About Agicap

Agicap all-in-one modular treasury management platform meets most cash challenges. It relies on several complementary and interconnected solutions:

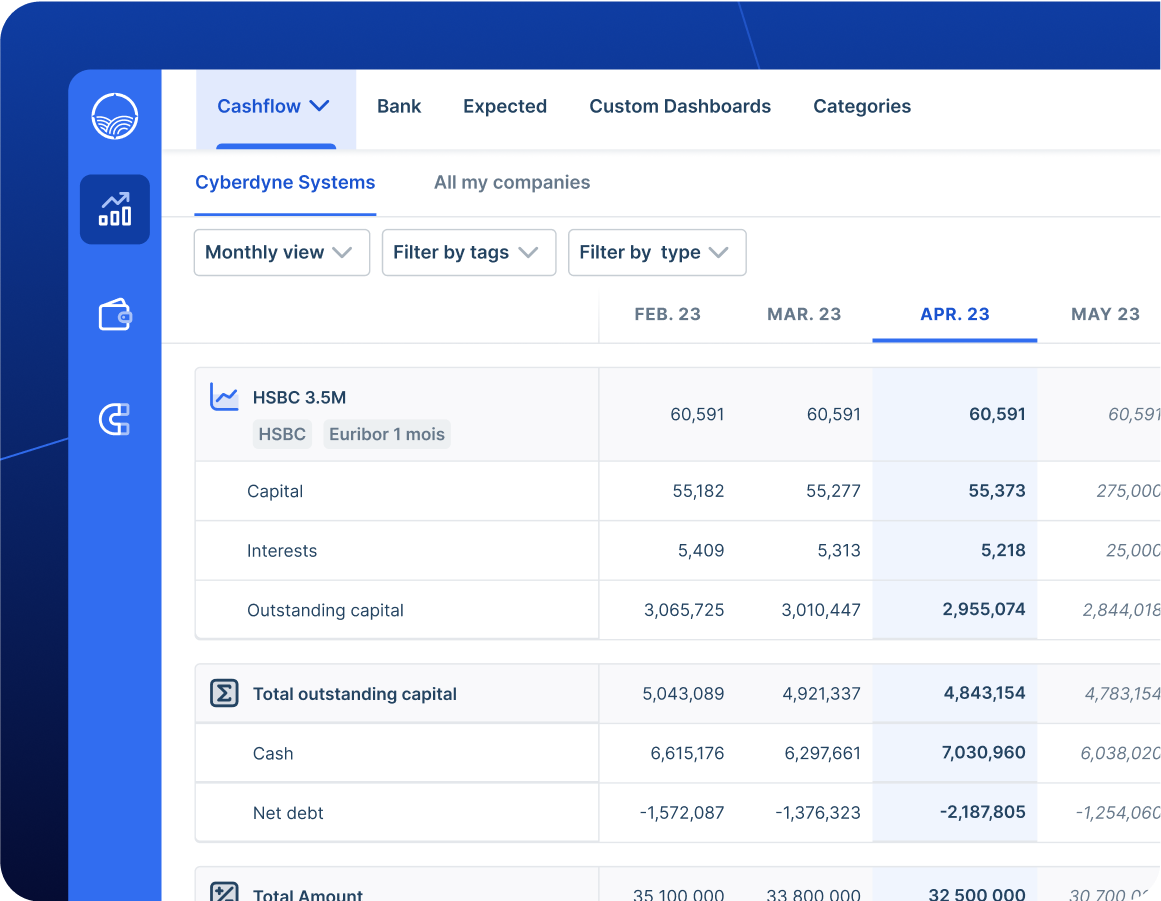

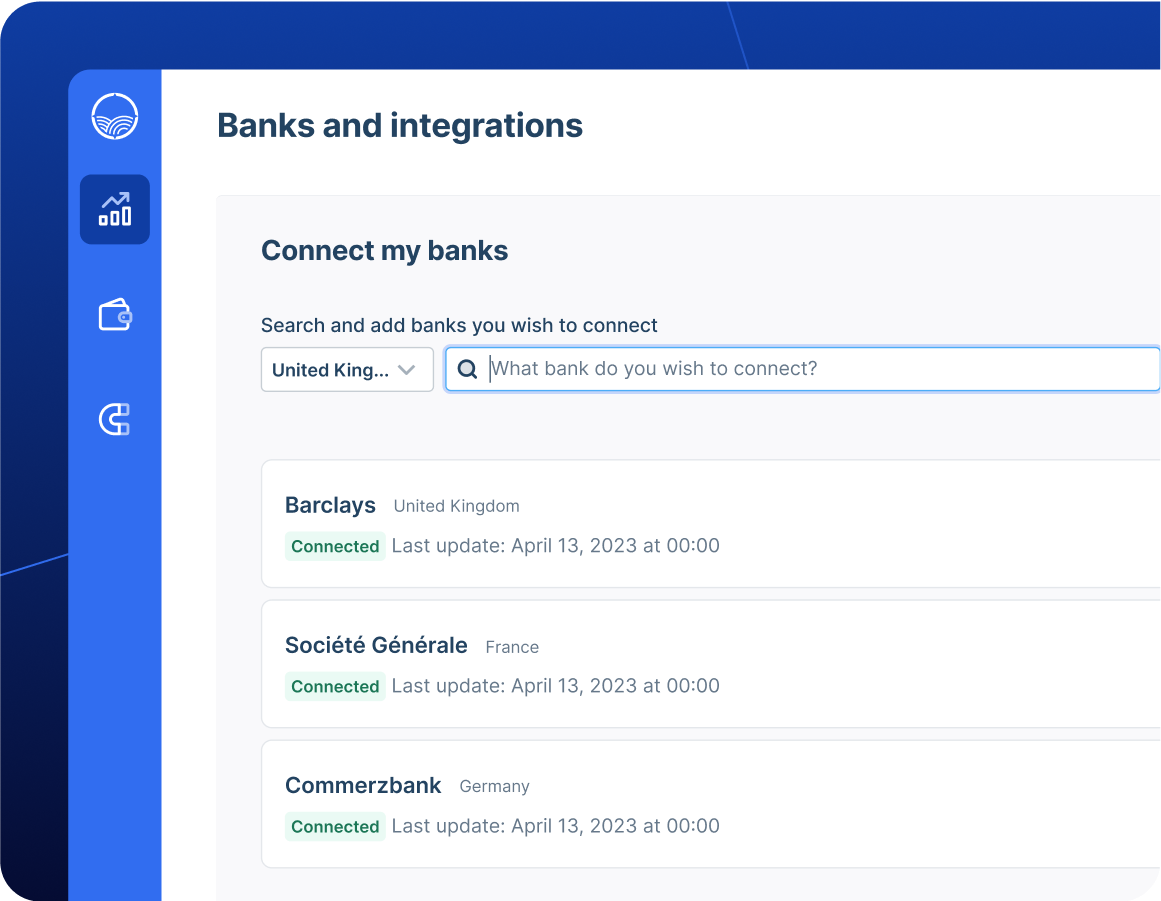

- Banking & ERP connectivity: Manage data connections between your banks and other systems. Namely, automatically retrieve all your bank statements to import them into Netsuite. Schedule your payments without connecting to all your banks.

