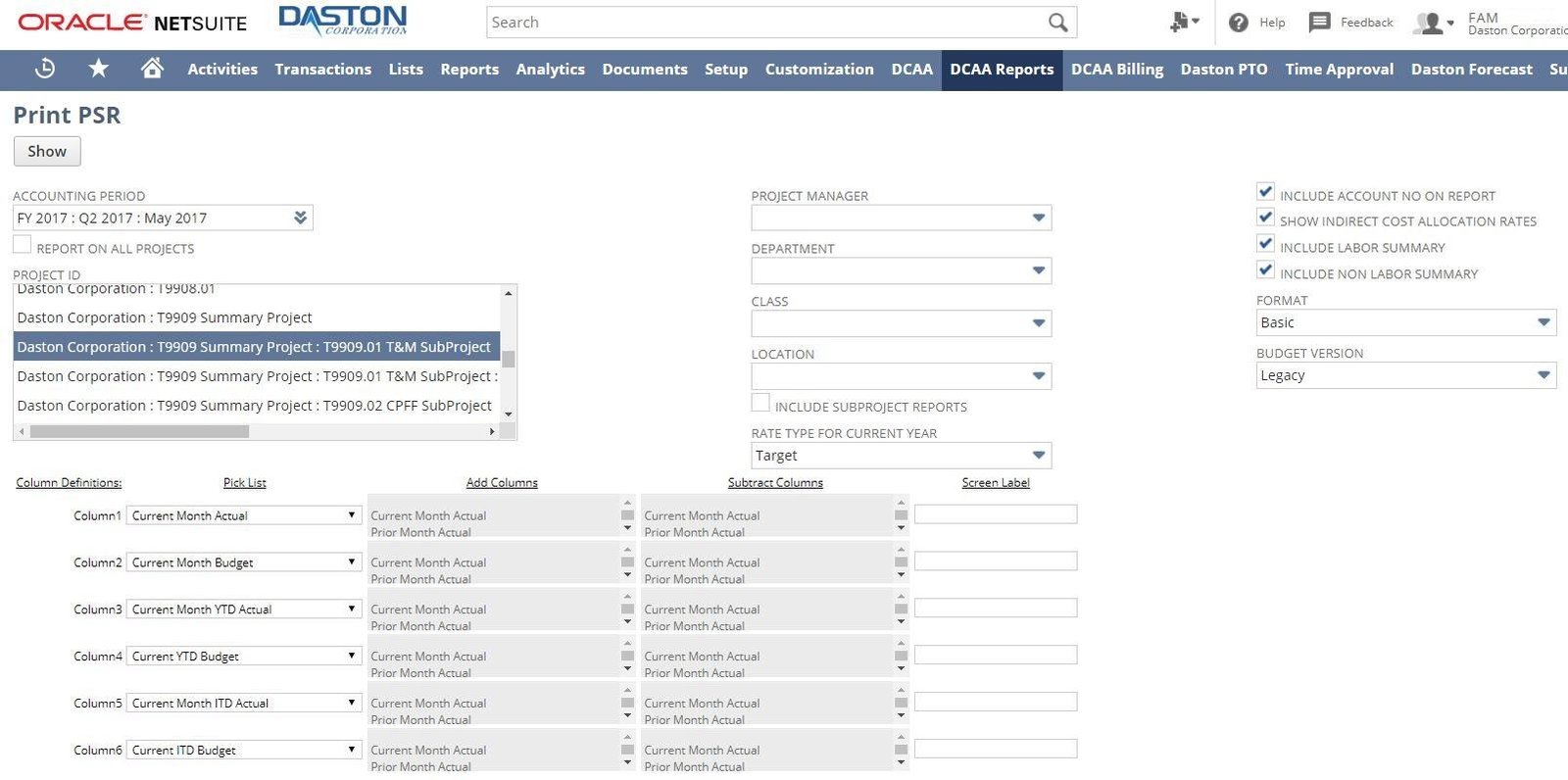

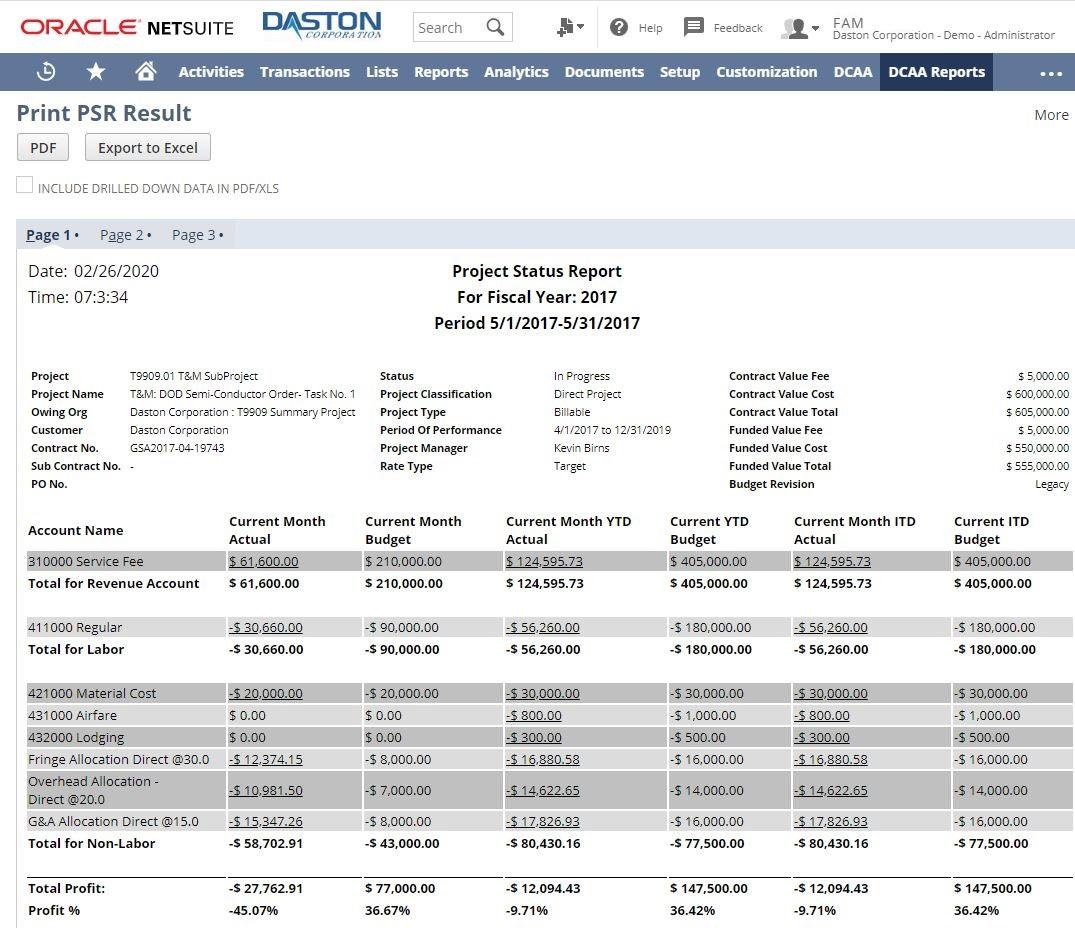

Project Status Report Module

The Project Status Report module generates a single report that will provide government contractors with ability to:

-

- Print the true profitability report for each project which includes Revenue, Direct Costs, and Indirect Costs.

- Print an additional Labor Cost Detail report for the project that reports on the actual labor costs by each Employee and Labor Category.

- Print an additional ODC Detail report for the project that displays all cost transactions charged to a project by G/L Account and Vendor.

In addition, this module interfaces with Daston’s Indirect Cost Allocation module, and is able to report using actual or target indirect rates and month-to-date (MTD), year-to-date (YTD), and/or inception-to-date (ITD) numbers.

The module can provide budget vs. actual reporting with variance and features flexible data columns, allowing users to choose up to six data elements to be displayed at a time from a list of fourteen data elements such as Current Month Actual, Prior Month Actual, Current Month YTD Actual, Prior Month YTD Actual, Current Month ITD Actual, etc. Sub-project costs and revenue may also be included in the parent-project.

