Sales & Use Tax Automation

Vertex helps automate sales and use tax compliance for businesses of all sizes globally.

Real-time tax calculations for all sales transactions:

Quotes/Estimates; Cash sales; Sales orders; Invoices

- Simplified NetSuite Tax Setup

- Consumers Use Tax on the SuiteTax integration only

- Address validation

- Sales orders: ensure the accuracy of taxes to be collected or paid

- Invoices: update your tax journal with real-time tax information

- Credit memos: calculate the correct tax amount for credit memos

- Cash sales: enter correct tax information for in-person purchases

- Cash sales refunds: calculate the correct tax amount for cash returns

- Subsidiaries: separate taxation amount subsidiaries (in NetSuite OneWorld only)

Key Benefits

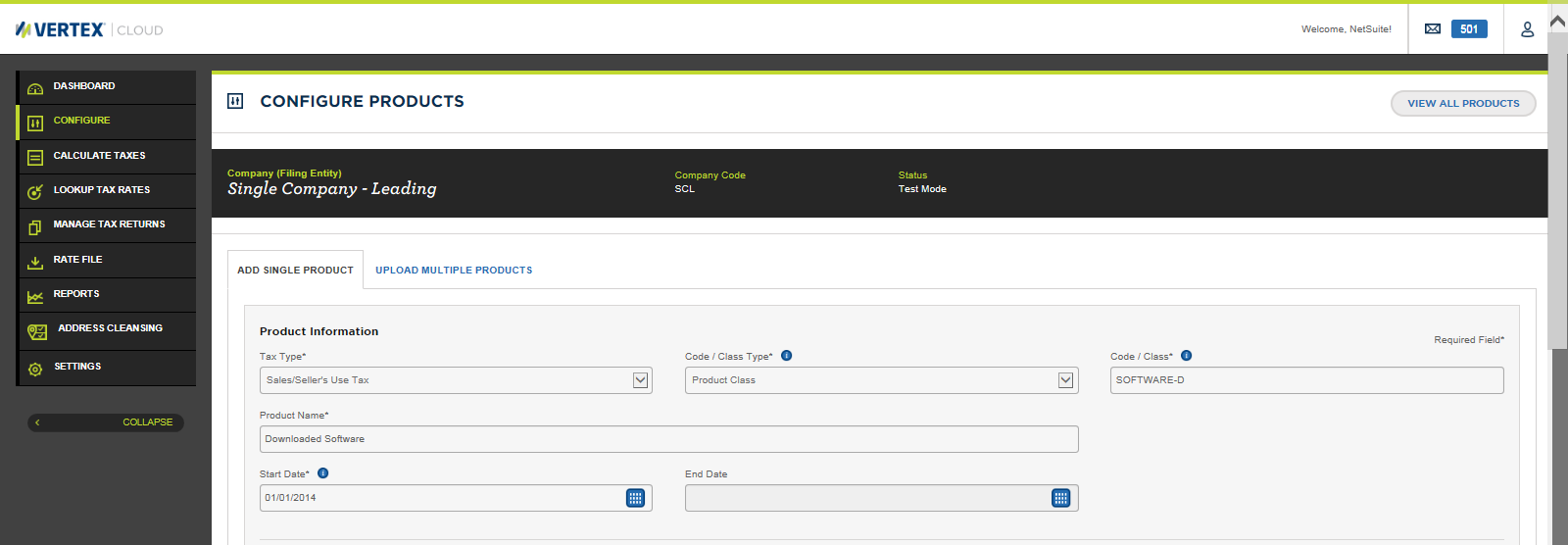