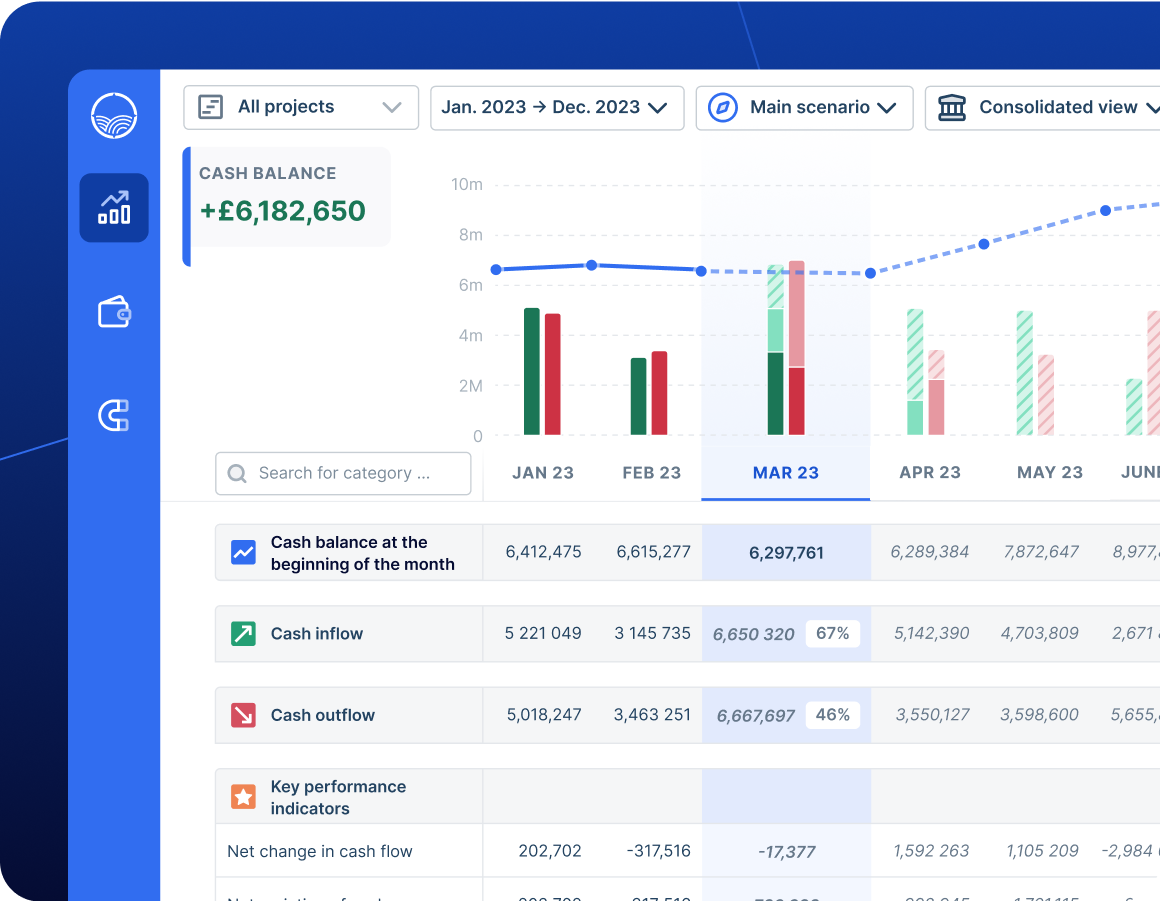

- Daily Cash Management: Manage and monitor company-wide cash in one place to establish a solid foundation for short-term financial decision-making.