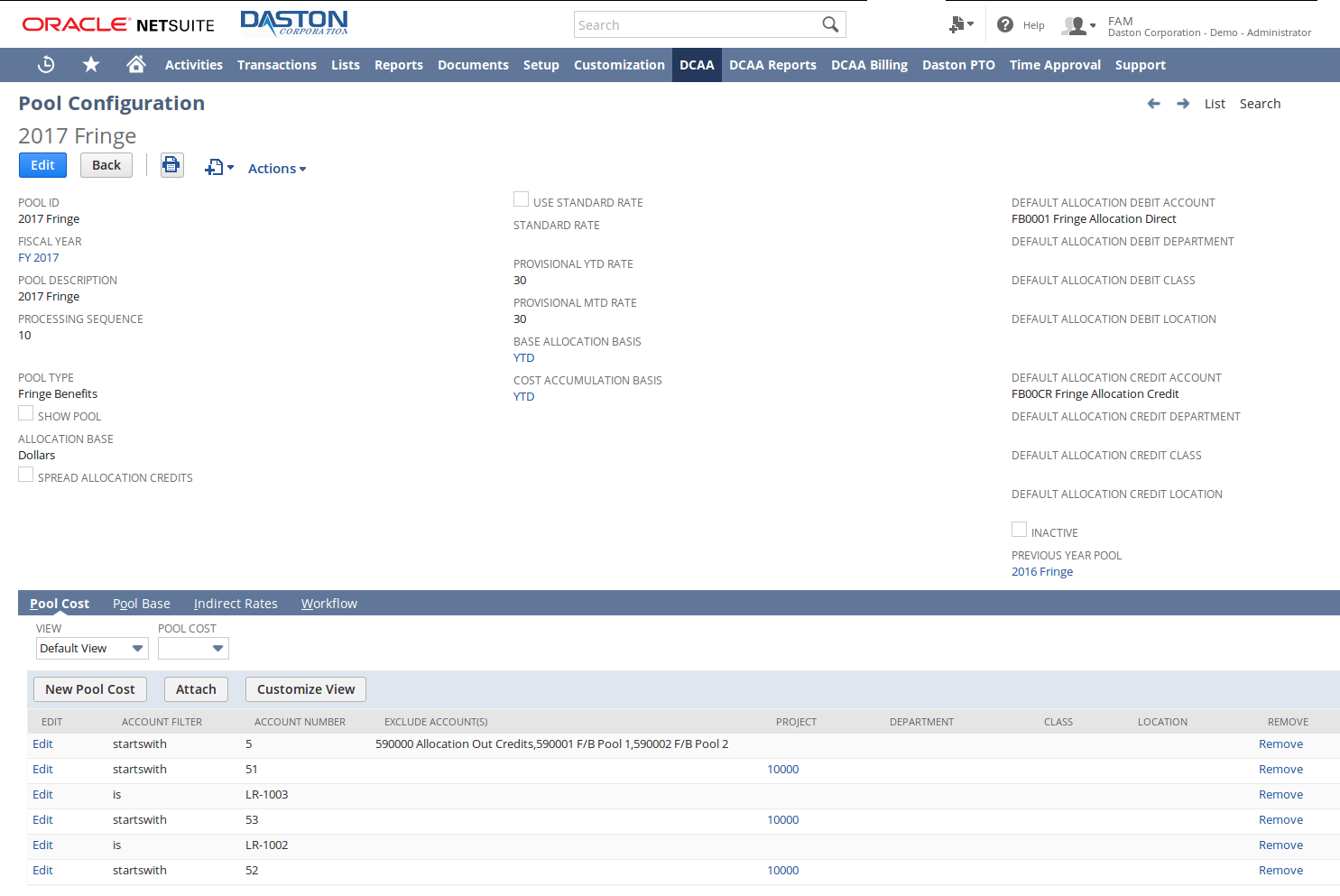

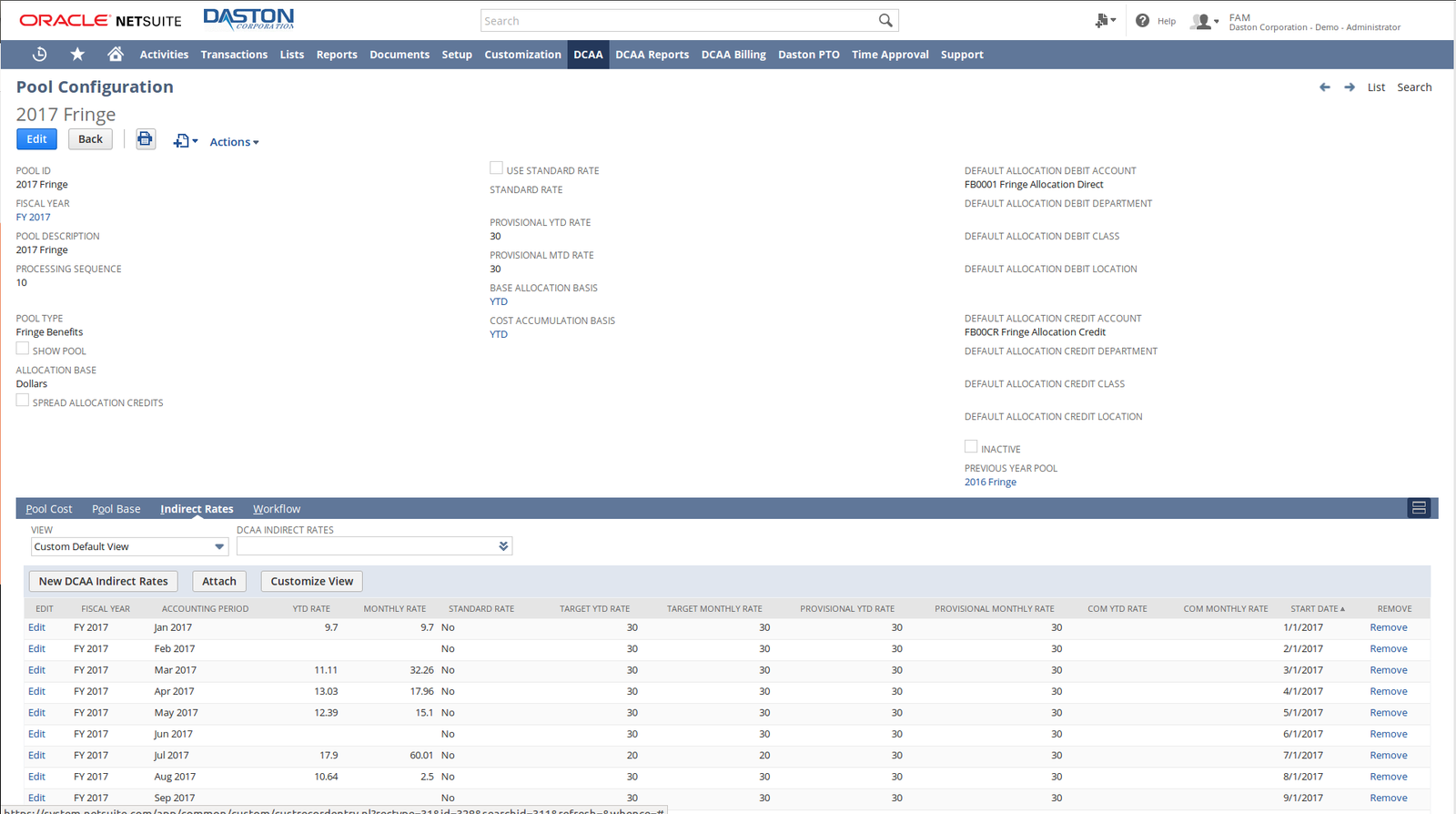

Indirect Cost Allocation Module

Indirect cost allocation is simply a mechanism for determining fairly and conveniently--within the boundaries of sound administrative principle-- what proportions of departmental/organizational administration costs each program should bear. Indirect cost allocations are performed using an indirect cost rate, where an indirect rate represents the ratio between the total indirect costs and benefiting direct costs.

Daston’s Indirect Cost Allocation module enables users to easily and simply:

-

-

- Identify and accumulate indirect costs by logical cost groupings (cost pools), with due consideration of the reasons for incurring such costs.

- Identify and accumulate the base (direct) costs to which a specific indirect cost pool will be allocated.

- Calculate the indirect cost rate for each of the indirect cost pools.

- Allocate the indirect costs to each base using system calculated “actual” rates, “target” rates, “provisional” rates for billing, or optionally “standard” rates for service centers.

Daston’s solution is compliant with the Cost Accounting Standards and DCAA Regulations, including Cost of Money allocations. It works with existing charts of accounts and organizational structure, and supports an unlimited number of user-defined allocation pools or service centers, tiers or processing sequences.

In addition, the module automatically accumulates pool costs and bases, and supports allocations based on dollar amounts, labor hours, or units. Pre-configured reports, such as Statement of Indirect Costs and Indirect Cost Trend Analysis, are also included

