Automation with Accuracy

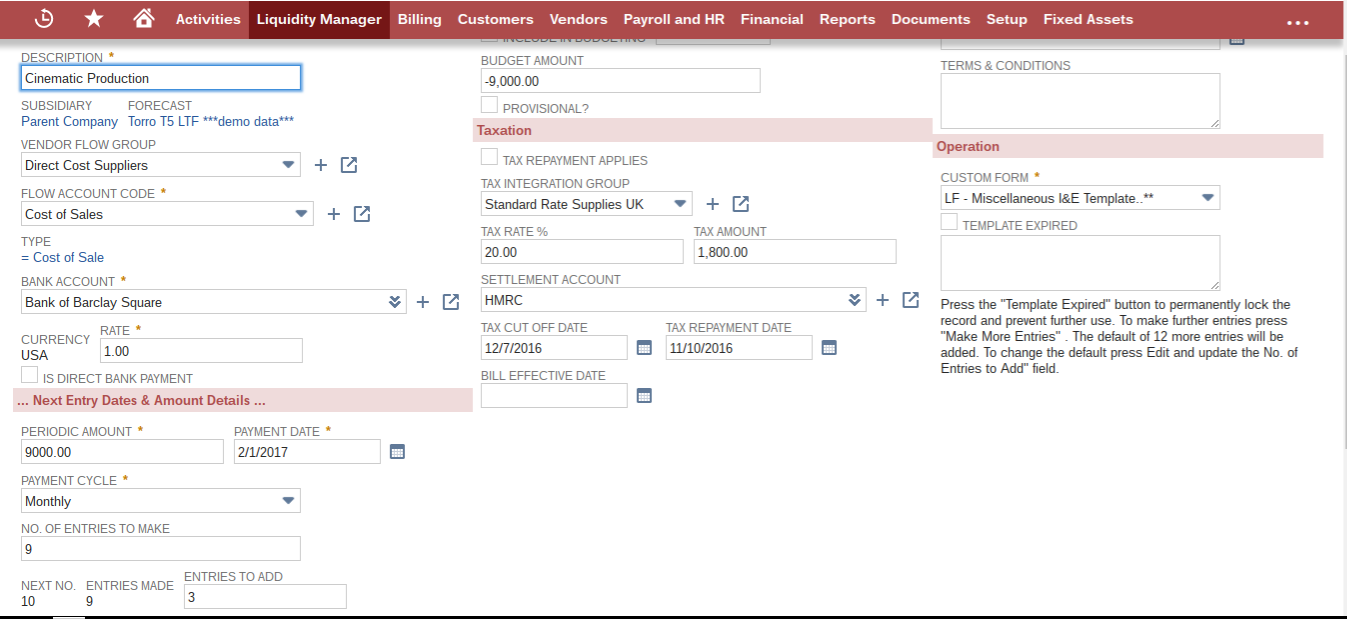

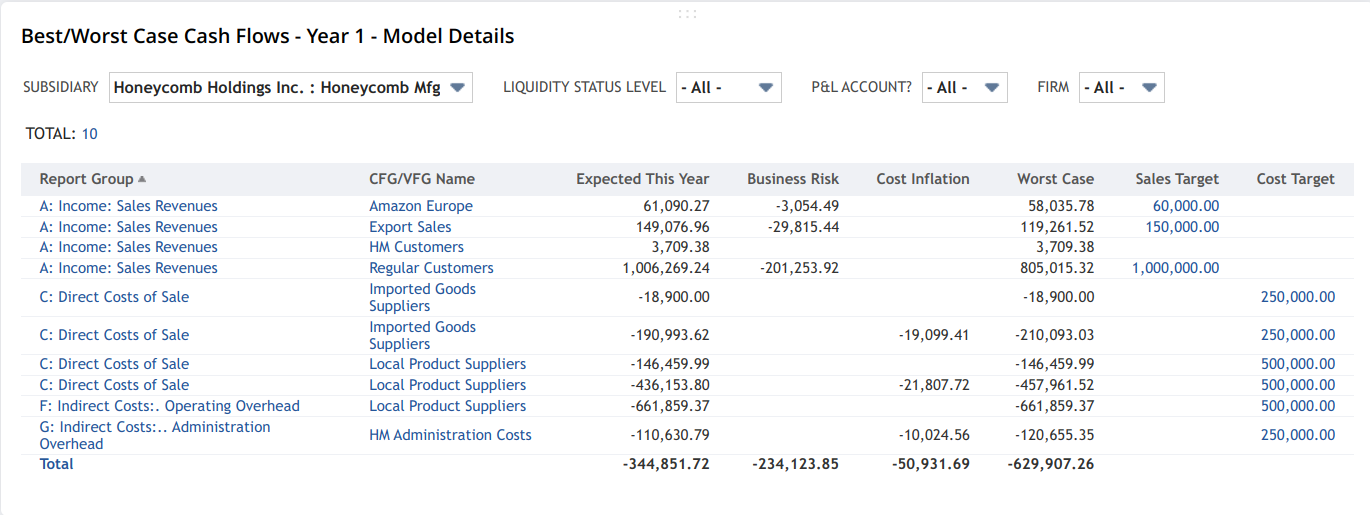

By taking as much existing information about NetSuite debtors, creditors, banks, sales invoices, bills and orders as is available. By adding future “flow stream forecasts” Liquidity Manager is able to give dynamic and accurate forecasts of your future business prospects that take into account such variables as cost inflation, business risk. efficiency measures and growth. And that’s all within your familiar NetSuite accounting environment.

Key Benefits

Liquidity Manager is self-populating from customer and vendor transactions which are seamlessly merged with flow forecasts for repeating income, standing charges, loans, capital costs and operating costs.

