Built for NetSuite Integration

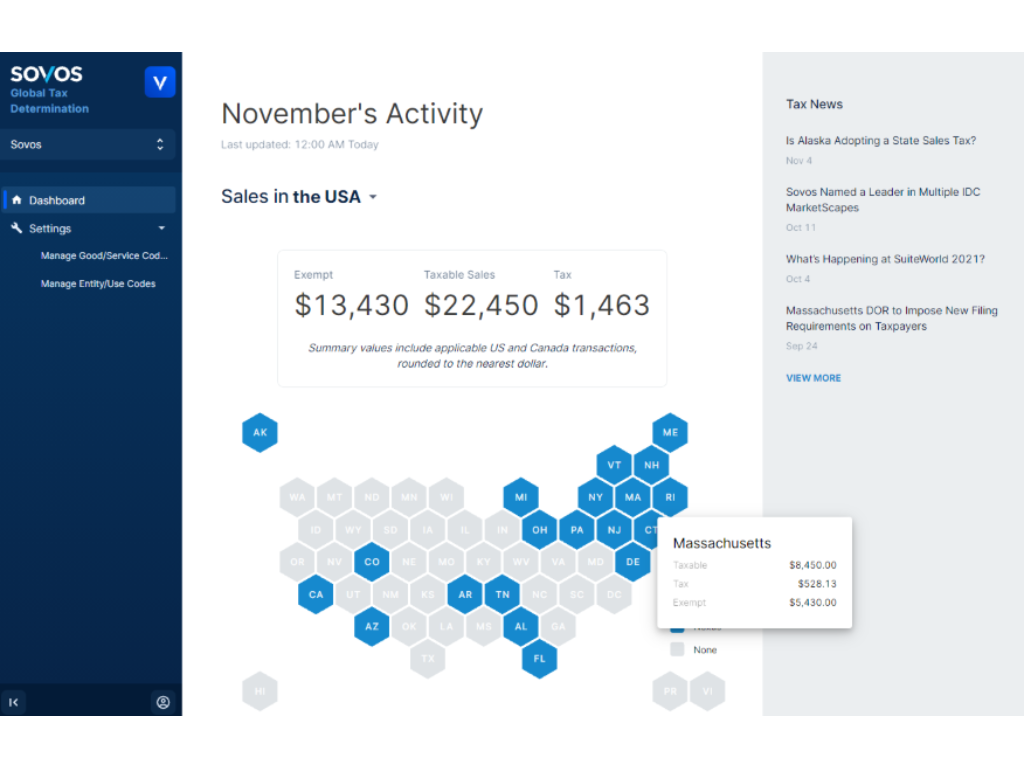

Streamline your business. Reduce audit exposure. The Sovos sales tax integration with NetSuite simplifies indirect tax determination and compliance, giving you the confidence to focus on the core activities that drive your business.

Key Benefits

- Easily calculate taxes and fees on domestic transactions and invoices, as well as accounts receivable credit memos

- Sovos’ regulatory team tracks hundreds of annual tax code and form changes so you don’t have to

- Active-Active cloud infrastructure ensures reliability and uptime during high transaction periods

- A hands-on implementation process, wiht post go-live domestic support and knowledge center

- Additoinal capabilities to support your extended compliance needs for exemption certificate mangaement and sales tax filing

Why Sovos?

Sovos is a true partner for your organization. We take the time to understand your business processes and any industry-specific nuances before you sign a contract, ensuring our products are a good fit for your needs.

Sovos offers a hands-on implementation process, featuring clear project plans and defined responsibilities for both sides. Our professional services team keeps pace with yours to meet targeted go-live dates.

Our solutions are built to grow with you. For organizations with extended compliance needs, Sovos offers a complete suite of tax solutions to give you the confidence to do business in any jurisdiction:

- Sovos Filing seamlessly integrates with GTD to help streamline your sales and use tax filing process

- Sovos CertManager centralizes your customers’ exemption documentation and automatically applies valid certificates to orders

- Benefit from support for e-invoicing and VAT compliance

- Utilize the Built for NetSuite 1099 reporting solution