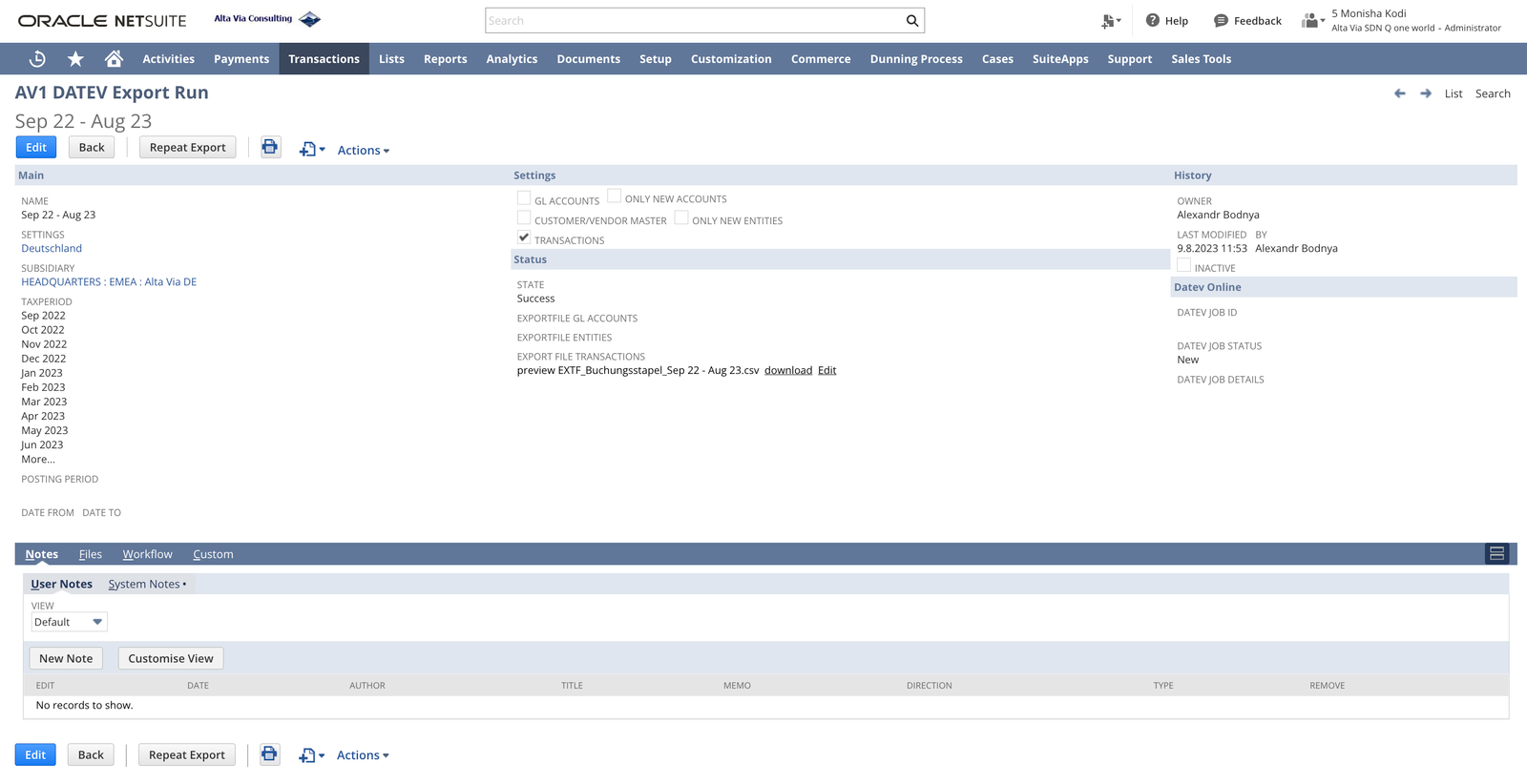

Master Data and Transactional Data Export

You can transfer master data (GL accounts and customers/vendors) as well as transactions with general ledger relevance (posting stacks / Buchungsstapel) from NetSuite to DATEV.

Mapping NetSuite to DATEV

To process the transactions in DATEV, they must structurally meet the DATEV requirements. To achieve this, various transformations are necessary.

- The G/L account in NetSuite is replaced by the account from the DATEV chart of account. In the account master in NetSuite there is the field DATEV account. For automatic accounts there is an additional mapping table with NetSuite account and tax code.

- Accounts receivables as well as accounts payables are booked in NetSuite to the general ledger account A/R or A/P with an additional assignment to the customer/vendor/employee. In DATEV, a sub ledger account is used here; all accounts receivables/payables have a sub ledger account. To realize this, NetSuite uses a DATEV Account field in the master records of customers, vendors, and employees.

- The NetSuite booking logic for VAT with net booking, tax code and extra tax line is converted into a DATEV gross booking with posting key or automatic account.

- NetSuite debit and credit line items are converted into DATEV line items with account and contra account.

- NetSuite's cost of sales method is transformed into periodic inventory change postings to represent a total cost method in DATEV.

- Support of revenue recognition

Periodical Run

In one run, all postings of a period (month, quarter, fiscal year, or individual days) are exported to tables that conform to the DATEV standard format. So these can be imported directly into DATEV.