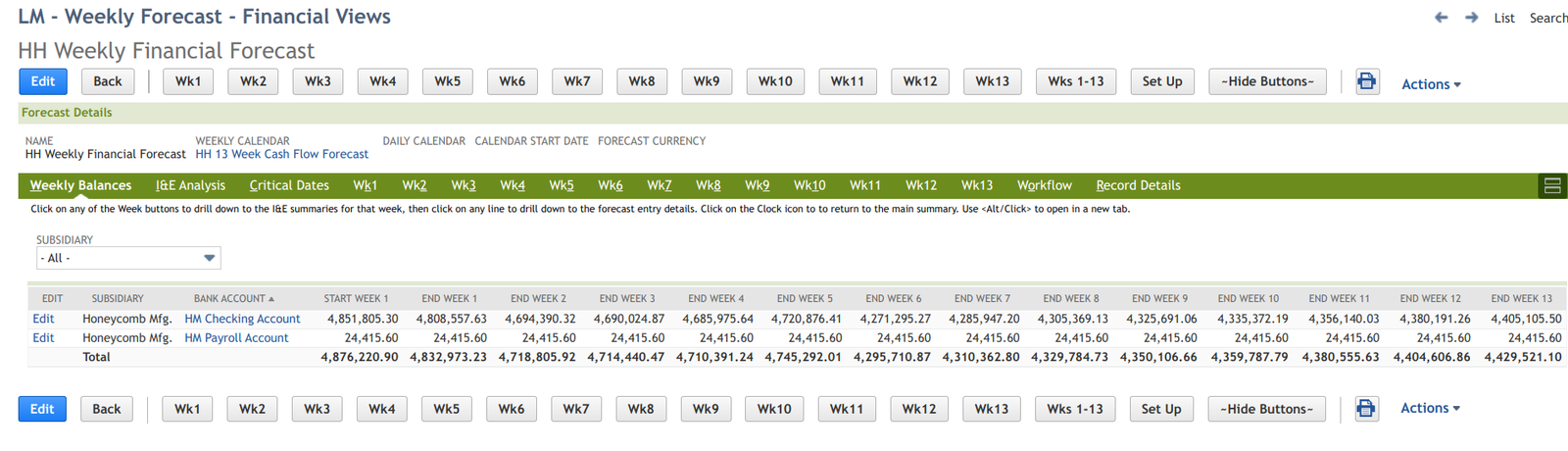

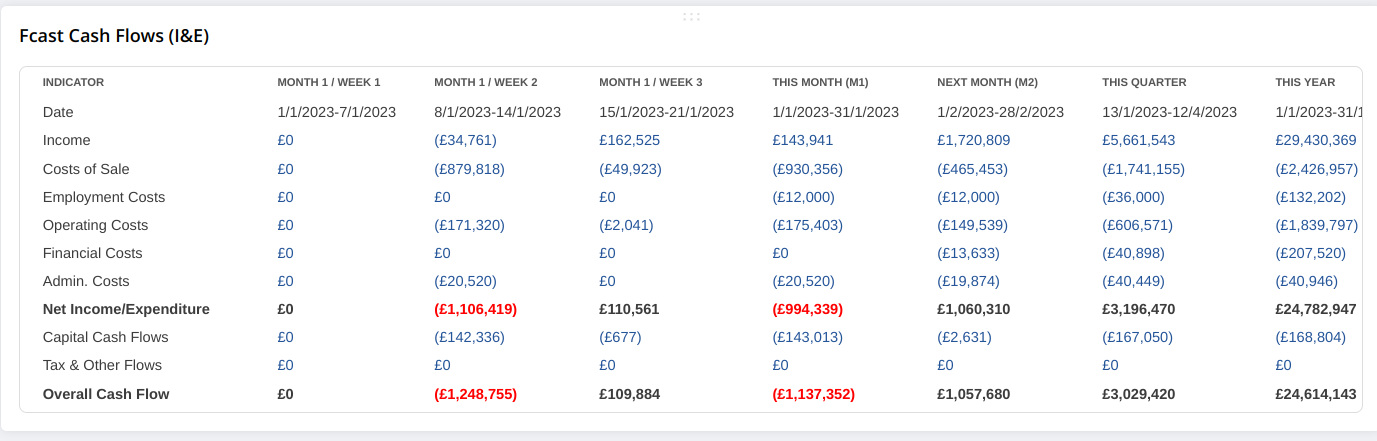

All this data is available instantly – on a single click – for the next 14 days by day, and the next 13 weeks by week in easy to understand views.

