Overview

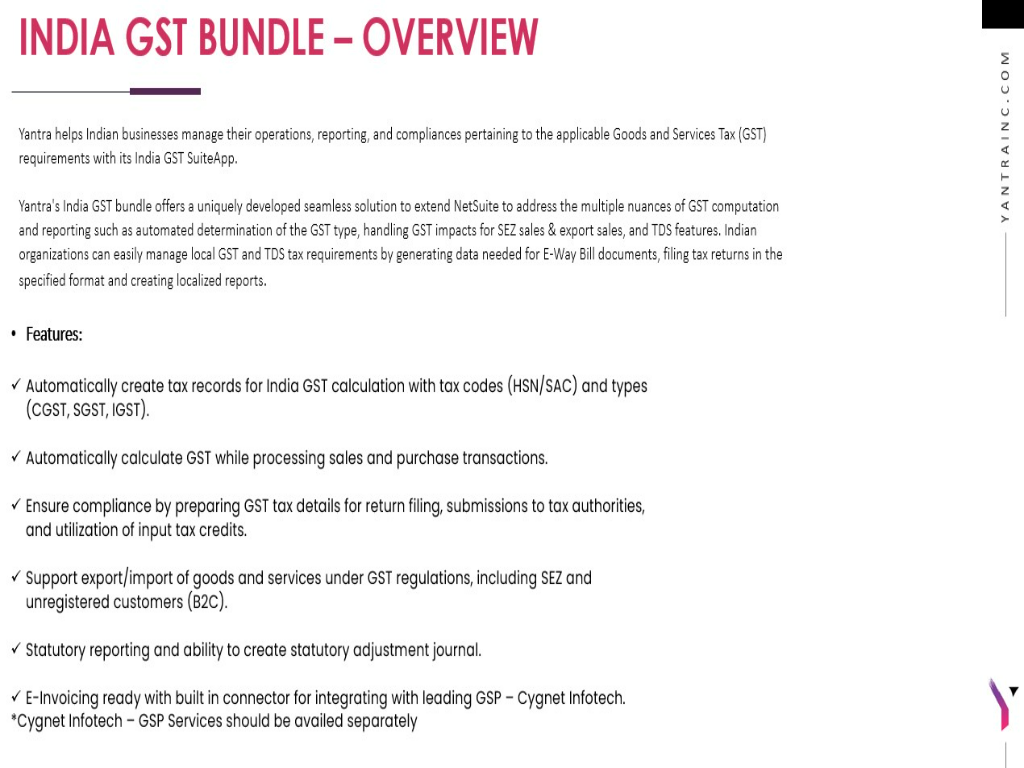

India adopted GST from 1st July 2017 across the country. Hence it is imperative that the GST compliant tax reports as well as transactions can be executed or extracted from the accounting systems being used. Currently, the India tax localization is not released for all customers. Thereby, arising a pressing need for a solution that can handle the evolving GST landscape for India region.Yantra’s GST bundle offers a uniquely developed seamless solution to address the multiple nuances of GST computation and reporting such as, Automated determination of GST type, handling GST impacts for SEZ sales and Export sales and TDS features.

Key Benefits

- Tax Control Accounts, Tax Types, Tax Codes and Tax Groups on per state and per schedule basis.HSN Codes on items and Expense Categories.

- GSTN Codes on Customer and Vendors.

- Validation for mandatory fields for India Subsidiary.

- Automated determination of GST Type (Inter and Intra) on transactions.

- Handling SEZ Sales, Export Sales, Unregistered Customers (B2C).

- TDS Compatibility on purchase and sales transactions.

- Ability to determine GST type on third party shipments.

- Reporting: GSTR 1 and GSTR 2.

Business Benefits

- Compliance

- Automated Rules Management

- Accurate accounting

- Statutory Reporting

- Ease of matching and settlement.