Brief Description

Blue Tiger Consulting’s Withholding Payment application is a Japan-specific module that enable withholding income tax to be assessed automatically against payments of certain taxable income for personal vendors.

Key Benefits

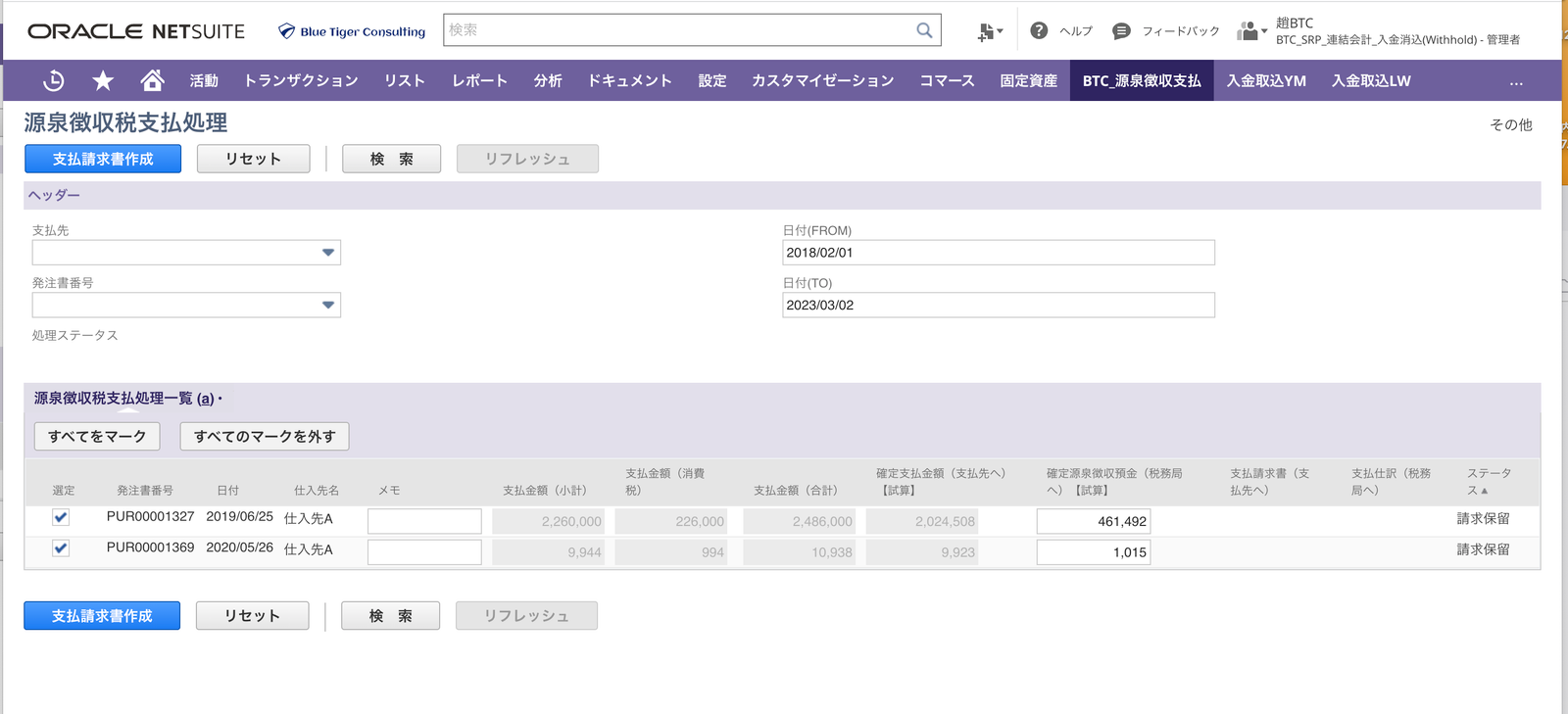

Japan’s tax filing system is based as a rule on self-assessed income tax payment where individuals (tax payers) calculate their annual income and tax amount, and file tax returns by themselves. In addition, a tax withholding system where companies (income payers) collect income tax on the date of payment and pay the tax on behalf of individuals (income earners), is also introduced for specific incomes. Withholding income tax is assessed against payments of certain taxable income, whether paid to an individual. Income subject to withholding income tax is determined in accordance with the type of income and the classification of the recipient of that income. BTC’s Withholding Payment application makes it possible to automatically pay the taxation office the amount of tax withheld at source.

