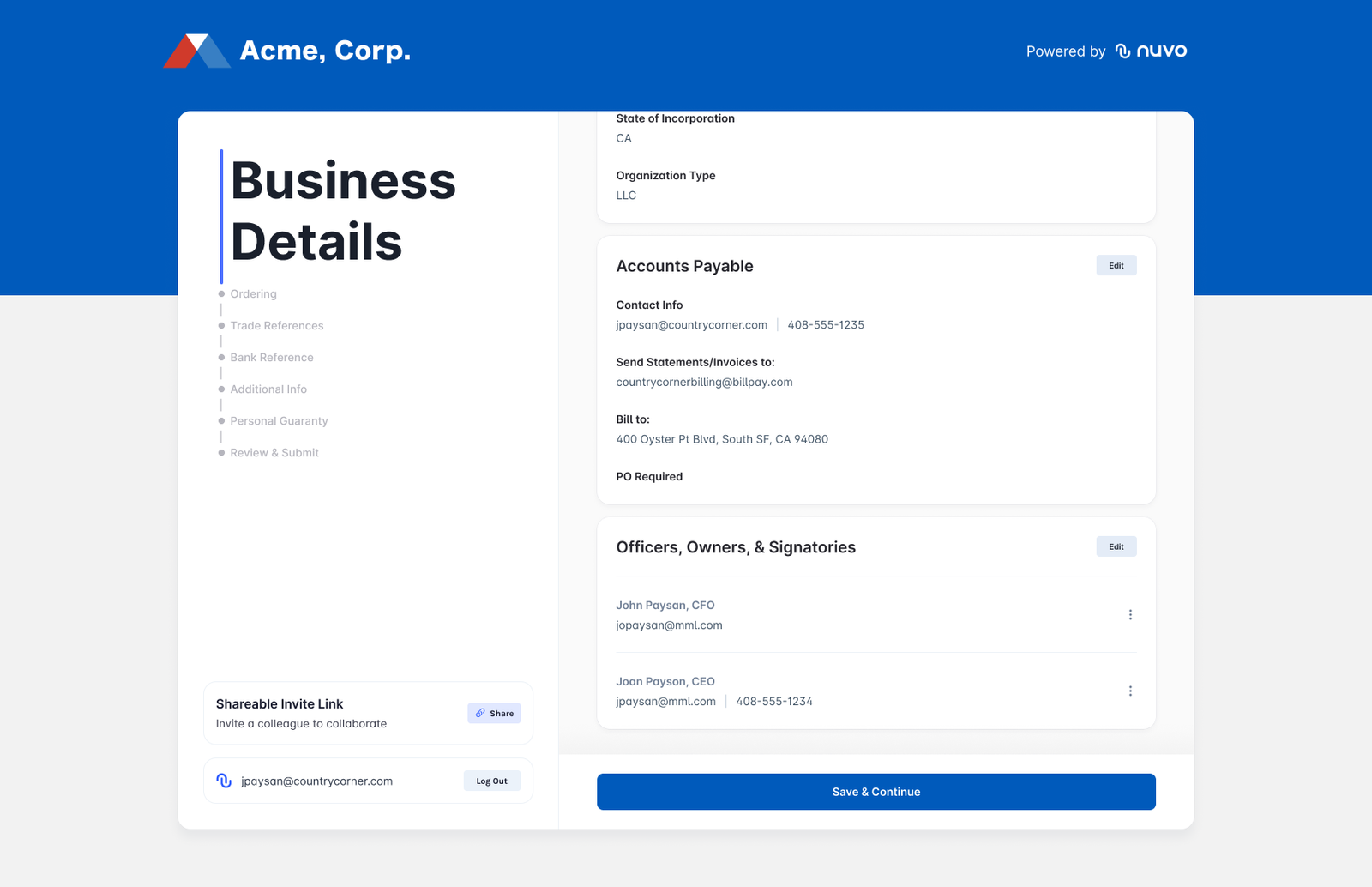

Digitize credit onboarding and automatically verify submissions.

