Compliance for NetSuite in Korea

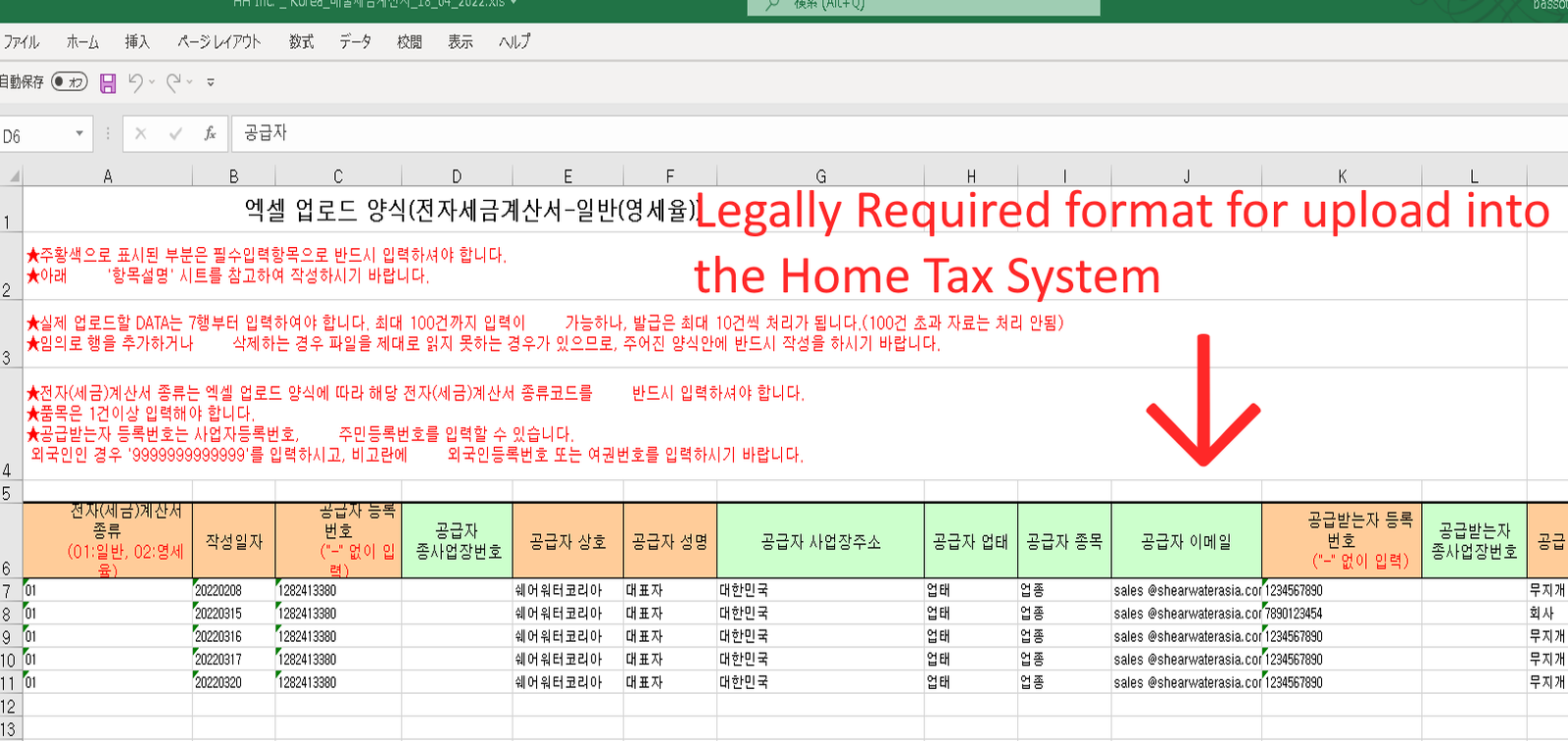

In 2011, Korea introduced an electronic tax invoice system (e-Tax), making the electronic issuance of VAT invoices mandatory for Korean companies. This tax invoice system reduces accounting costs by enabling the online issuance and distribution of eVAT invoices and their web-based transmission to the Korean tax authority, the National Tax Service (NTS).

