Localization in Poland – Financial services

Staria’s Poland Localization SuiteApp is designed to perform specific financial operations and processes by local Polish requirements.

SuiteApp includes:*SAF-T file generation

*FIFO reconciliation process for bank accounts

*Integration with NBP for daily exchange rates

*Polish invoicing

*payment templates

*Automatic selection of tax code in sales transactions according to item VAT nature

Key Benefits

Everything in One

One package and everything that is essential for using NetSuite in Poland.

Fast and Easy

No more hassle with searching the key components for implementation. This is an easy and fast NetSuite localisation for the Polish market.

Best in Breed

The collection of best practices and bullet proof concepts that works for NetSuite in Poland.

Features

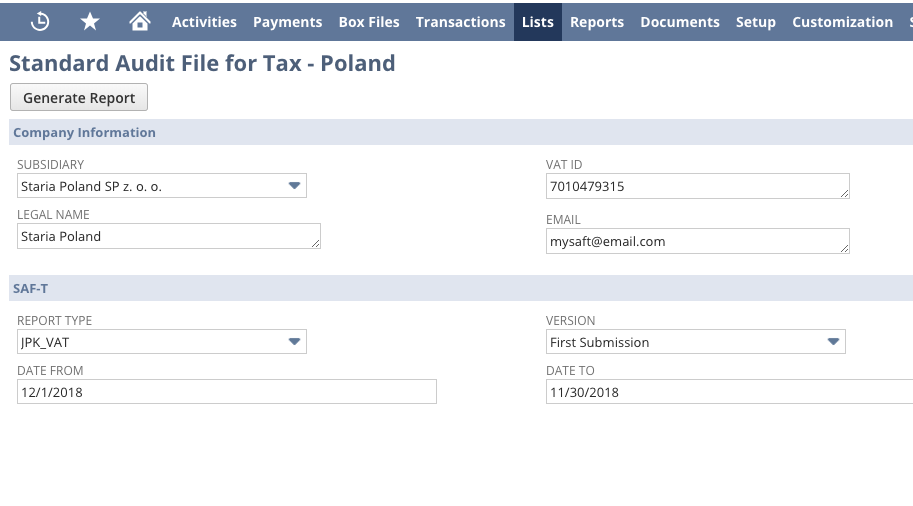

Standard Audit File (SAF)

This feature allows users to generate SAF in XML format based on the records in NetSuite. The following JPK structures are supported:

*JPK_VAT with the declaration

**JPK_V7M

**JPK_V7K

*JPK on request

**JPK_KR

**JPK_FA

**JPK_MAG

**JPK_WB

Vendor Whitelisting

This feature allows users to check vendor or suppliers information in NetSuite against the list of VAT taxpayer from Ministerstwo Finansów – Krajowa Administracja Skarbowa. The users may run the validation against the list in bulk or on-demand.

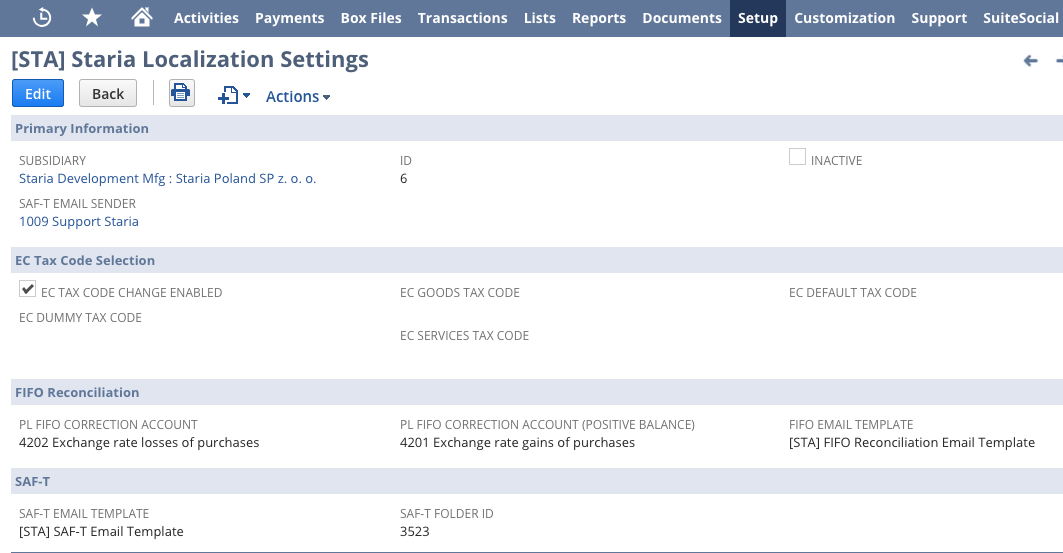

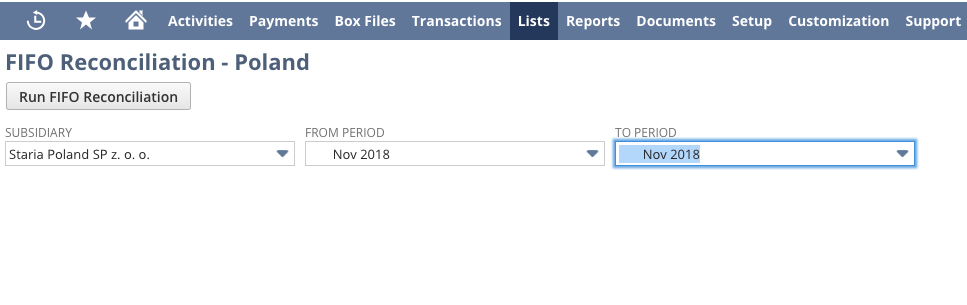

FIFO Reconciliation Process

In the month end the outgoing payment entries are corrected to the exchange rate of the last unused incoming payment entries.