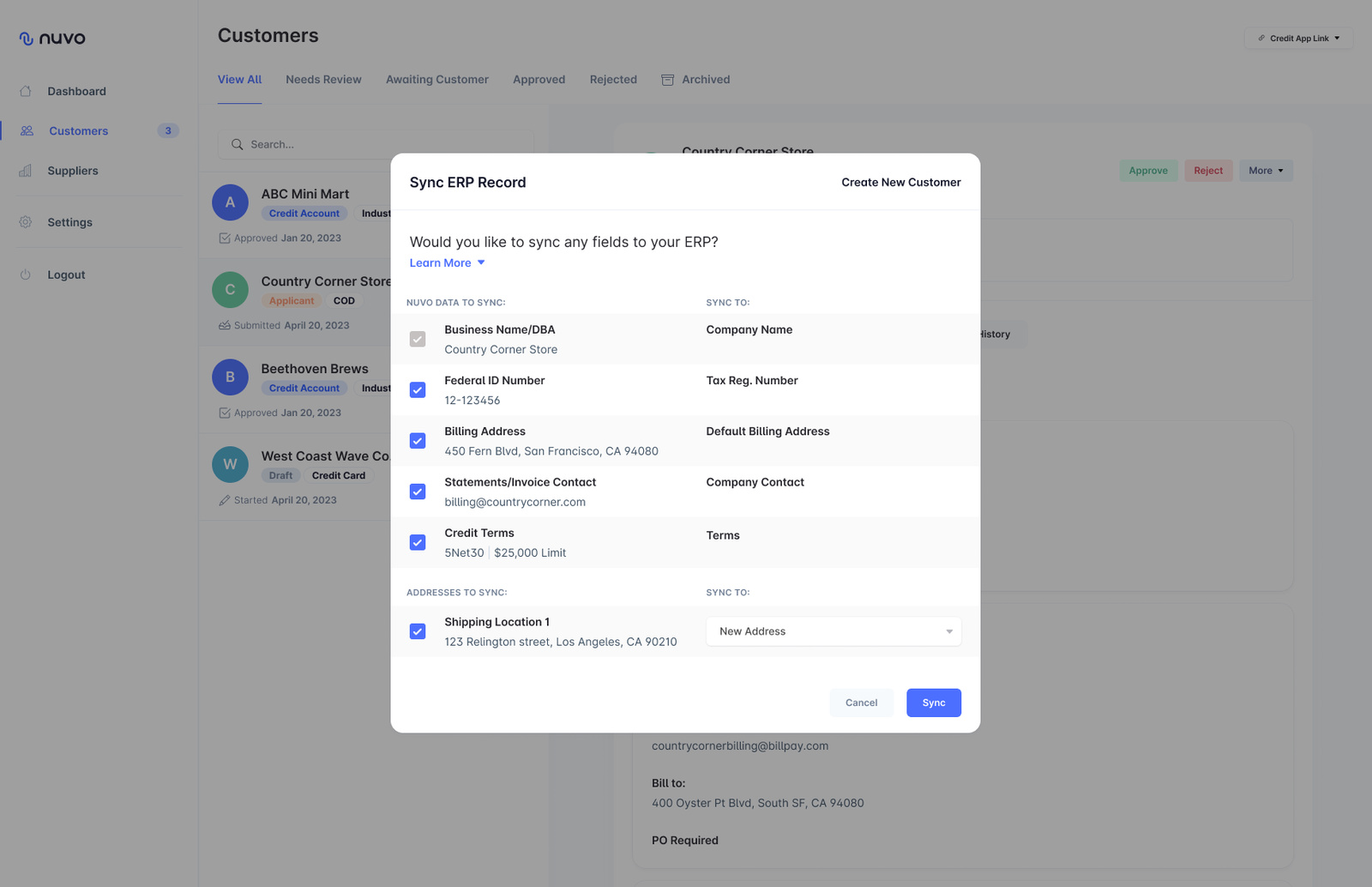

Nuvo verifies company profiles with tax and licensing authorities so you can update NetSuite with reliable customer records.

- Get complete, validated submissions and reduce back and forth with applicants.

- Protect against fraud with instant verification through the IRS and business licensing authorities.

- Automate data collection from banks, trade references and credit bureaus in a dashboard.

