Quickly and easily fulfill all 1099 reporting requirement

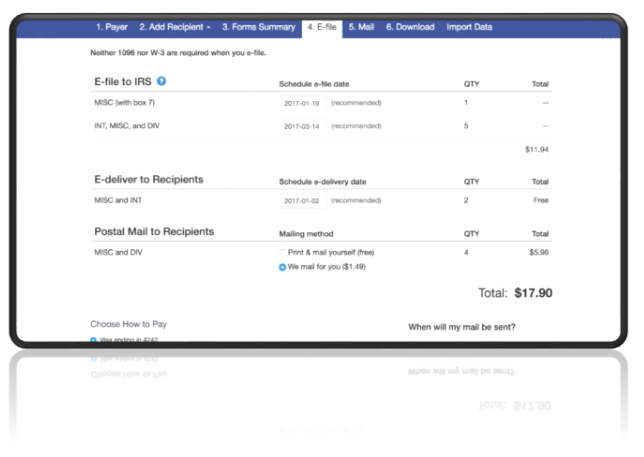

Avalara 1099 allows tax pros and businesses to quickly and easily create and e-file 1099s, W-2s, 1095s, 1042-S and other information returns to the IRS. Avalara 1099 also offers recipient e-delivery, e-corrections, postal delivery, address verification, Taxpayer Identification Number (TIN) check, individual state filing, and participation in the Combined Federal and State Filing program.

Key Benefits

E-file to the IRS. Secure e-delivery to recipients.

How It Works

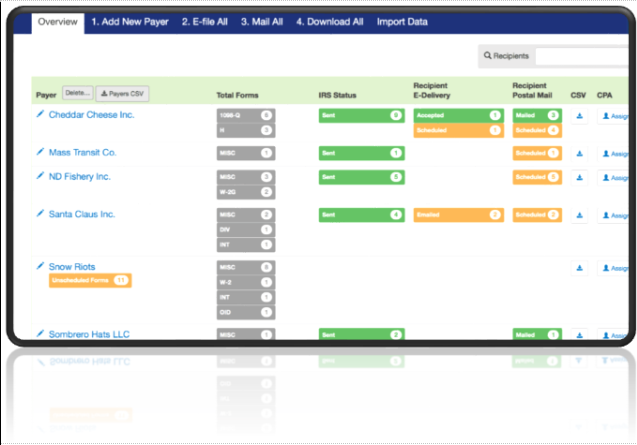

It’s simple to e-file your returns. First, add your payer and recipients’ info, either manually, via a CSV Import, or by data transfer from popular payroll software. Then review your forms and schedule them for e-file and e-delivery. Once complete, you may download files for your records and add more payers when necessary.