Lease accounting compliance in NetSuite for ASC 842 & IFRS 16

100% built in NetSuite, LeaseQuery for NetSuite lets you ditch your lease tracking spreadsheets and automate and consolidate your lease accounting processes.

Key Benefits

- 100% built for NetSuite and NetSuite native, without the need for integrations or reconciliations with outside systems.

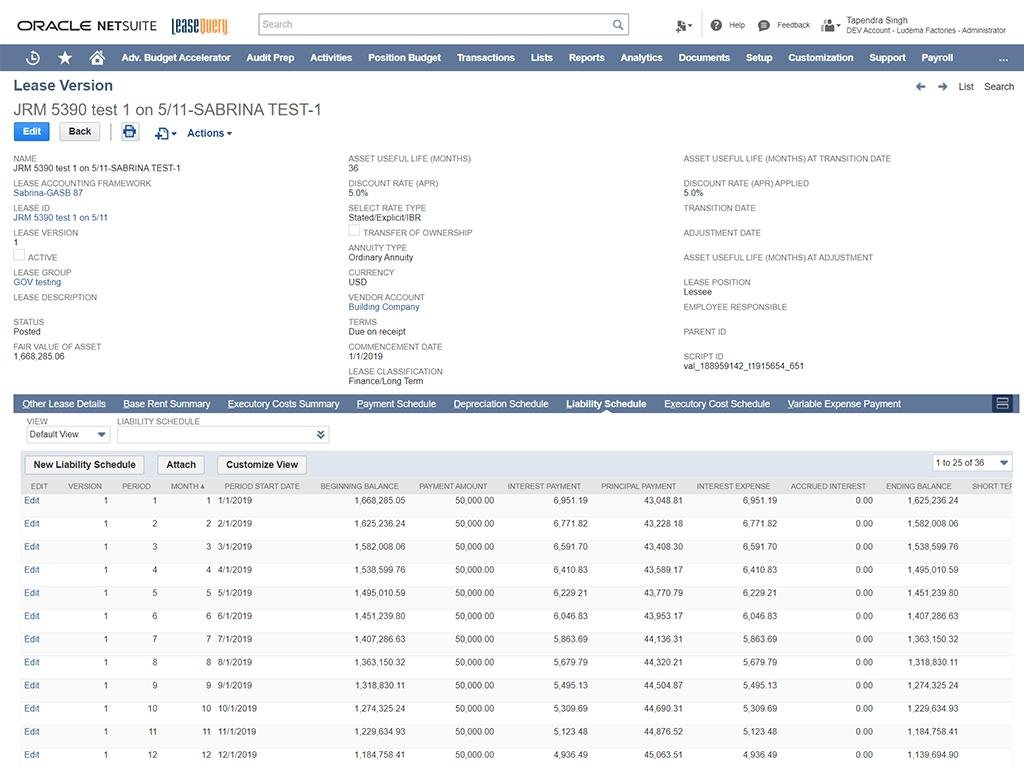

- Calculates schedules including lease payments, lease liability amortization, and right-of-use asset depreciation/amortization.

- Generates journal entries for the initial recognition and subsequent measurement of the lease liability and right-of-use asset.

- Automatically classifies leases as finance or operating, low-value or short-term, and accounts for each accurately.

- Centrally stores lease management information such as vendor, commencement date, renewal options, and other significant contract details.

- Seamlessly integrates with your company’s chart of accounts, currencies, vendors, departments, classes, and locations.

- Practical expedient application simplifies the transition to ASC 842 and IFRS 16.

- Automatically generates disclosures with the click of a button.

- Robust lease modification/change reporting and audit trail for confident compliance.

- CPA-approved calculations with more than 40 accountants on staff for numbers you can trust.

Capabilities

- Catch errors before they occur with data validation and duplicate entry prevention.

- Generate reports with the click of a button, including amortization schedules, footnote disclosures, and roll forward reports.