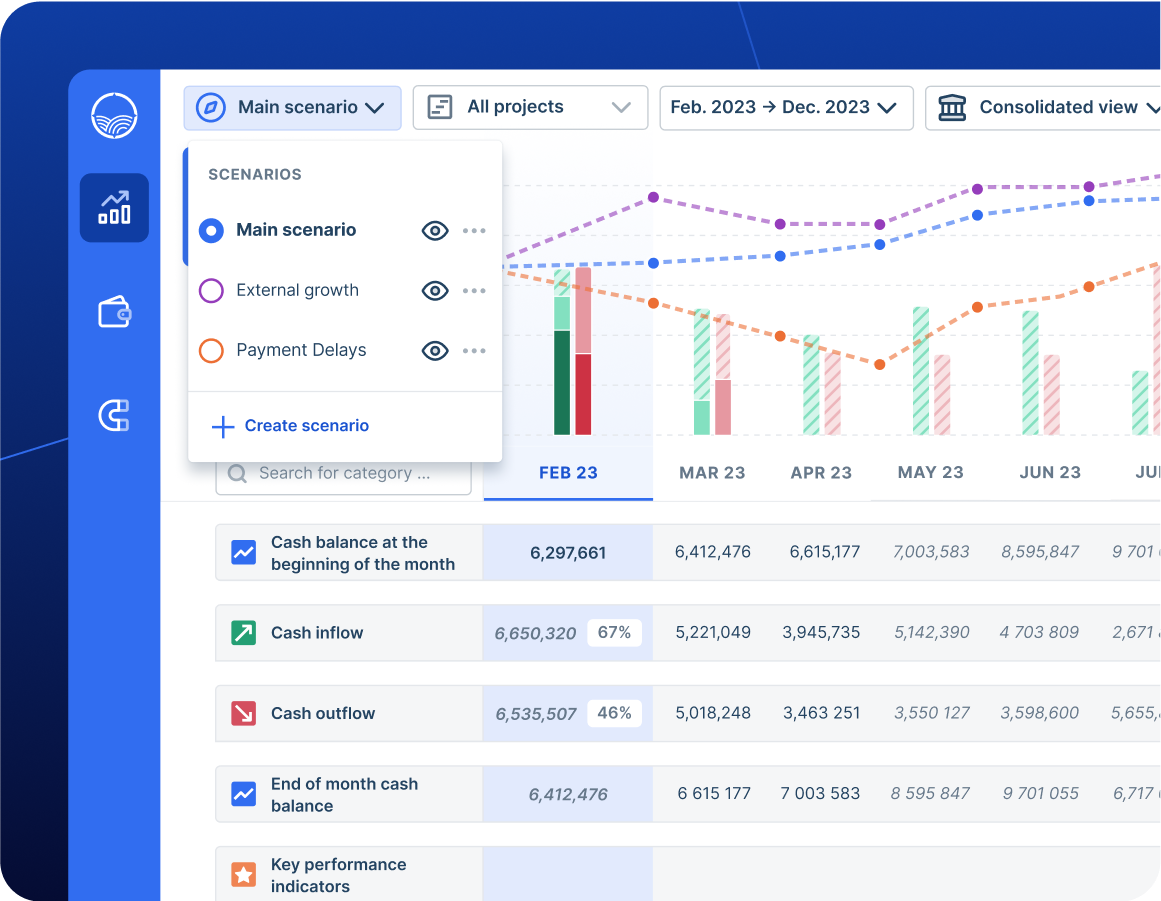

- Liquidity Planning: Plan long-term liquidity by consolidating data from multiple sources and enhancing forecast modelisation and actuals comparison.