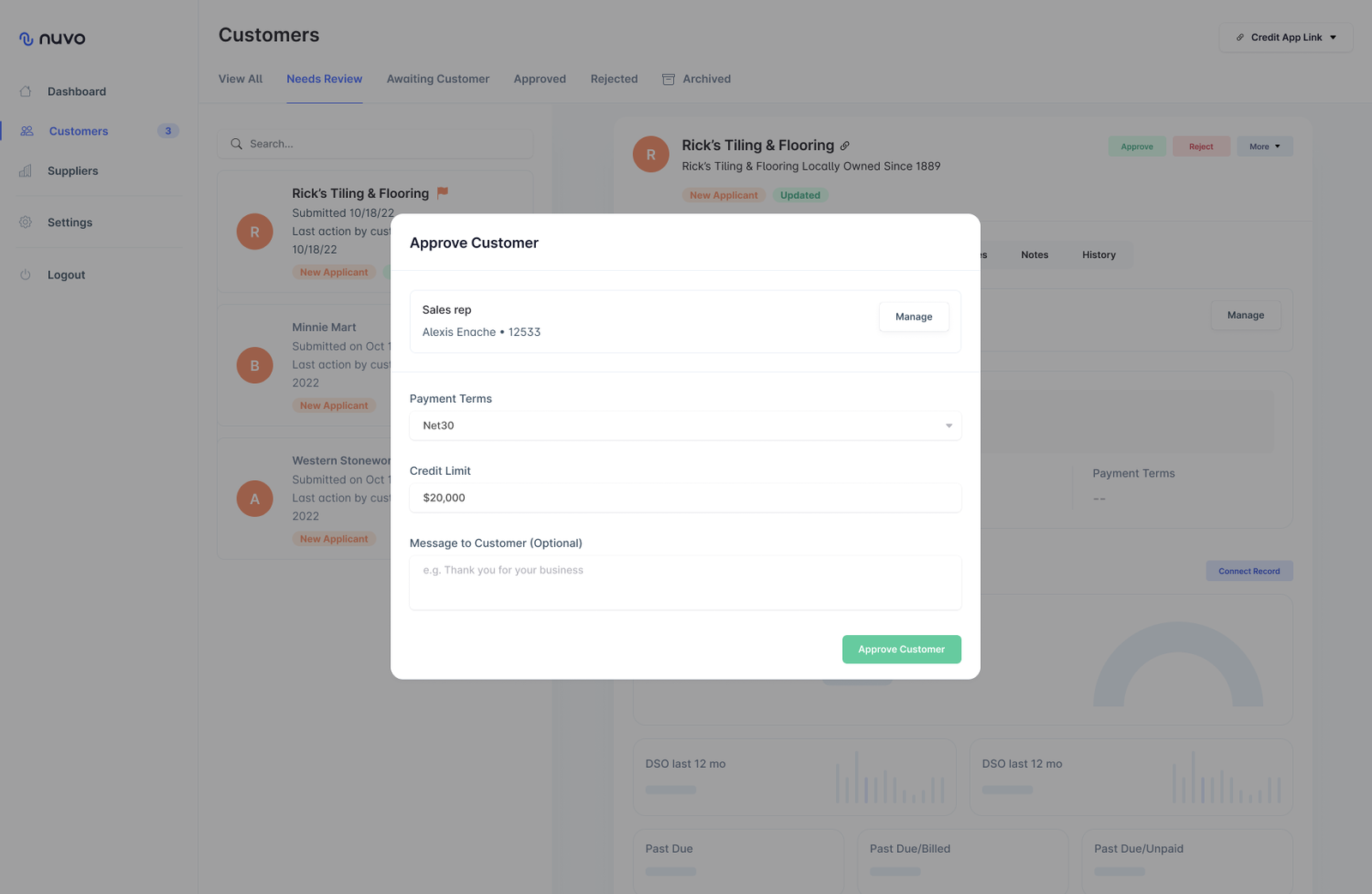

- Update customers and sales reps automatically when decisions are made.