Customer Quote

N/A

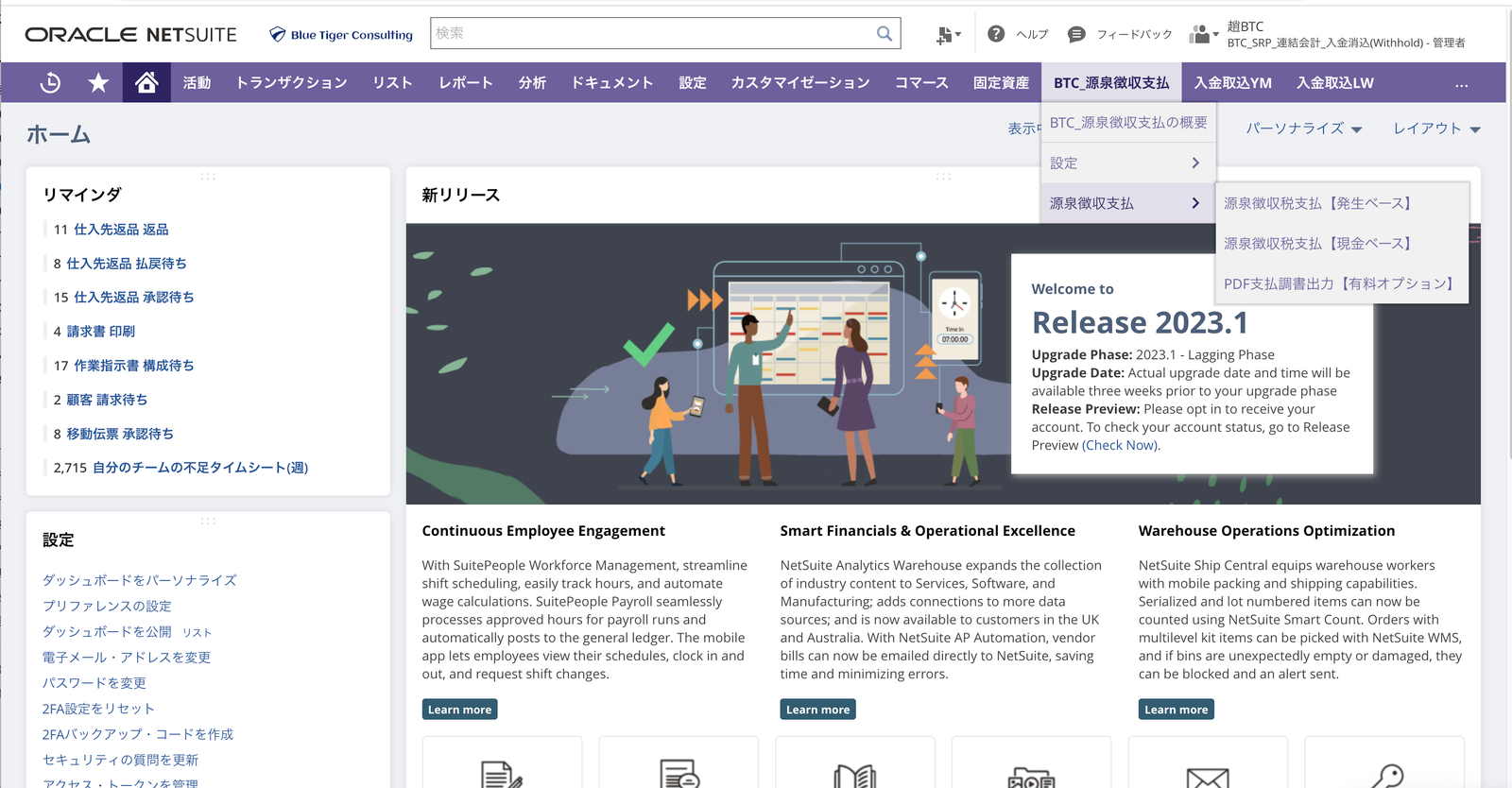

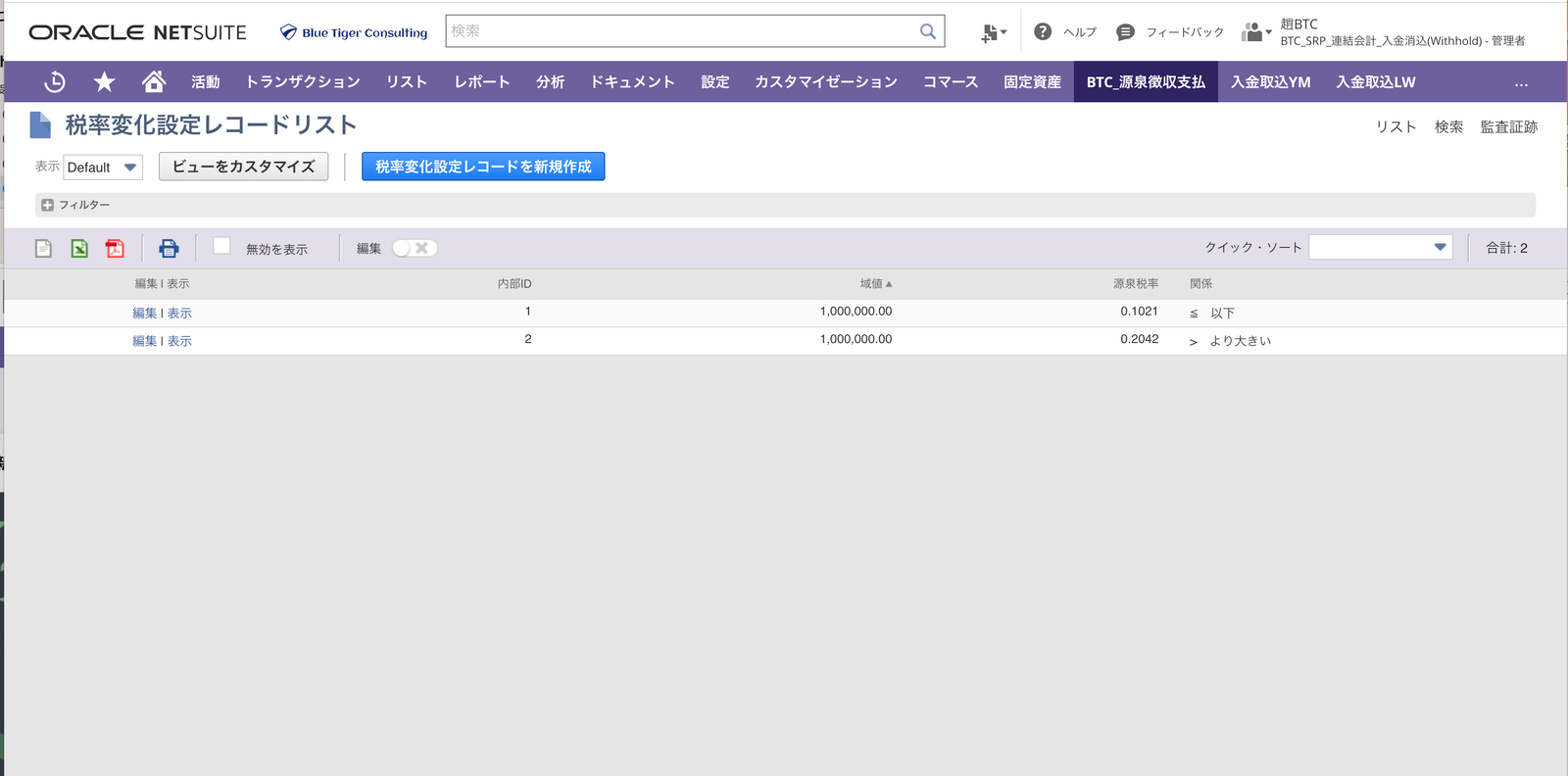

Key Operation

The process is linked to NetSuite standard purchase order. It is possible to select the appropriate multiple purchase orders to improve operational efficiency. Manual journal entry is not required.