The Shearwater Asia Localization SuiteApp for South Korea provides you with the necessary fields and export formats to operate in Korea along with the National Tax System.

Key Benefits

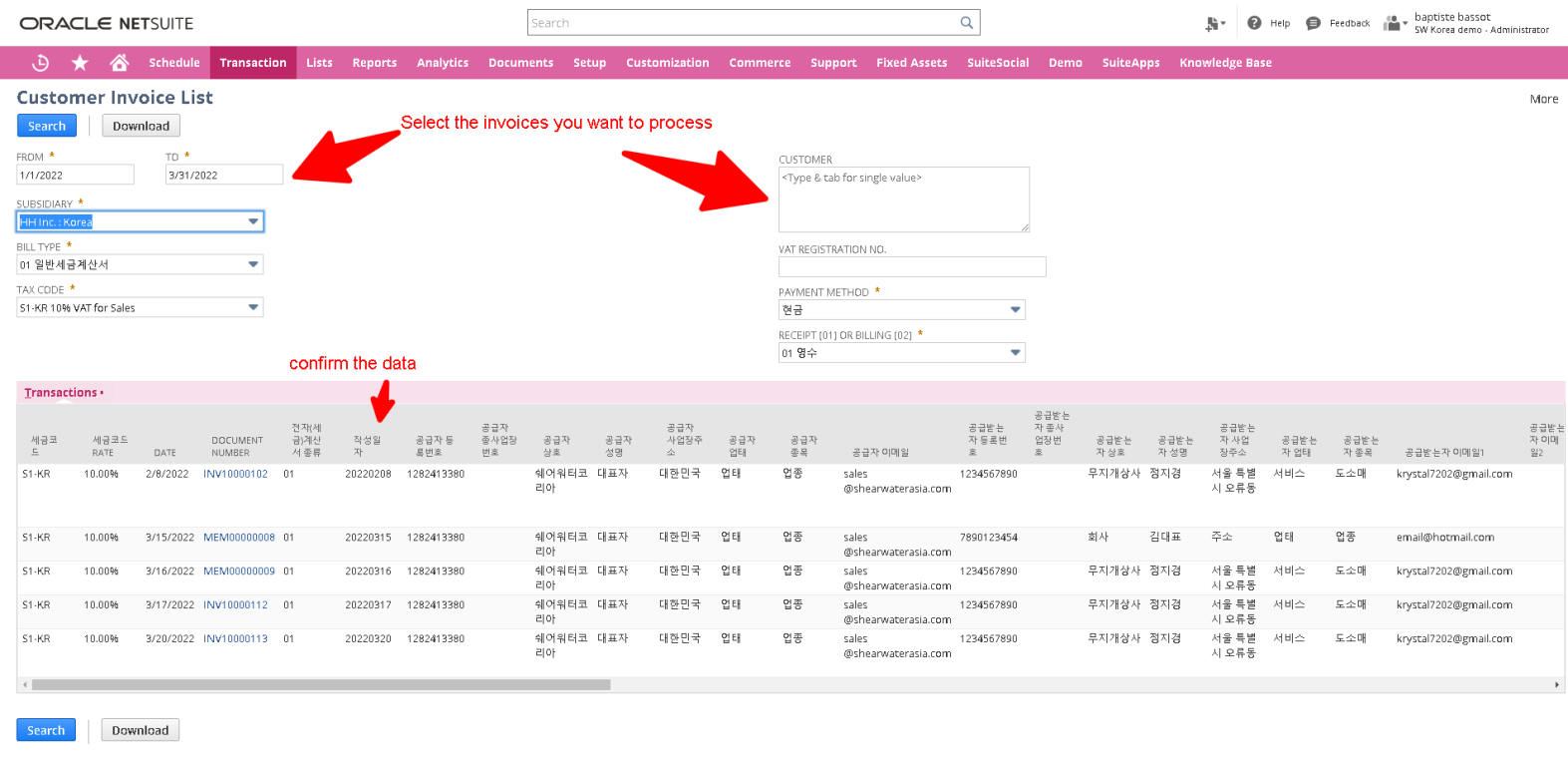

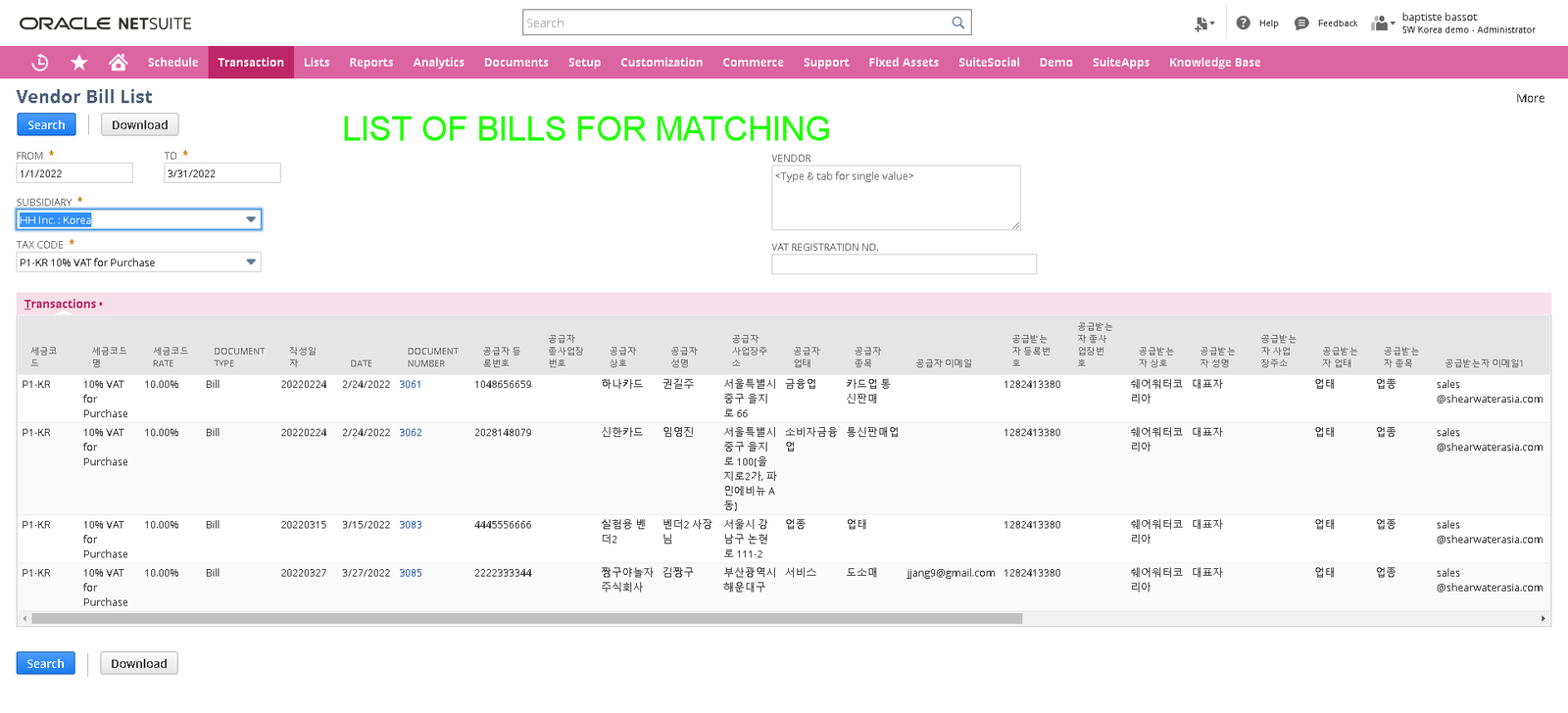

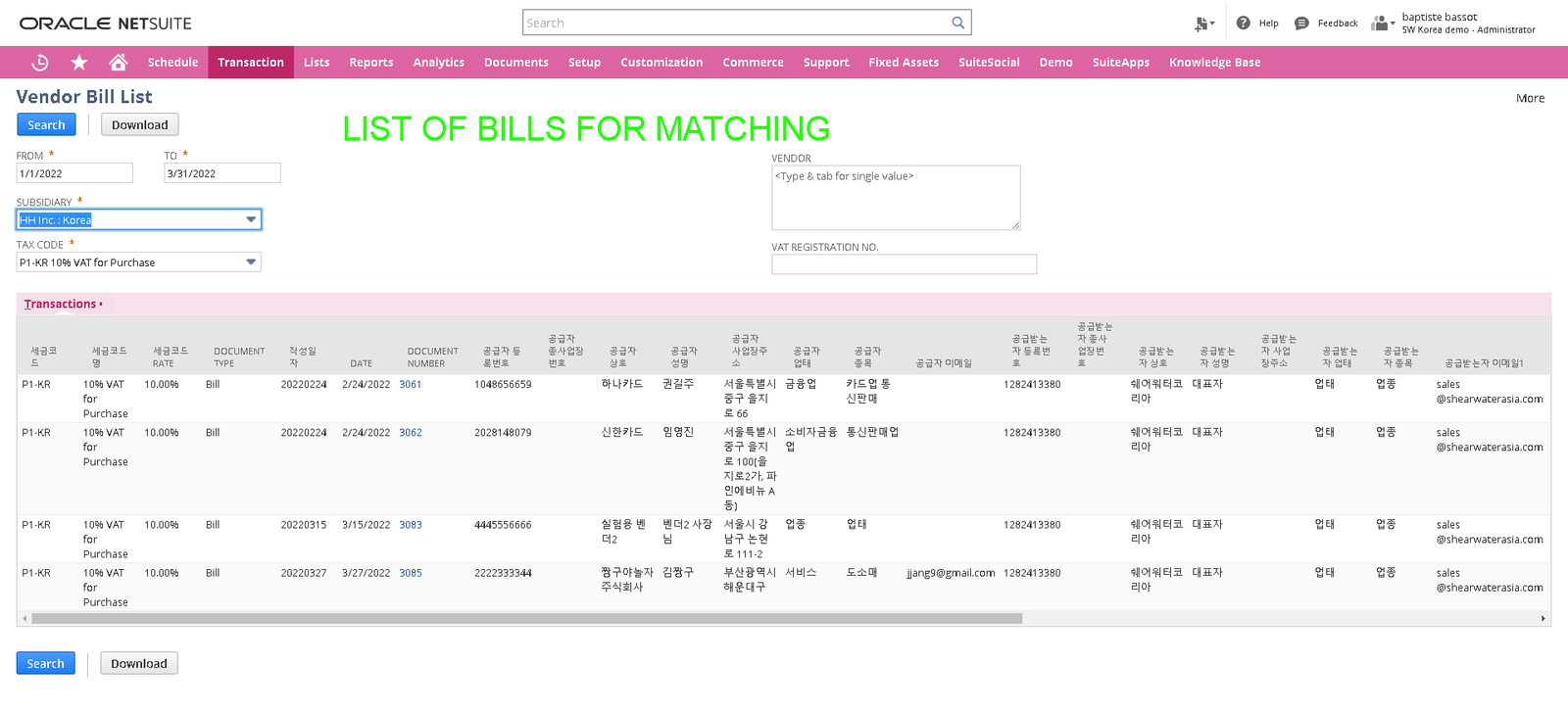

The Shearwater Asia Localization SuiteApp for South Korea is necessary to use NetSuite as the primary ERP and accounting system in Korea. It allows for full compliance with the National Tax System.It also adds a tool to verify that all bills coming from the National Tax System are also available and correct in NetSuite.

Who uses it?

All companies operating on NetSuite in Korea are required to use the National Tax System. Although it is possible to key-in manually invoice data into the National Tax System, it becomes costly and risky beyond a few dozen invoices per months. The SuiteApp is geared toward SMB issuing more than 10 invoices per month. Very large customers with high volume might use another SuiteApp leveraging API.