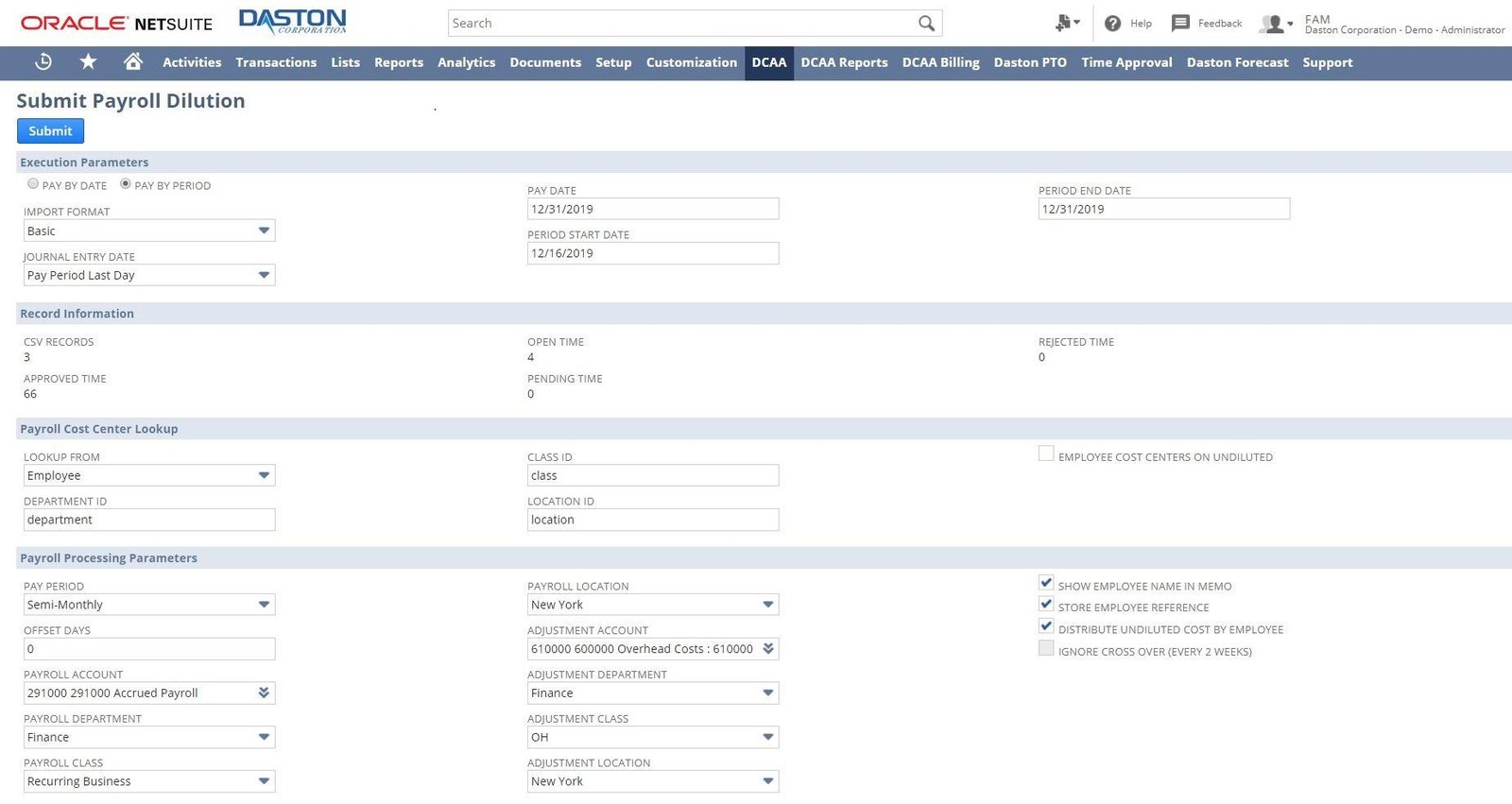

Payroll Cost Allocation Module

Daston’s Payroll Cost Allocation module provides an automated solution to allocate labor costs to projects in compliance with the Cost Accounting Standards and DCAA Regulations by:

-

-

- Calculating the Effective Hourly Rate for each employee for each pay-period. The effective hourly rate may vary depending on the number of days in each pay-period or number of hours an employee is working each day.

- Creating a Journal Entry in the system to allocate the gross payroll cost of every employee to each project they worked on, hence providing the client with visibility into the actual labor cost on each project.

This module works with your existing payroll provider such as NetSuite Perquest, ADP, or any other payroll provider, as well as with any pay- period increments, e.g., weekly, bi-weekly, monthly, or twice a month. It can also accommodate overtime, bonus, commissions, etc.

The application is flexible, enabling the user to exclude certain pay types from effective hourly rate calculations, such as overtime and bonus pay; and exclude certain special payments from automated journal entry.

DCAA-Compliant Time Entry Module

Daston’s DCAA Time Sheet functionality prohibits entry of time In advance (vacation, holiday, sick, and PTO are allowed). It also provides mandatory change tracking with employee comments after initial entry, and generates a missing time sheet report and alert to the employee and supervisor when time sheets are not completed on a daily basis.

In addition, the module requires an employee “certification” as part of the submittal process and prohibits changes by employee once the time sheet has been approved.