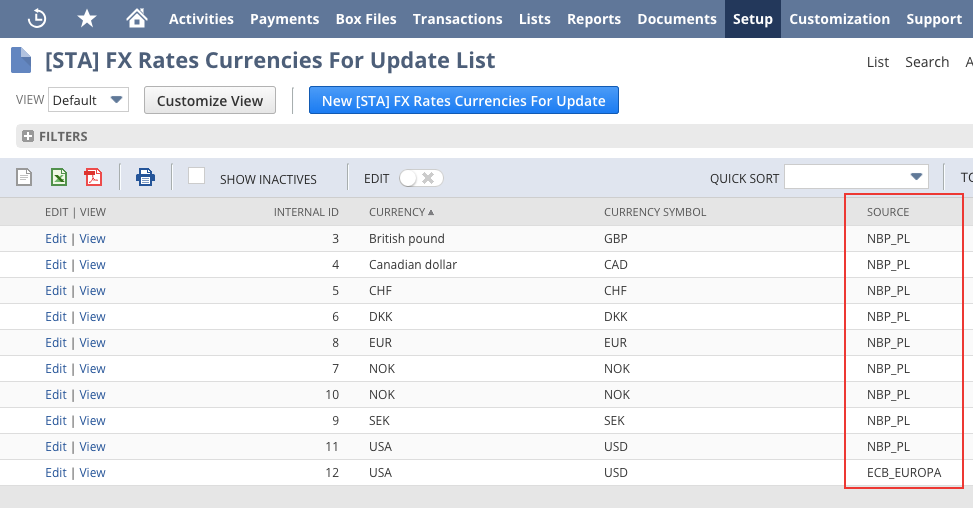

Integration with NBP

Daily exchange rate updates from National Bank of Poland

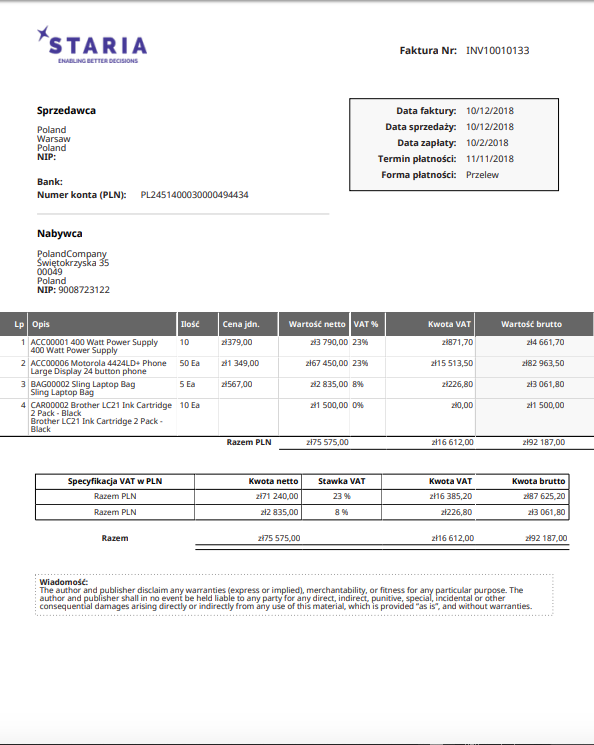

Polish invoicing

Invoice layout and VAT detailed summary by VAT code

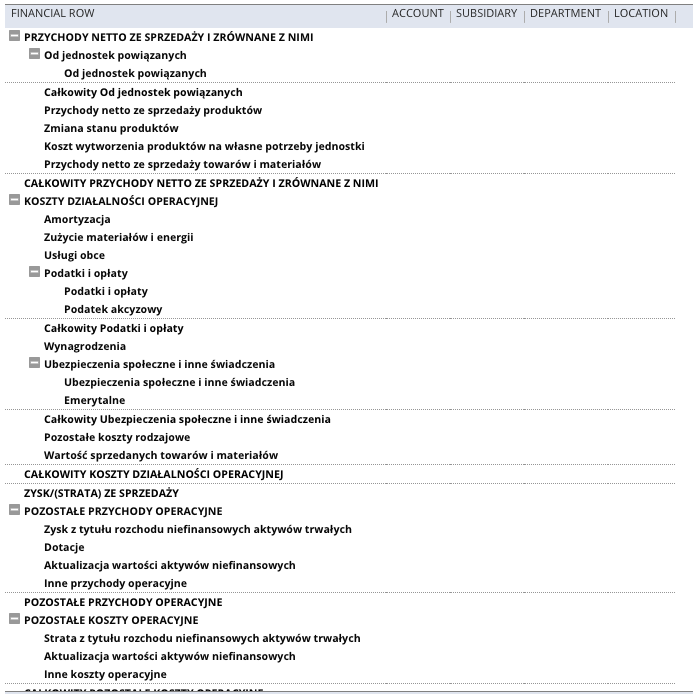

Financial Statements

P&L and Balance Sheet statements

Payment Templates

Correct invoicing

European VAT codes

Automatic VAT code selection for transactions within European Community according to item VAT nature