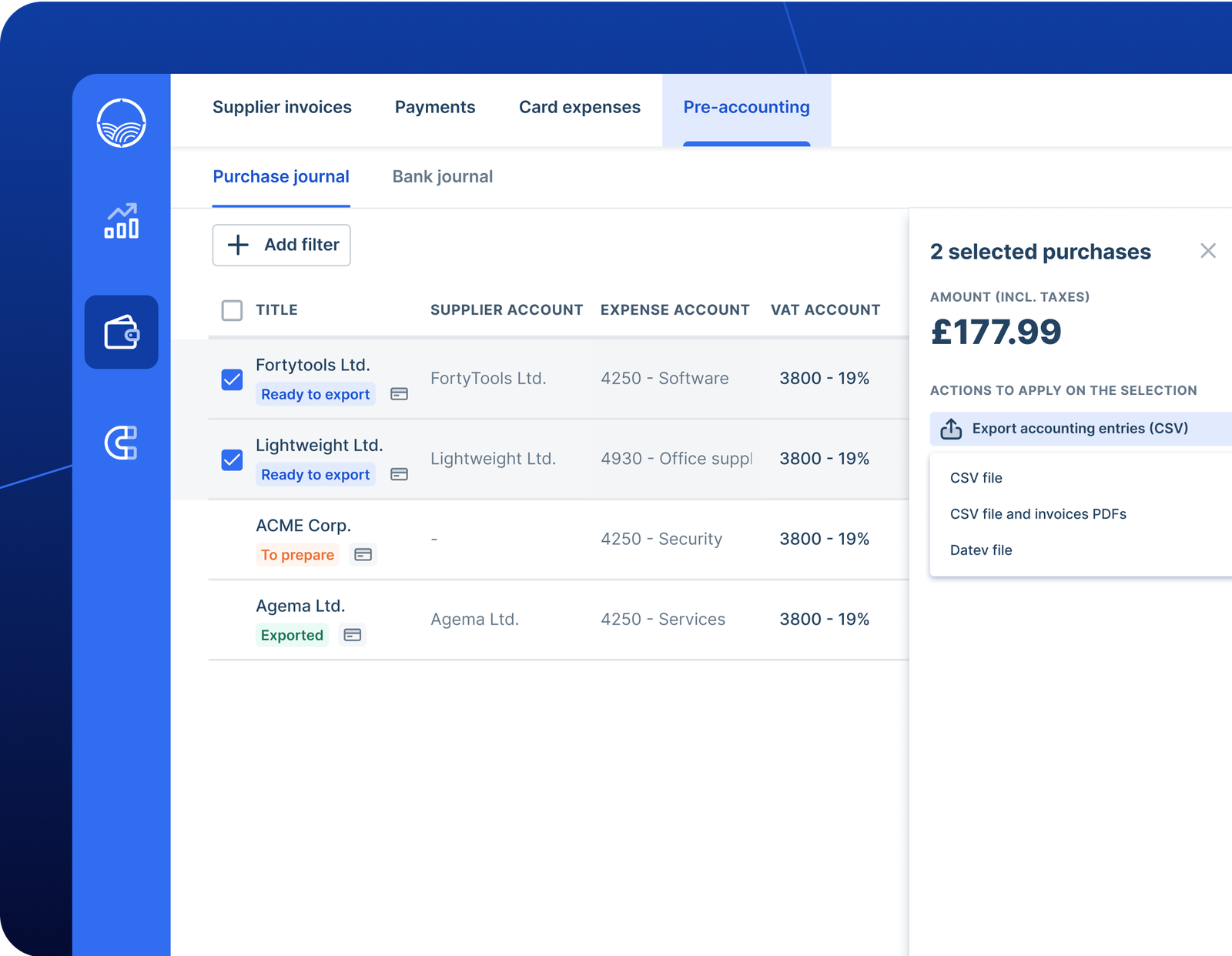

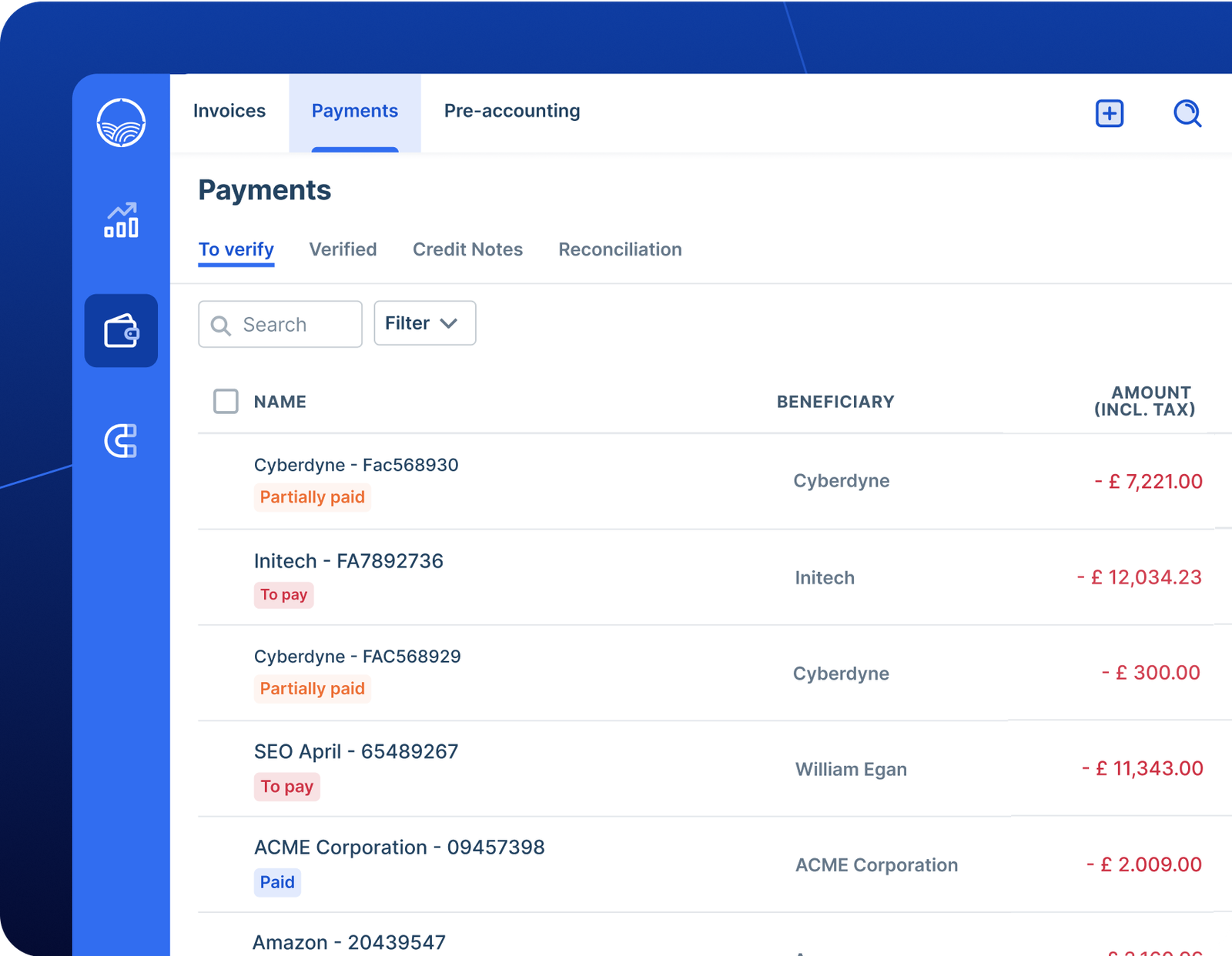

- Business Spend Management: Streamline company-wide spending processes from procurement to pre-accounting with advanced payment capabilities.