Key Benefits

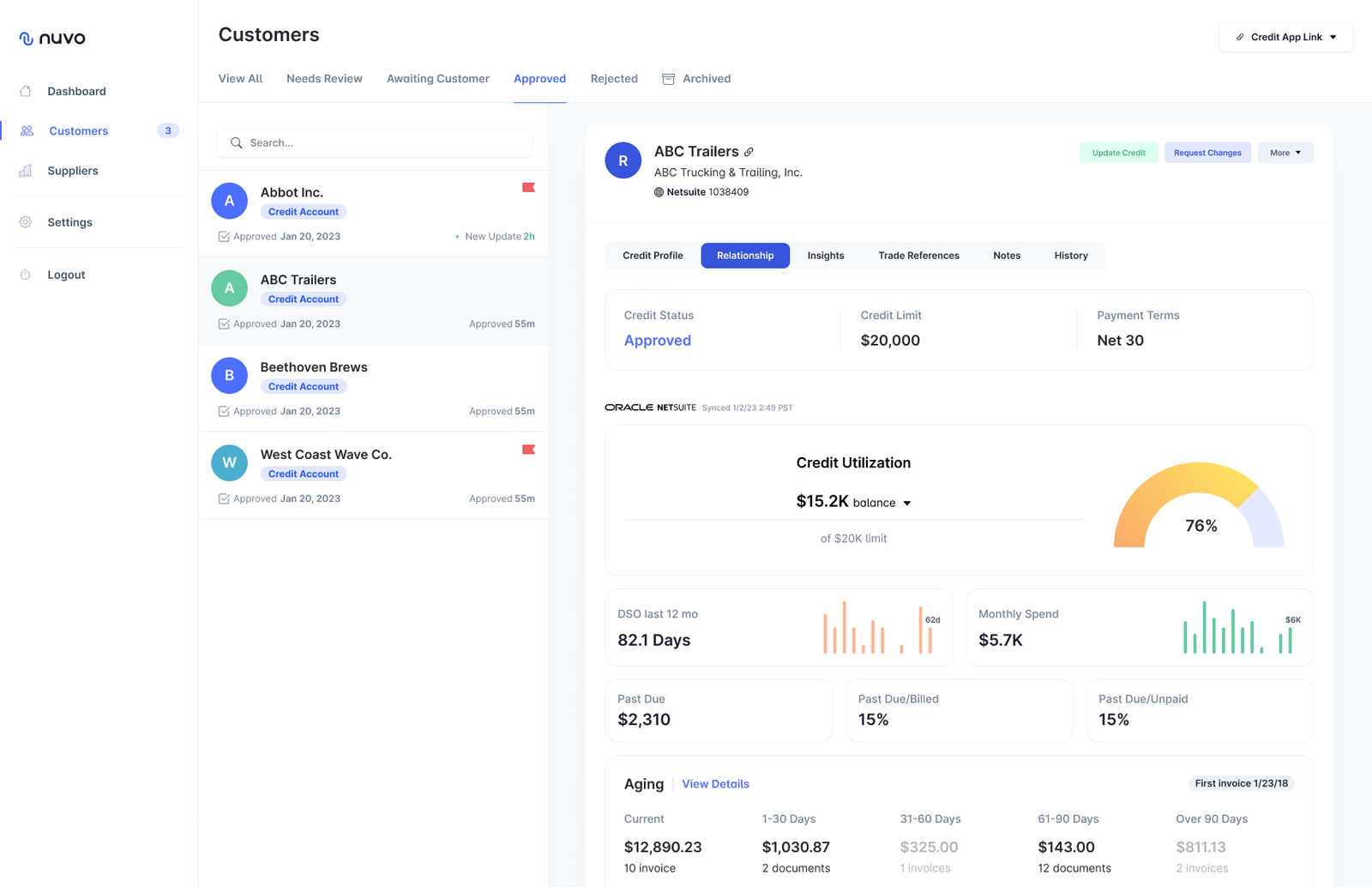

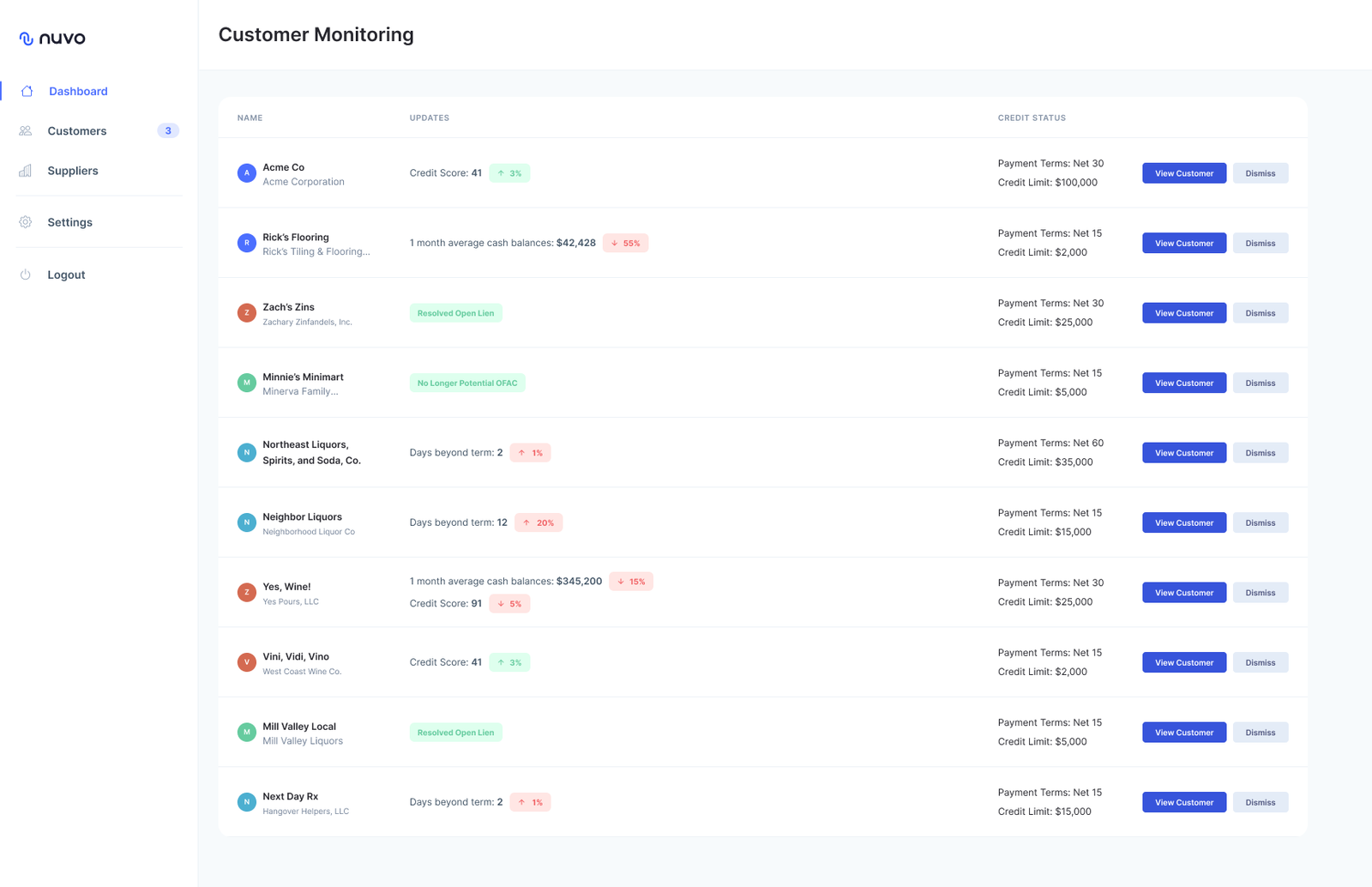

Discover revenue opportunities in your customer base by proactively monitoring their credit health across multiple data sources including accounts receivable from NetSuite.

- Monitor customer credit utilization and invoice payments history via Nuvo’s NetSuite integration and analytics dashboard.

- Identify customers with growing cashflows & bank deposits using Nuvo’s instant bank verification & financial health monitoring.

- Track improvements in credit bureau scores & credit recommendations through direct integrations with CreditSafe & Equifax.

- Discover changes in customer payment behavior with other suppliers with automated updates to trade references.

Take control of your credit risk.

Accurately evaluate customer creditworthiness in-house instead of relying on insurers and card processors.

Convert more customers to trade credit accounts with Nuvo’s digital credit application.

Get risk alerts on customers with declining bank balances, credit scores, and more.

Tighten credit terms for risky customers in a click, and update limits in NetSuite.