Automates tax determination for sales, use and value-added

tax, reducing time and effort

• Provides greater accuracy of returns and compliance data

• Scales to meet changing global indirect tax requirements

• Improved ROI and faster time-to-value for the Vertex

tax engine

• Increases the efficiency of finance and tax teams

• Less reliance and burden on IT team

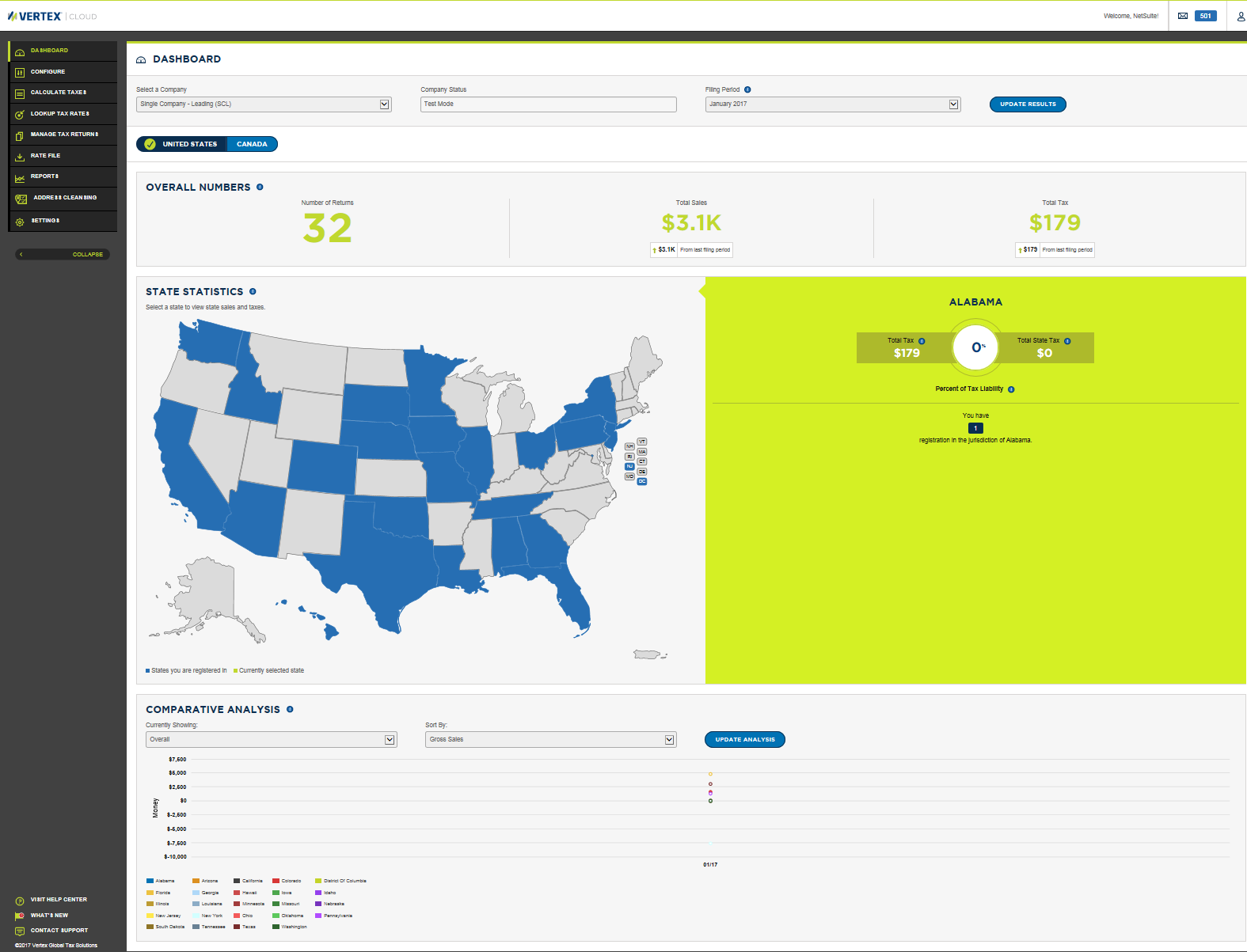

• Improved usability of the Vertex tax engine for reporting

and returns

• Streamlined audit processes and reduced audit exposure

• Backed by Vertex’s global team of Oracle-certified consultants

and support specialists

Proven Solution from a Leader in the Industry

Vertex Cloud Indirect Tax

- 40 years of tax expertise

- Leading Tax provider

- Sales and Use Tax Automation for growing businesses.