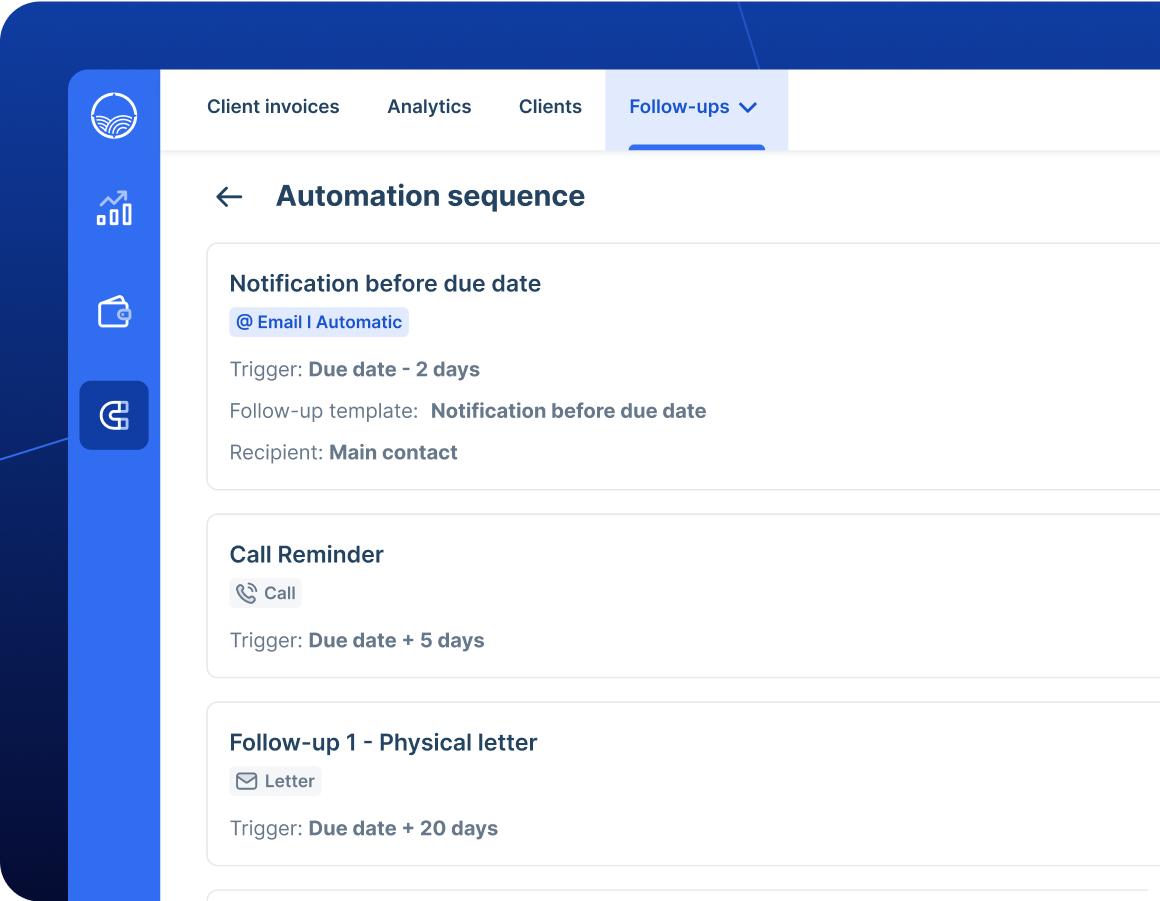

- Cash Collection: Enhance late payment collection capabilities, automate processes and resolve disputes.

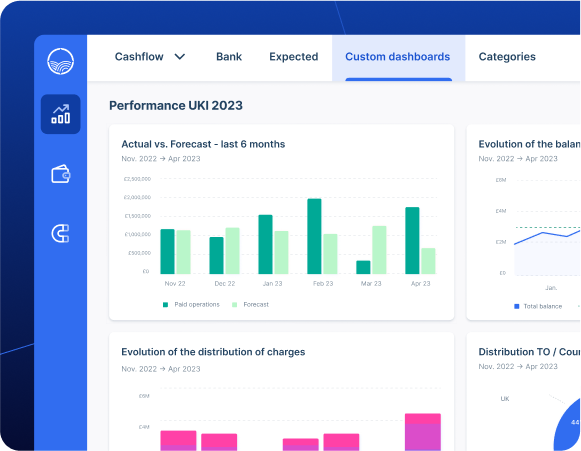

- Reporting & Analytics: Streamline financial reporting internally and externally by building custom reports, accessing them from the mobile app, and sharing them easily.

Key Benefits

Agicap delivers value at every level of the company, turning cash into a lever for growth and profit:

- CEOs:

- Secure financing for business strategy

- Mitigate risk of cash shortage

- Gain visibility and control over cash inflows & outflows

- Improve external financial communication

- CFOs:

- Increase financial income from investments

- Reduce financing costs

- Facilitate negotiations with banks

- Improve internal financial communication

- Their teams:

- Improve cash forecasts

- Increase available cash

- Increase efficiency

- Make life easier for teams

A bit of context

With high interest rates, Cash is now once again a valuable resource that business leaders must manage accordingly. No wonder we hear every day that managing cash is a burning challenge for:

- CEOs: “Cash is the lifeblood of my business”, “The interest rates make our inaccurate cash management costly”

- CFOs: “I lack the visibility to ensure we can finance our development while mitigating cash shortage risk”, “The flexibility of my cash forecasts falls far short of the responsiveness I need”

- Their teams: “So many hours wasted on Excel”, “Lots of human mistakes”

The information, levers and challenges related to cash flow involve virtually the whole company (Treasury, CEO, CFO, Accounting, FP&A, Sales Procurement…).

Yet traditional cash management tools are hardly suited to transcend the boundaries of the Treasury function.

We therefore designed Agicap based to this conviction: Treasury is not only treasurers’ business.