Sales & Use Tax Automation

Vertex helps automate sales and use tax compliance for businesses of all sizes globally. By enabling calculations and returns, Vertex meets the sales and use tax automation needs of growing businesses.

Automates tax determination for sales, use, and value added tax, reducing time and effort.

• Provides greater accuracy of returns and compliance data.

• Flexibility to meet changing global indirect tax requirements.

• Improved ROI and faster time-to-value for the Vertex

tax engine.

• Increases the efficiency of finance and tax teams.

• Less reliance and burden on IT team.

• Streamlined audit processes and reduced audit exposure.

• Backed by Vertex’s global team of NetSuite and Oraclecertified

consultants and support specialists.

Key Benefits

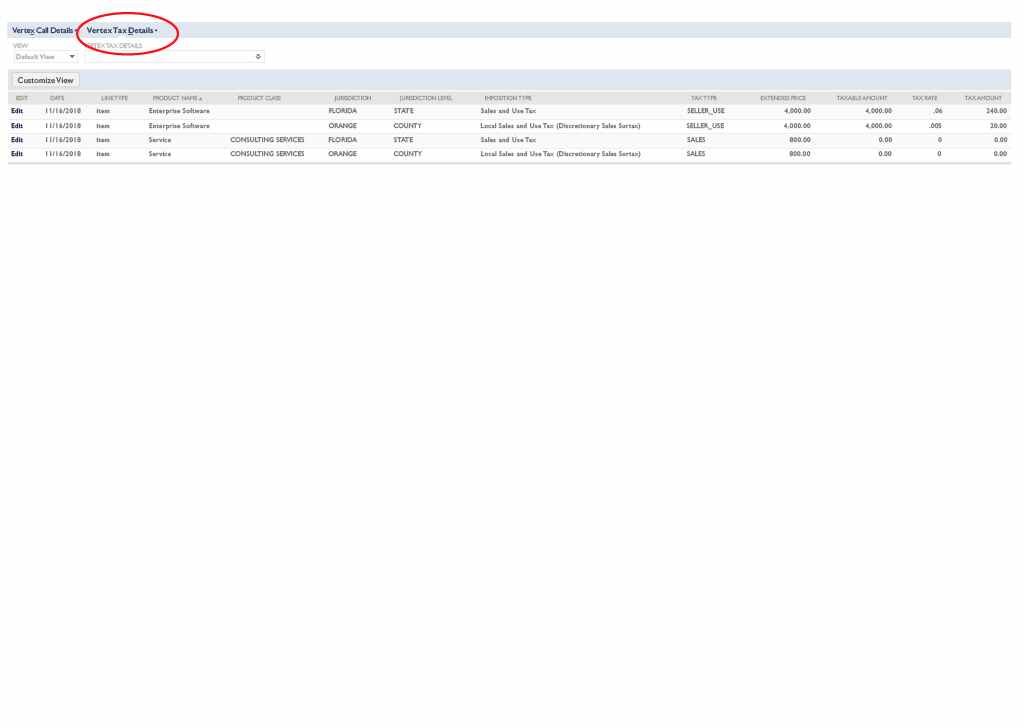

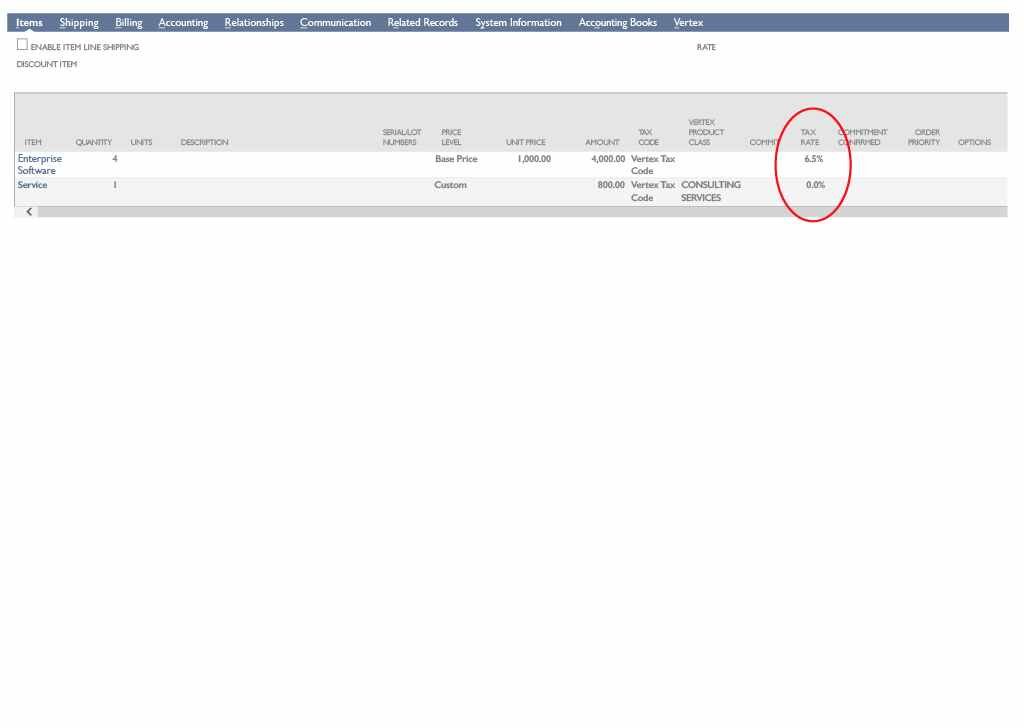

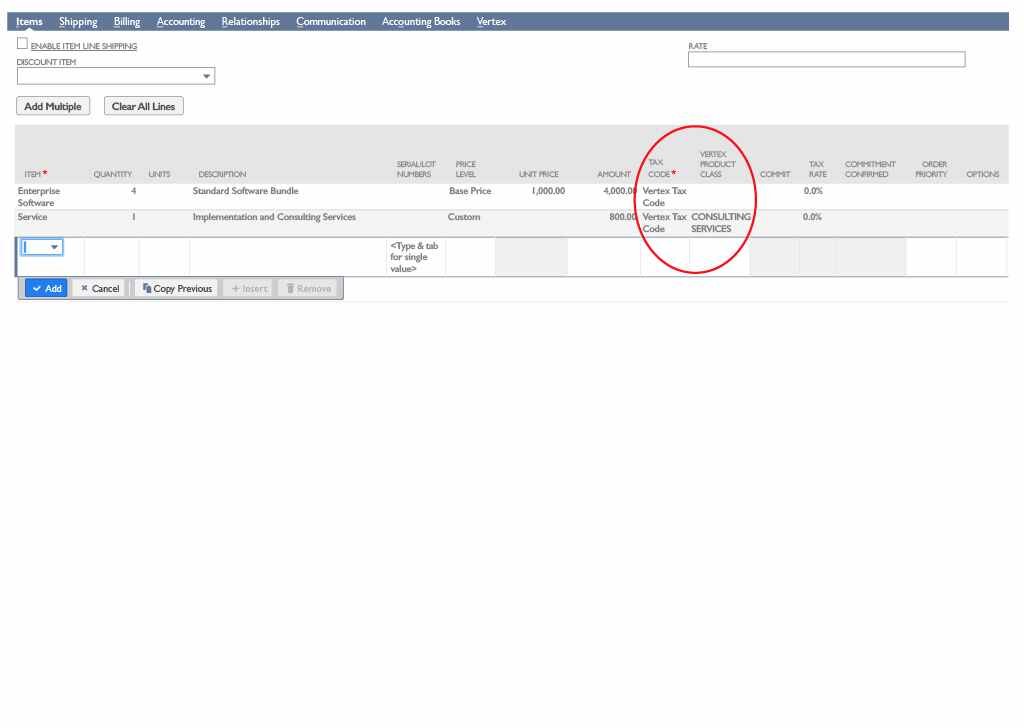

- Real-time tax calculations for sales and procurement transactions

- Quotes/estimates

- Cash sales

- Sales orders

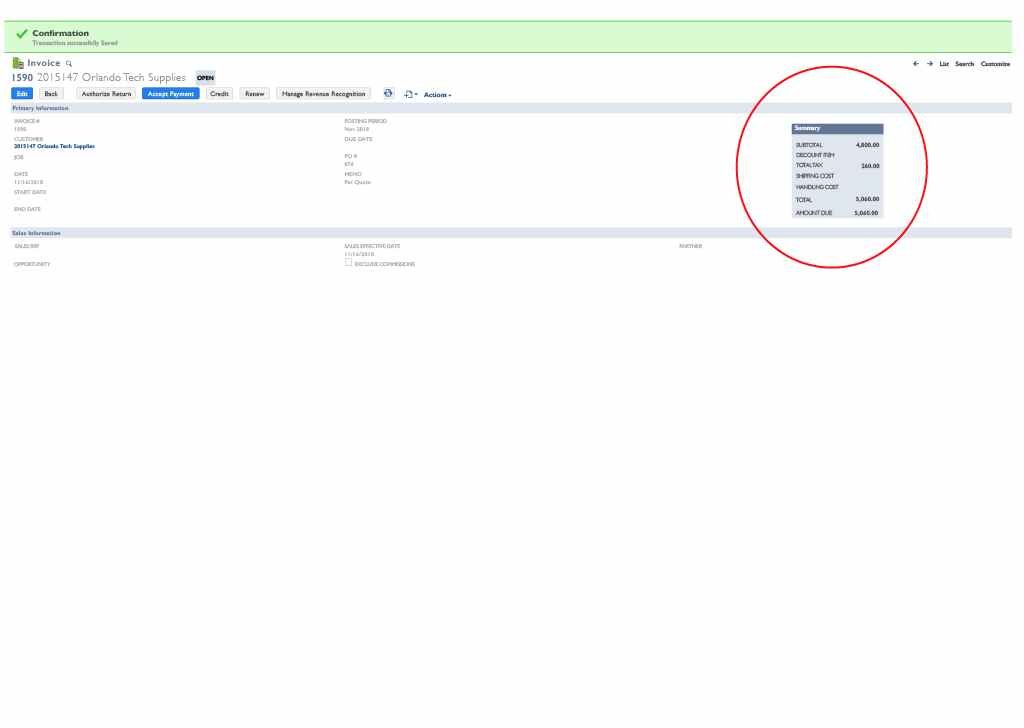

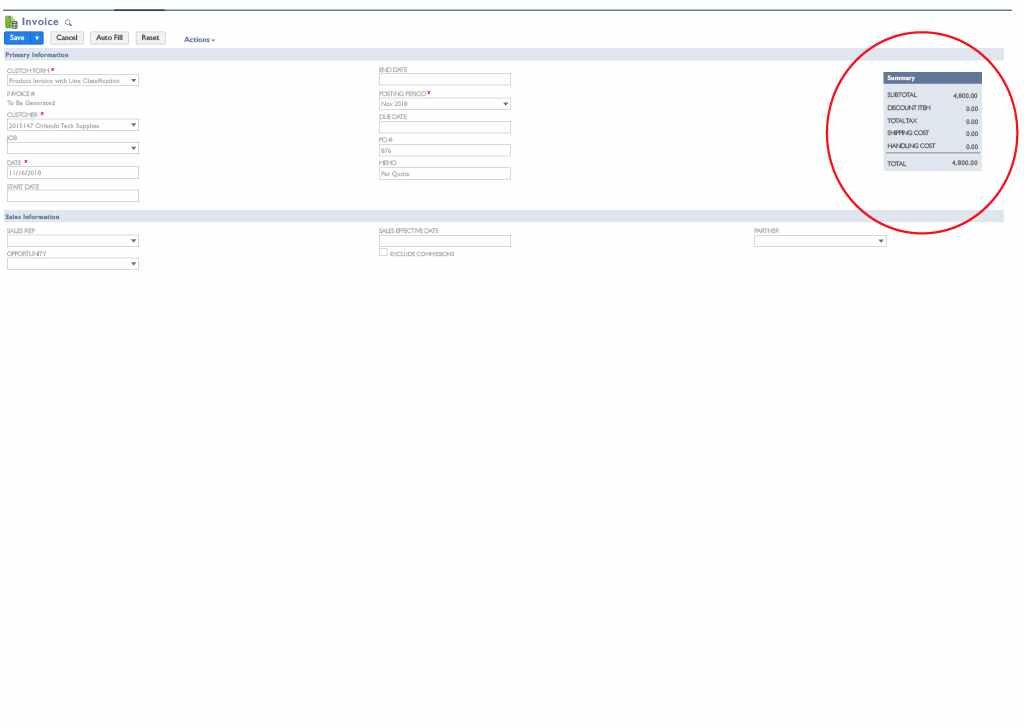

- Invoices

- Supports Value Added Tax (VAT)

- Simplified NetSuite tax setup Consumers Use Tax on the SuiteTax integration

- Address validation: validate address information for accurate tax calculation

- Estimates: get accurate tax rates for the estimates you prepare

- Sales orders: ensure the accuracy of taxes to be collected or paid

- Invoices: update your tax journal with real-time tax information

- Credit memos: calculate the correct tax amount for credit memos

- Cash sales: enter correct tax information for in-person purchases

- Cash sales refunds: calculate the correct tax amount for cash returns

- Subsidiaries: separate taxation amount subsidiaries in NetSuite OneWorld

Proven Solution from a Leader in the Industry

Vertex for SuiteTax is available for use in three deployment models – on-premise, on-demand and cloud to integrate directly with mid-market ERPs, procurement solutions, and ecommerce platforms. From returns-only processing, tax calculations, and signature-ready PDF returns to outsourcing services that include returns filing and payment processing, Vertex provides a proven and reliable solution for businesses looking to save time, effort, and risk associated with sales and use tax calculation, returns, remittance, and compliance.