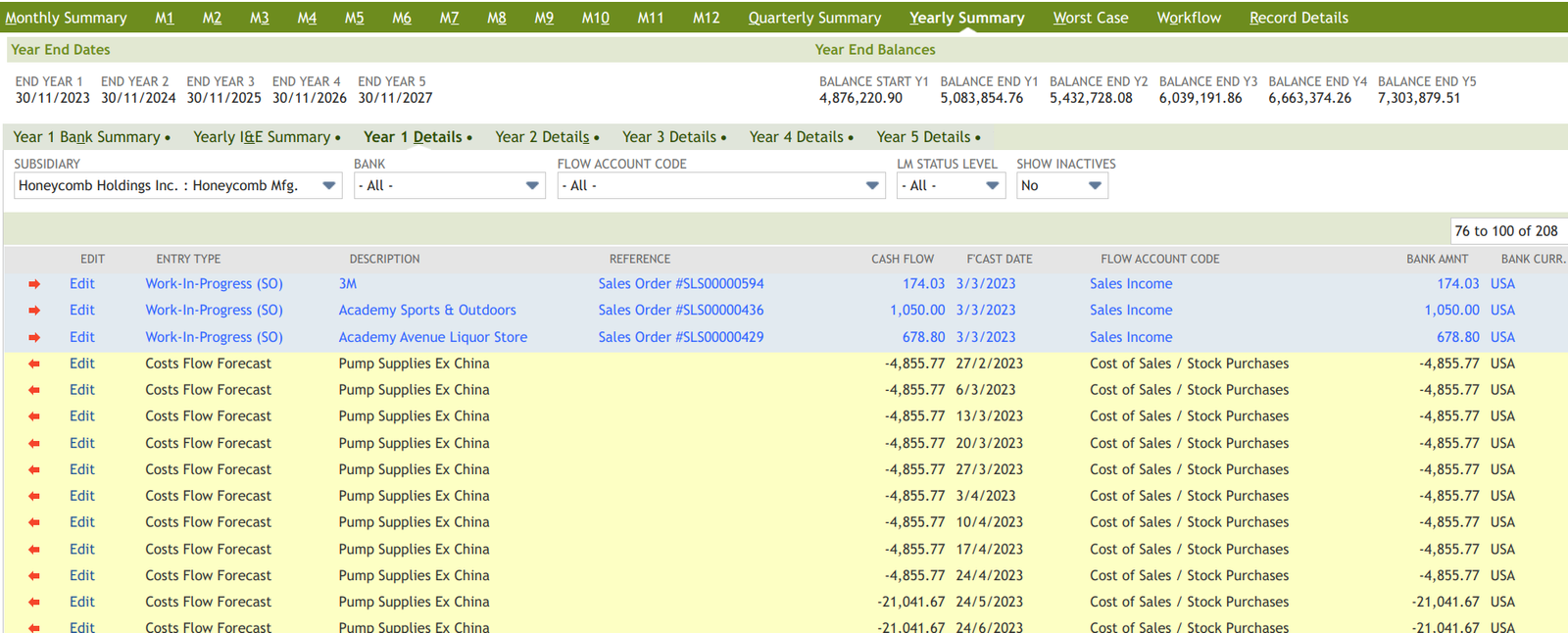

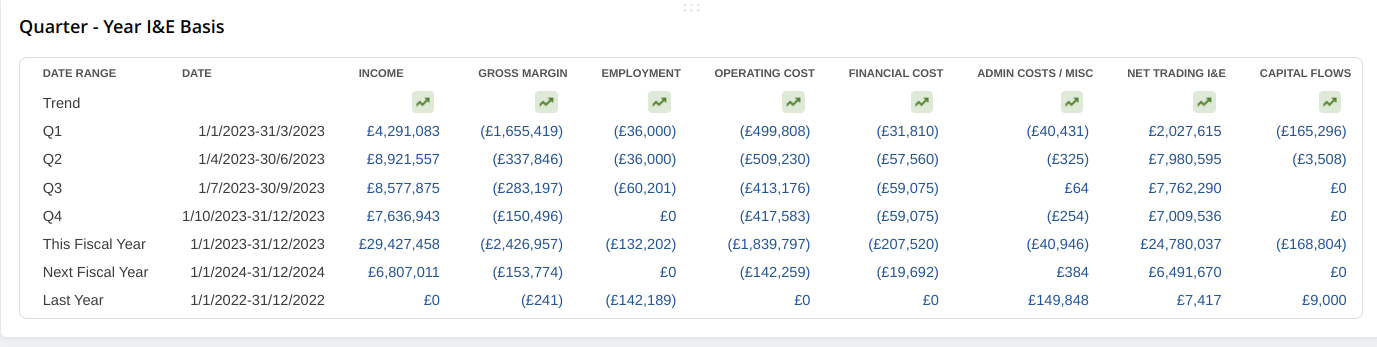

Liquidity Manager longer-term planning is automatically done using sales and purchase order payment date predictions and by using statistical modelling to forecast up to 5 years ahead.

Always up to date: Refreshing the underlying data is achieved through a combination of daily calendar control, automated date filtering, background synchronisation with NetSuite and spreadsheet-style list editing by users.

Time and Cost Savings:

Liquidity Manager allows you to dispense with those quickly outdated, costly, difficult to manage and intrinsically inaccurate spreadsheets that you may now depend on.

FlowStream is fully automatic, working on the same principles as car navigation, you’ll know (financially) where you are, where you are going and which decisions to take.

Customer Quote

“A phenomenal improvement in my knowledge and control of our liquid resources and future profitability”.

– Paul Edwick, CEO Fairy Glam Group.

Target Users

Because Liquidity Manager runs automatically with a minimum of clerical effort the target users are those who ‘Read’ the forecasts, not the traditional type of user who pumps lots of manually collected data into spreadsheets. The main outputs are NetSuite Dashboard based, and the views can be deployed on many other users’ dashboards.

Chief Operating Officers and Business Managers: A reliable single-source-of-information that’s based on latest daily forecast data.

CFOs, Treasurers and Financial Controllers.

Daily, weekly and monthly cash flow planning based on live transactions, direct bank payments and predicted payment dates.

Investors: Long term 5-year cash flow forecasts based on rolling monthly reporting cycles.