- Three deployment models – on-premise, on-demand and cloud

- Integrate directly with mid-market ERPs,

- Procurement solutions, and

- Ecommerce platforms.

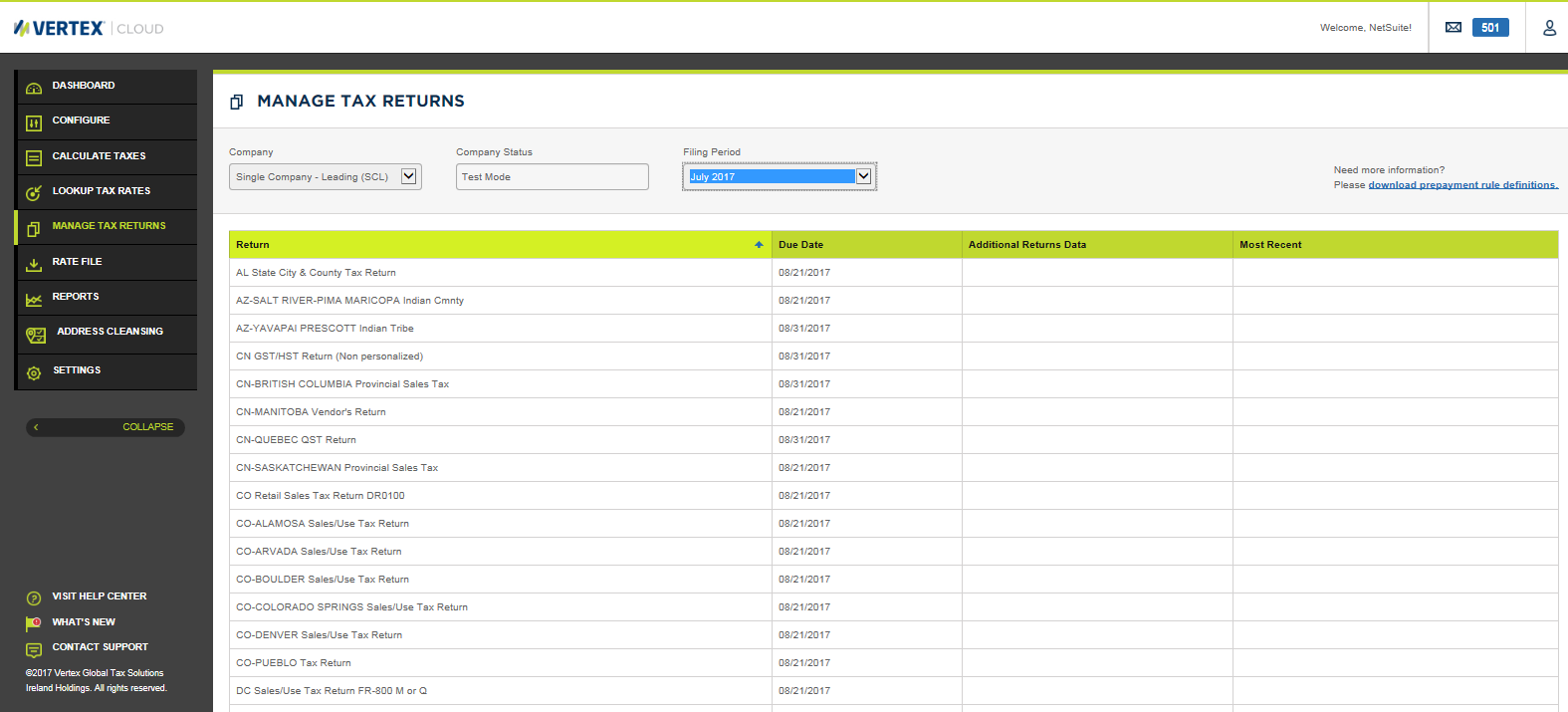

From returns-only processing, tax calculations, and signature-ready PDF returns to outsourcing services that include returns filing and payment processing, Vertex Cloud provides a proven and reliable solution for businesses looking to:

- Save time, effort, and risk associated with sales and use tax calculation, returns, remittance, and compliance.